Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Accounting. Multiple questions that i need help on . i appreciate it. I need all answered i always leave good reviews! Thank you Knowledge

Financial Accounting. Multiple questions that i need help on . i appreciate it.

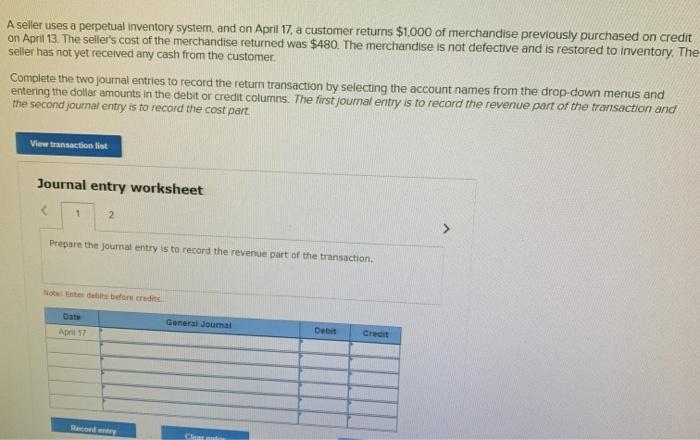

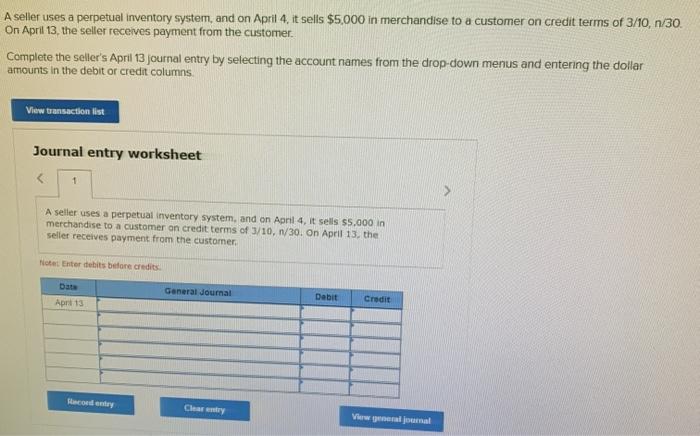

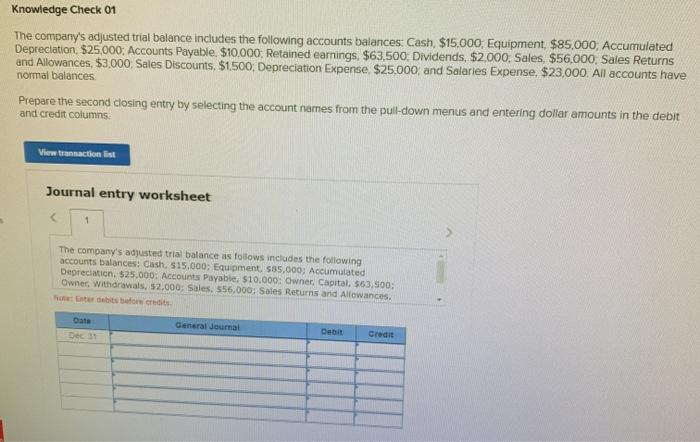

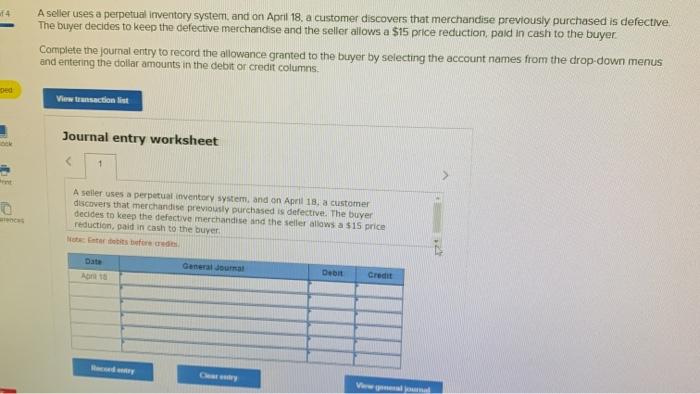

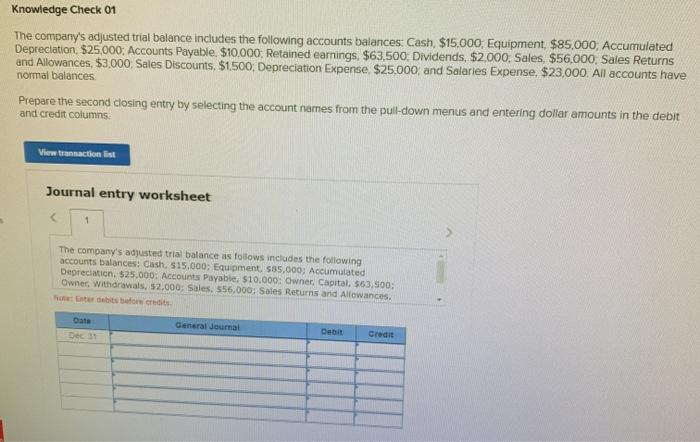

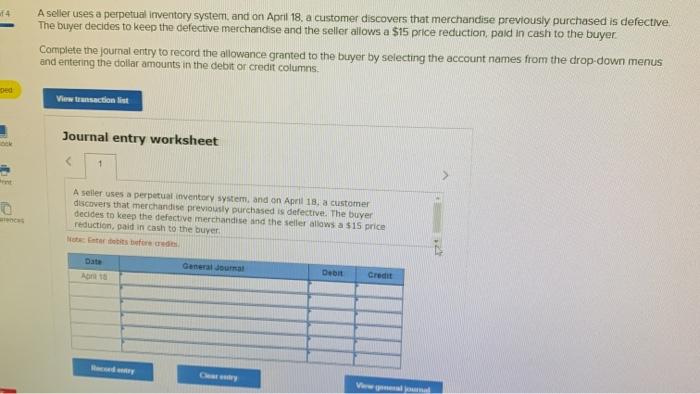

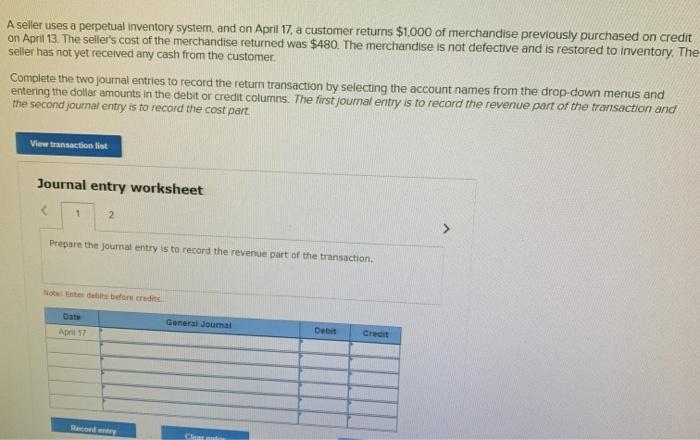

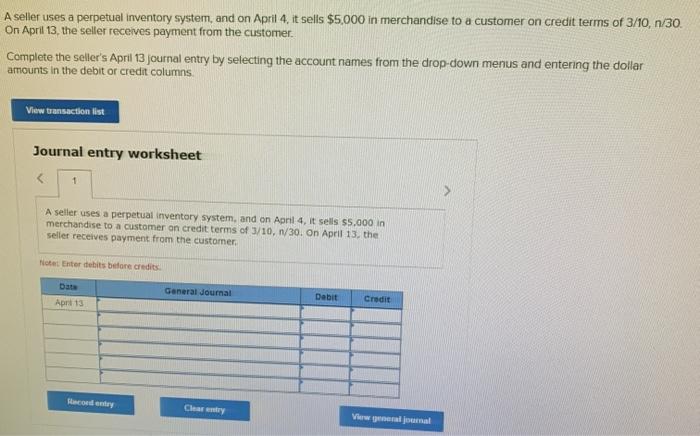

Knowledge Check 01 The company's adjusted trial balance includes the following accounts balances Cash $15,000Equipment, $85,000, Accumulated Depreciation $25,000: Accounts Payable, $10,000: Retained earnings $63,500: Dividends, $2.000, Sales, $56.000 Sales Returns and Allowances, $3,000, Sales Discounts, $1500, Depreciation Expense. $25,000, and Salaries Expense, $23,000. All accounts have normal balances Prepare the second closing entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns View transaction list Journal entry worksheet 1 The company's adjusted trial balance as follows includes the following accounts balances: Cash, $15.000; Equipment. 555.000; Accumulated Depreciation. $25.000; Accounts Payable, $10,000: Owner. Capital. $63.500: Owner, Withdrawals, 52.000; Sales. 556.000; Sales Returns and Allowances. Edebitsbereits Date General Journal Debit Credit A seller uses a perpetual inventory system, and on April 18, a customer discovers that merchandise previously purchased is defective The buyer decides to keep the defective merchandise and the seller allows a $15 price reduction, paid in cash to the buyer. Complete the journal entry to record the allowance granted to the buyer by selecting the account names from the drop-down menus and entering the dollar amounts in the debitor credit columns View