Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For an account with full acces... more PC and all parties trading with it are registered for VAT. VAT is levied at 15%. The IQ-

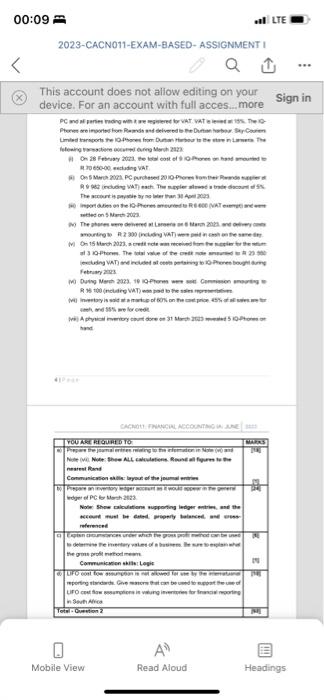

For an account with full acces... more PC and all parties trading with it are registered for VAT. VAT is levied at 15%. The IQ- Phones are imported from Rwanda and delivered to the Durban harbour. Sky-Couriers Limited transports the IQ-Phones from Durban Harbour to the store in Lanseria. The following transactions occurred during March 2023: (10) On 28 February 2023, the total cost of 9 IQ-Phones on hand amounted to R 70 650-00, excluding VAT. (ii) On 5 March 2023, PC purchased 20 IQ-Phones from their Rwanda supplier at R 9 982 (including VAT) each. The supplier allowed a trade discount of 5%. The account is payable by no later than 30 April 2023. (iii) Import duties on the IQ-Phones amounted to R 6 600 (VAT exempt) and were settled on 5 March 2023. (iv) The phones were delivered at Lanseria on 6 March 2023, and delivery costs amounting to R2 300 (including VAT) were paid in cash on the same day. (v) On 15 March 2023, a credit note was received from the supplier for the return of 3 IQ-Phones. The total value of the credit note amounted to R 23 550 (excluding VAT) and included all costs pertaining to IQ-Phones bought during February 2023. (vi) During March 2023, 19 IQ-Phones were sold. Commission amounting to R 16 100 (including VAT) was paid to the sales representatives. (vii) Inventory is sold at a markup of 60% on the cost price. 45% of all sales are for cash, and 55% are for credit. (viii) A physical inventory count done on 31 March 2023 revealed 5 IQ-Phones on hand.

YOU ARE REQUIRED TO:

a) Prepare the journal entries relating to the information in Note (vi) and Note (vii). Note: Show ALL calculations. Round all figures to the nearest Rand CACN011: FINANCIAL ACCOUNTING IA-JUNE 2023 Communication skills: layout of the journal entries

b) Prepare an inventory ledger account as it would appear in the general ledger of PC for March 2023. Note: Show calculations supporting ledger entries, and the account must be dated, properly balanced, and cross- referenced

c) Explain circumstances under which the gross profit method can be used to determine the inventory values of a business. Be sure to explain what the gross profit method means. Communication skills: Logic

d) LIFO cost flow assumption is not allowed for use by the internatuonal reporting standards. Give reasons that can be used to support the use of LIFO cost flow assumptions in valuing inventories for financial reporting in South Africa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started