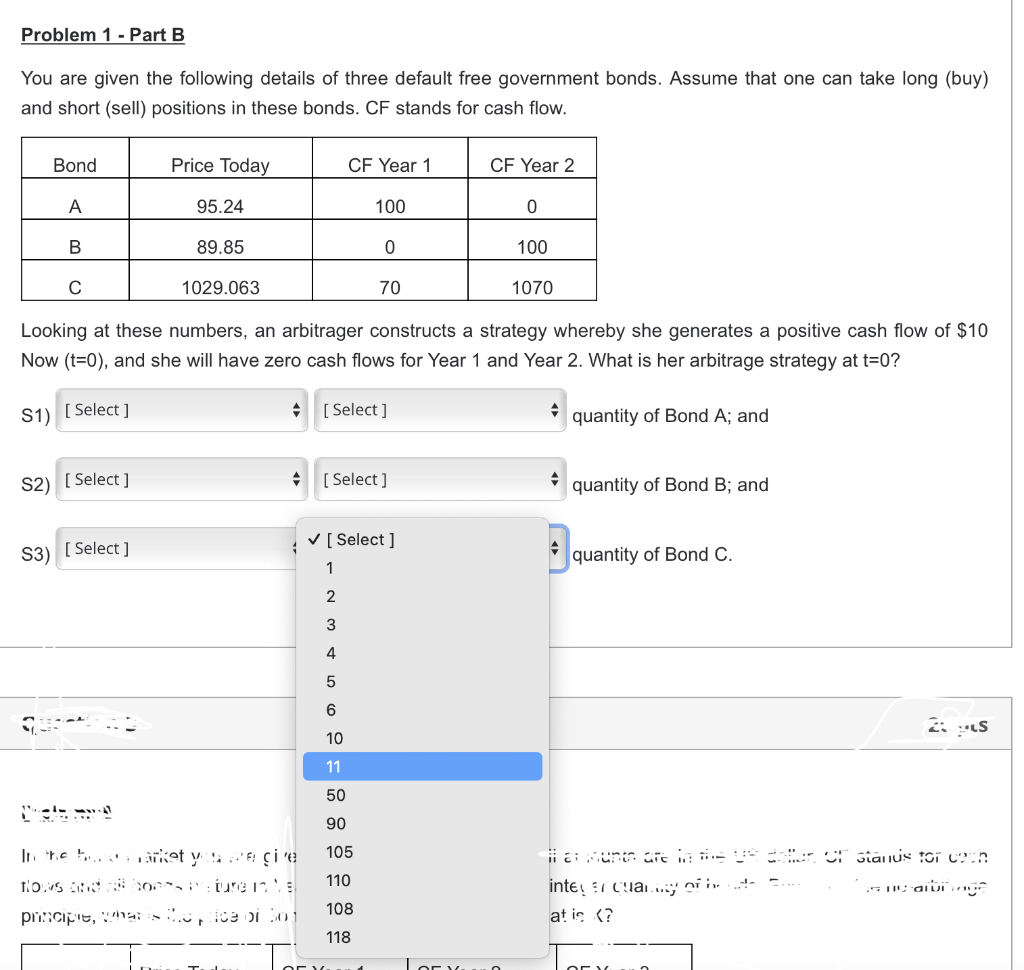

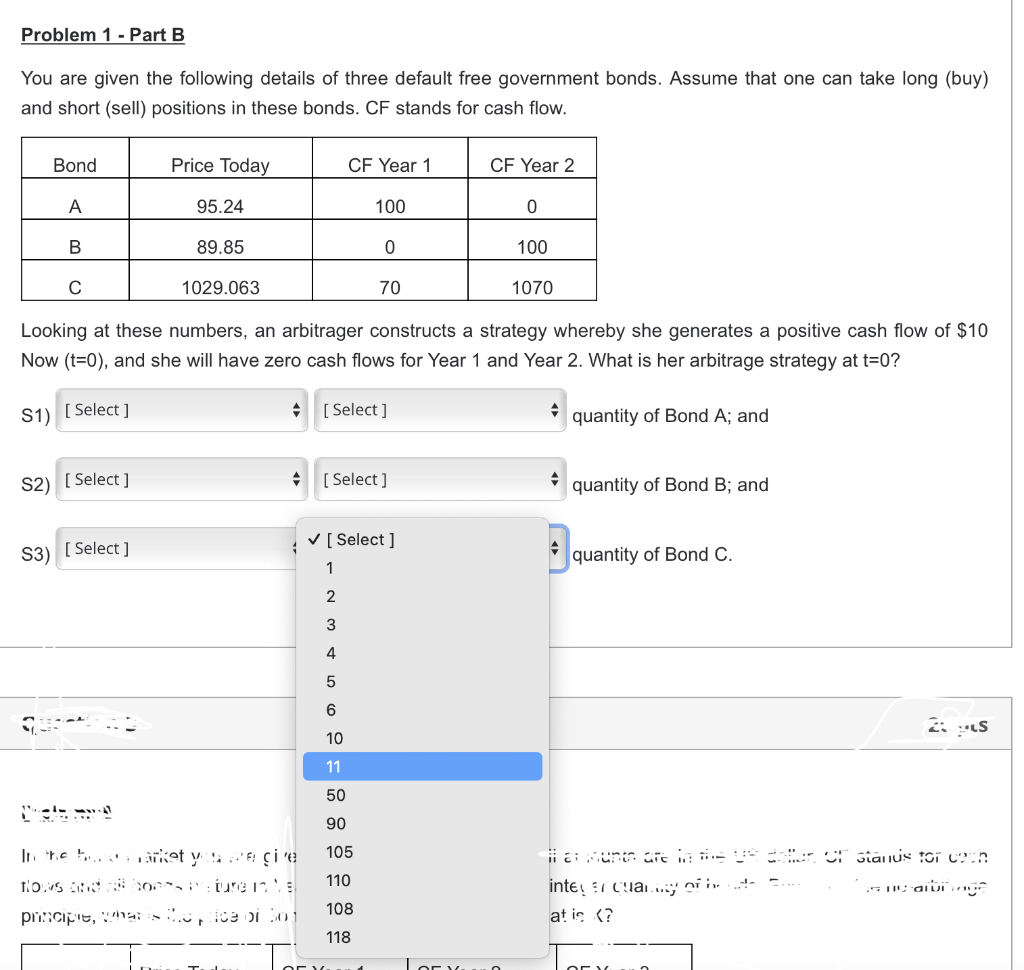

First option is Buy or sell.

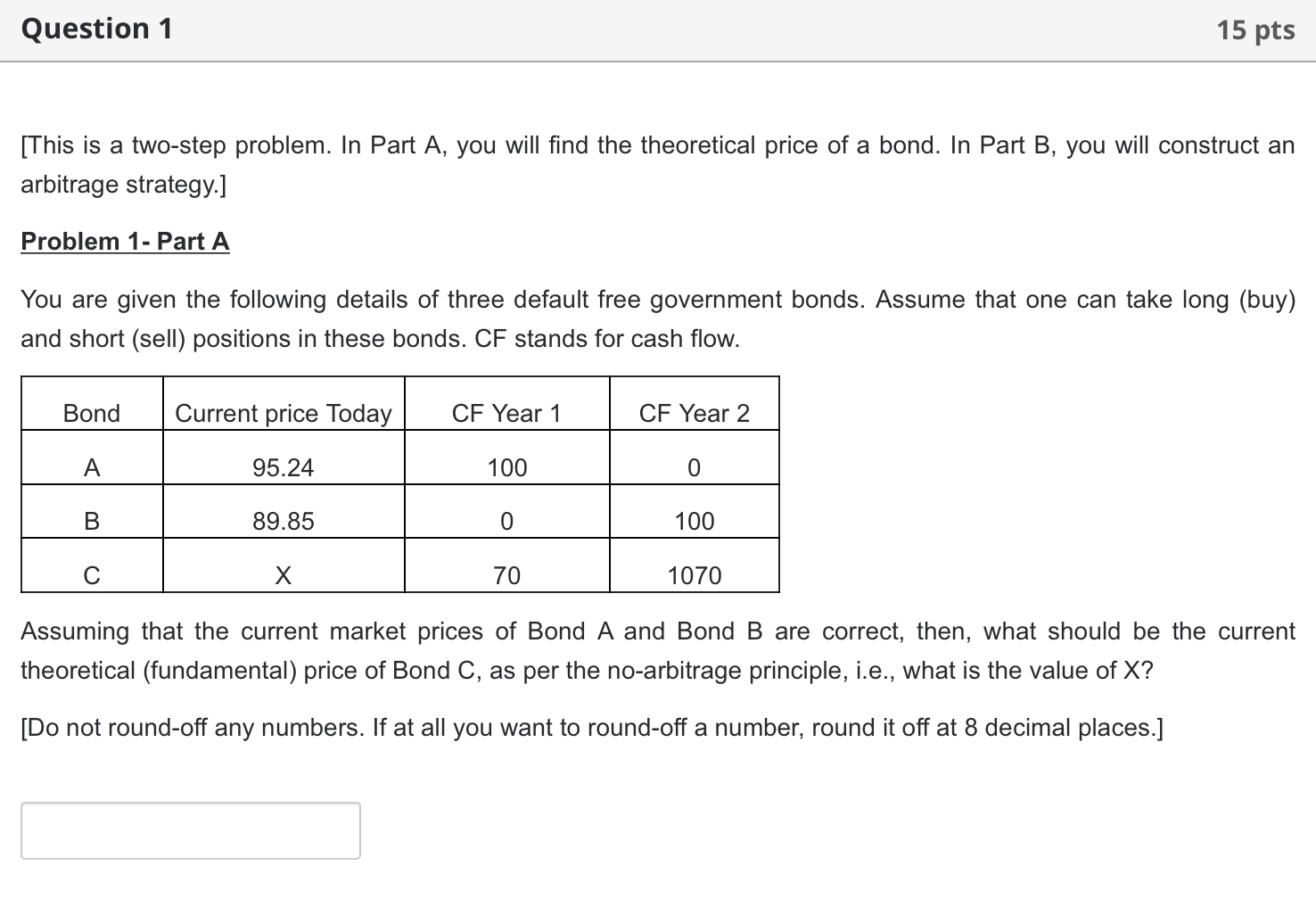

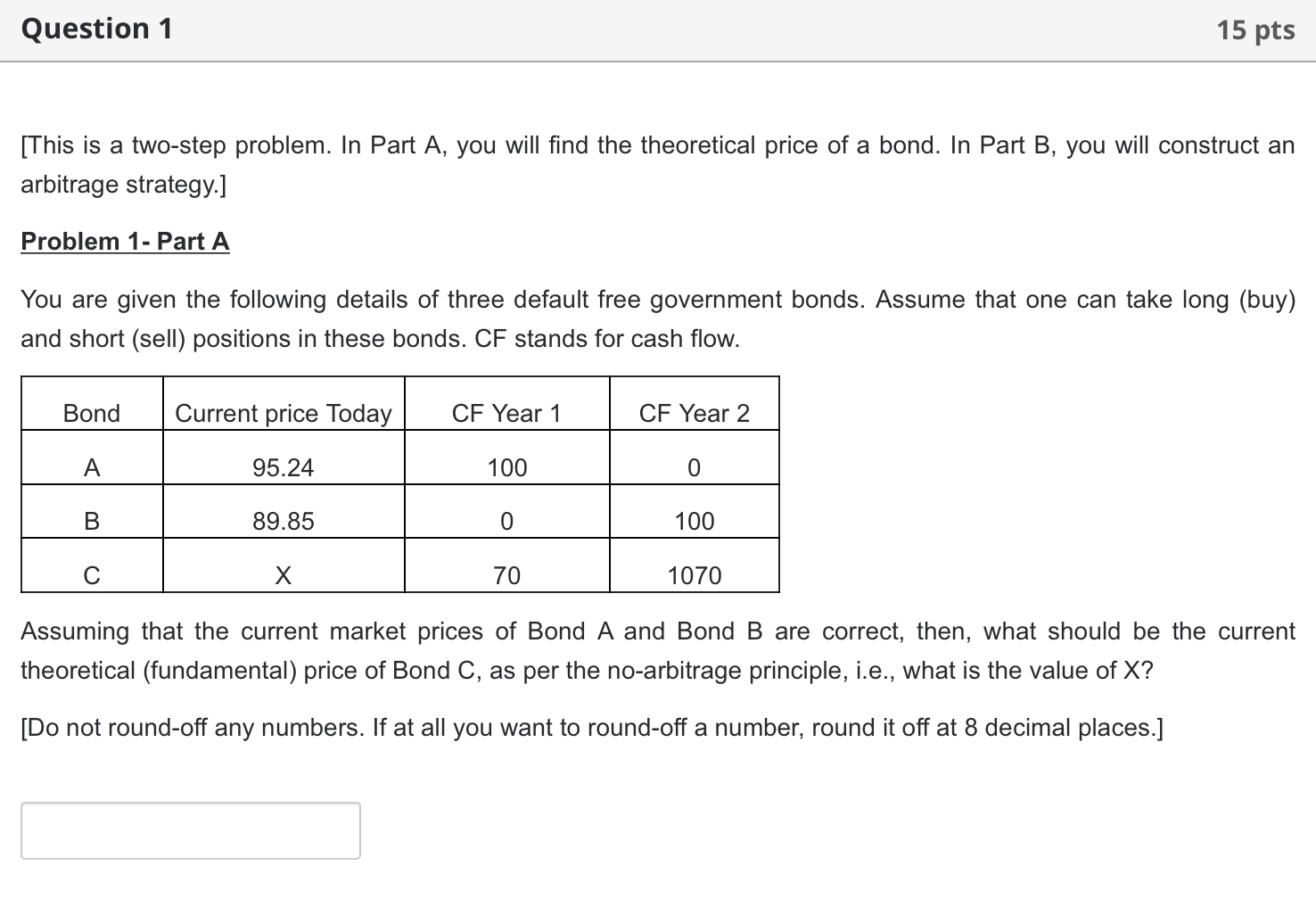

[This is a two-step problem. In Part A, you will find the theoretical price of a bond. In Part B, you will construct an arbitrage strategy. Problem 1-Part A You are given the following details of three default free government bonds. Assume that one can take long (buy) and short (sell) positions in these bonds. CF stands for cash flow. Assuming that the current market prices of Bond A and Bond B are