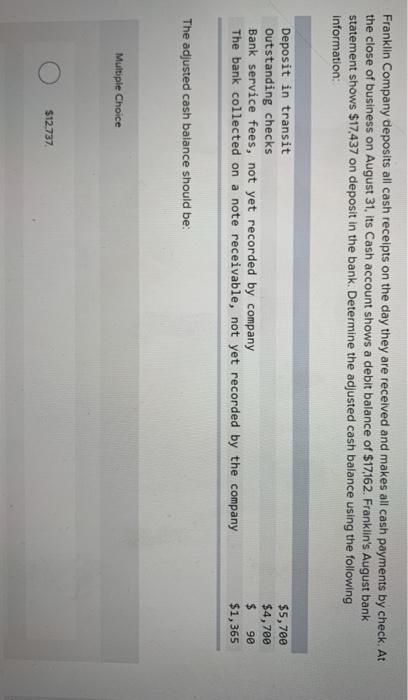

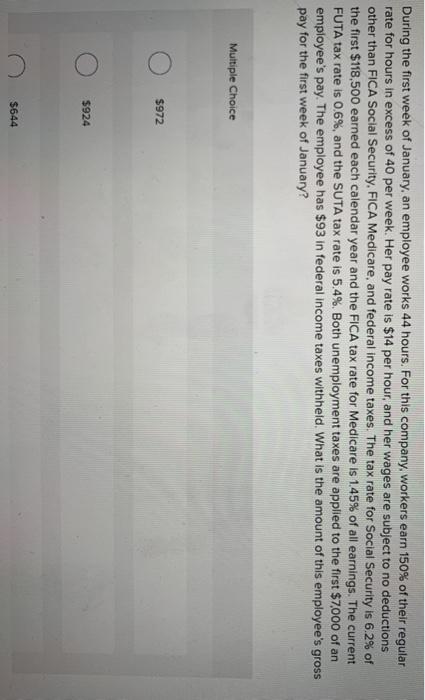

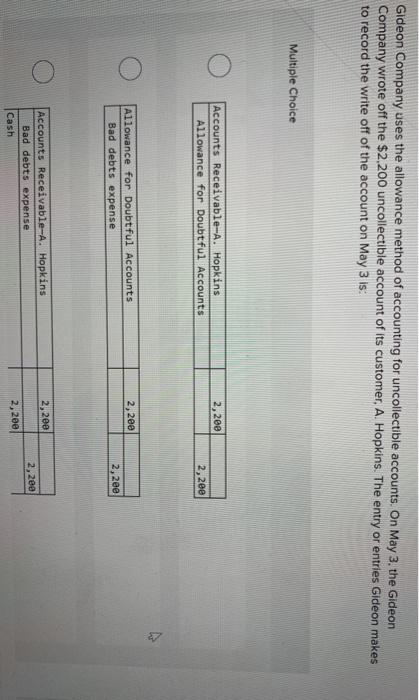

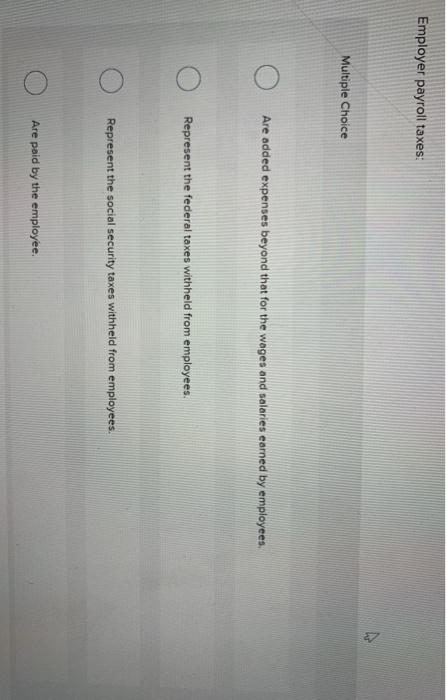

Franklin Company deposits all cash receipts on the day they are received and makes all cash payments by check. At the close of business on August 31, its Cash account shows a debit balance of $17,162. Franklin's August bank statement shows $17.437 on deposit in the bank. Determine the adjusted cash balance using the following information: Deposit in transit Outstanding checks Bank service fees, not yet recorded by company The bank collected on a note receivable, not yet recorded by the company $5,700 $4,700 $ 90 $1,365 The adjusted cash balance should be: Multiple Choice $12.737 During the first week of January, an employee works 44 hours. For this company, workers earn 150% of their regular rate for hours in excess of 40 per week. Her pay rate is $14 per hour, and her wages are subject to no deductions other than FICA Social Security, FICA Medicare, and federal income taxes. The tax rate for Social Security is 6.2% of the first $118,500 earned each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. The employee has $93 in federal income taxes withheld. What is the amount of this employee's gross pay for the first week of January? Multiple Choice $972 $924 $644 Gideon Company uses the allowance method of accounting for uncollectible accounts. On May 3. the Gideon Company wrote off the $2,200 uncollectible account of its customer, A. Hopkins. The entry or entries Gideon makes to record the write off of the account on May 3 is: Multiple Choice 2, 2ee Accounts Receivable-A. Hopkins Allowance for Doubtful Accounts 2,200 2,200 Allowance for Doubtful Accounts Bad debts expense 2,200 2,2ee Accounts Receivable-A. Hopkins Bad debts expense Cash 2,2ee 2,200 Employer payroll taxes: Multiple Choice Are added expenses beyond that for the wages and salaries earned by employees, Represent the federal taxes withheld from employees. Represent the social security taxes withheld from employees Are paid by the employee