Answered step by step

Verified Expert Solution

Question

1 Approved Answer

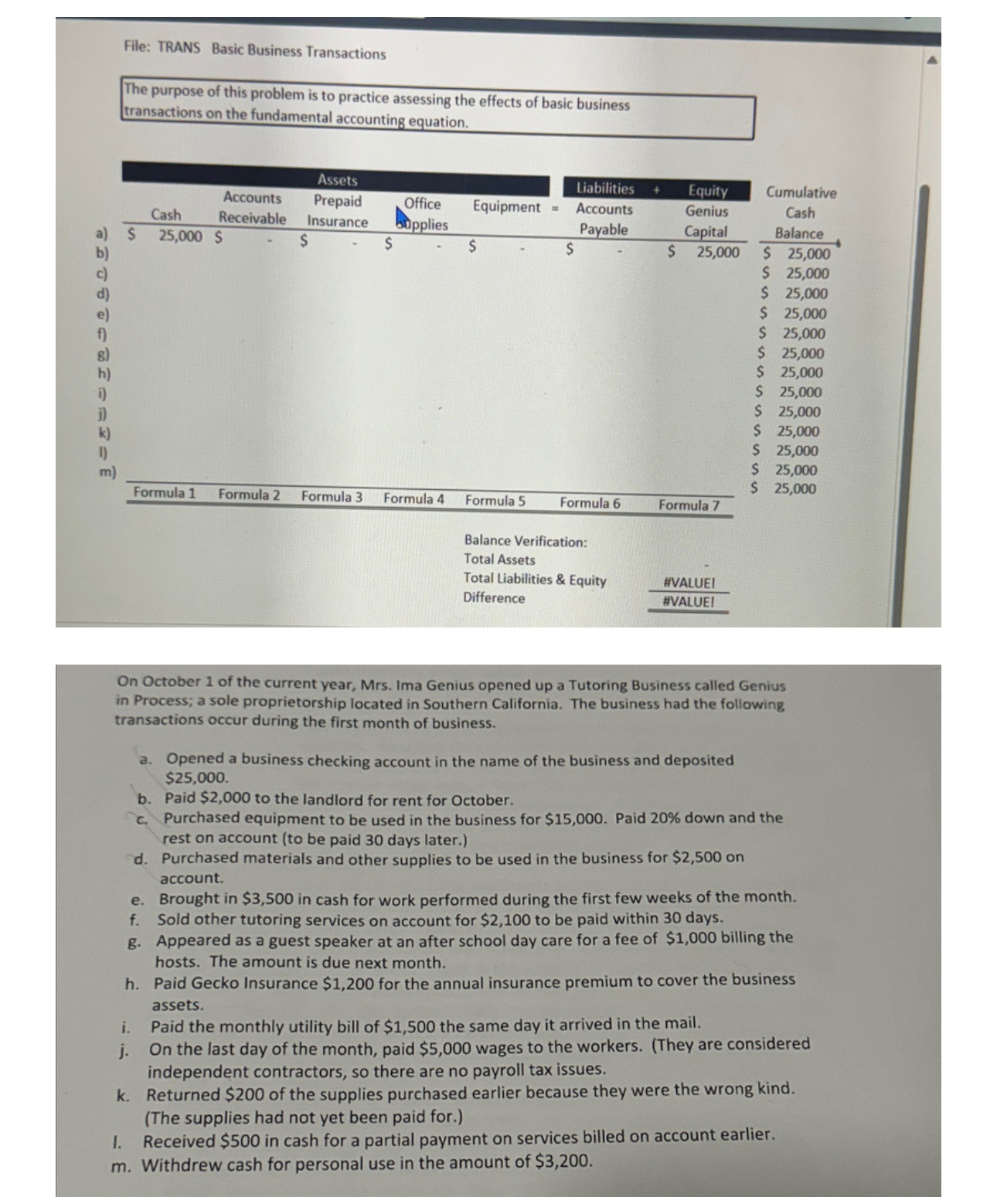

File: TRANS Basic Business Transactions The purpose of this problem is to practice assessing the effects of basic business transactions on the fundamental accounting

File: TRANS Basic Business Transactions The purpose of this problem is to practice assessing the effects of basic business transactions on the fundamental accounting equation. Accounts Cash Receivable Assets Prepaid Insurance Liabilities Equity Cumulative Office Equipment Accounts Genius Cash upplies Payable Capital Balance a) $ 25,000 $ $ $ $ $ $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 i) j) k) 1) $ 25,000 $ 25,000 $ 25,000 $ 25,000 m) $ 25,000 Formula 1 Formula 2 Formula 3 Formula 4 Formula 5 Formula 6 Formula 7 Balance Verification: Total Assets Total Liabilities & Equity Difference #VALUE! #VALUE! 1. On October 1 of the current year, Mrs. Ima Genius opened up a Tutoring Business called Genius in Process; a sole proprietorship located in Southern California. The business had the following transactions occur during the first month of business. a. Opened a business checking account in the name of the business and deposited $25,000. b. Paid $2,000 to the landlord for rent for October. Purchased equipment to be used in the business for $15,000. Paid 20% down and the rest on account (to be paid 30 days later.) d. Purchased materials and other supplies to be used in the business for $2,500 on account. e. Brought in $3,500 in cash for work performed during the first few weeks of the month. Sold other tutoring services on account for $2,100 to be paid within 30 days. f. g. Appeared as a guest speaker at an after school day care for a fee of $1,000 billing the hosts. The amount is due next month. h. Paid Gecko Insurance $1,200 for the annual insurance premium to cover the business assets. i. Paid the monthly utility bill of $1,500 the same day it arrived in the mail. j. On the last day of the month, paid $5,000 wages to the workers. (They are considered independent contractors, so there are no payroll tax issues. k. Returned $200 of the supplies purchased earlier because they were the wrong kind. (The supplies had not yet been paid for.) Received $500 in cash for a partial payment on services billed on account earlier. m. Withdrew cash for personal use in the amount of $3,200.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started