Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fiji Airways owns an aircraft worth $15 million and accumulated depreciation of $5 million. The aircraft has a fair value of $10,408,400. Due to

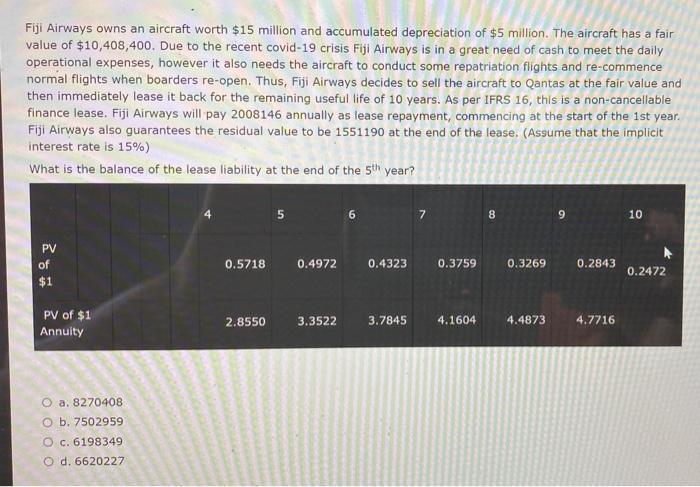

Fiji Airways owns an aircraft worth $15 million and accumulated depreciation of $5 million. The aircraft has a fair value of $10,408,400. Due to the recent covid-19 crisis Fiji Airways is in a great need of cash to meet the daily operational expenses, however it also needs the aircraft to conduct some repatriation flights and re-commence normal flights when boarders re-open. Thus, Fiji Airways decides to sell the aircraft to Qantas at the fair value and then immediately lease it back for the remaining useful life of 10 years. As per IFRS 16, this is a non-cancellable finance lease. Fiji Airways will pay 2008146 annually as lease repayment, commencing at the start of the 1st year. Fiji Airways also guarantees the residual value to be 1551190 at the end of the lease. (Assume that the implicit interest rate is 15%) What is the balance of the lease liability at the end of the 5th year? 6. 25 9 10 PV of 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 $1 PV of $1 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 Annuity O a. 8270408 O b. 7502959 O c. 6198349 O d. 6620227

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Option 2nd is correct 7502959 7502959 is very ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started