townsaction ist Journal entry worksheet 1 A seiler uses a perpetual inventory system, and on April 18, a customer discovers that merchandise previously purchased is defective. The buyer decides to keep the defective merchandise and the seller allows a $15 price reduction, paid in cash to the buyer i Det Credit A seller uses a perpetual inventory system, and on April 17, a customer returns $1,000 of merchandise previously purchased on credit on April 13. The seller's cost of the merchandise returned was $480. The merchandise is not defective and is restored to inventory. The seller has not yet received any cash from the customer. Complete the two journal entries to record the return transaction by selecting the account names from the drop-down menus and entering the dollar amounts in the debitor credit columns. The first joumal entry is to record the revenue part of the transaction and the second journal entry is to record the cost part. View transaction lit Journal entry worksheet 1 -2 Prepare the journal entry is to record the revenue part of the transaction Notes de beton Date General Journal April 17 Dobit Credit A seller uses a perpetual inventory system, and on April 4, it sells $5,000 in merchandise to a customer on credit terms of 3/10, n/30 On April 13, the seller receives payment from the customer. Complete the seller's April 13 journal entry by selecting the account names from the drop-down menus and entering the dollar amounts in the debitor credit columns. View transaction list Journal entry worksheet A seller uses a perpetual inventory system, and on April 4, it sells 55.000 in merchandise to a customer on credit terms of 3/10, 1/30. On April 13, the seller receives payment from the customer Notat Enter debits before credits Date Apr 13 General Journal Debit Credit Secondary Charay Vierwal I need all answered i always leave good reviews! Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started