correct, then, what should be the current theoretical (fundamental) price of Bond C, as per the no-arbitrage principle, i.e., what is the value of X ? [Do not round-off any numbers. If at all you want to round-off a number, round it off at 8 decimal places.] You are given the following details of three default free government bonds. Assume that one can take long (buy) and short (sell) positions in these bonds. CF stands for cash flow. Looking at these numbers, an arbitrager constructs a strategy whereby she generates a positive cash flow of $10 Now (t=0), and she will have zero cash flows for Year 1 and Year 2 . What is her arbitrage strategy at t=0 ? S1) quantity of Bond A; and S2) quantity of Bond B; and [This is a two-step problem. In Part A, you will find the theoretical price of a bond. In Part B, you will construct an arbitrage strategy. Problem 1-Part A You are given the following details of three default free government bonds. Assume that one can take long (buy) and short (sell) positions in these bonds. CF stands for cash flow. Assuming that the current market prices of Bond A and Bond B are correct, then, what should be the current theoretical (fundamental) price of Bond C, as per the no-arbitrage principle, i.e., what is the value of X ? [Do not round-off any numbers. If at all you want to round-off a number, round it off at 8 decimal places.] You are given the following details of three default free government bonds. Assume that one can take long (buy) and short (sell) positions in these bonds. CF stands for cash flow. Looking at these numbers, an arbitrager constructs a strategy whereby she generates a positive cash flow of $10 Now (t=0), and she will have zero cash flows for Year 1 and Year 2 . What is her arbitrage strategy at t=0 ? S1) quantity of Bond A; and S2) quantity of Bond B; and