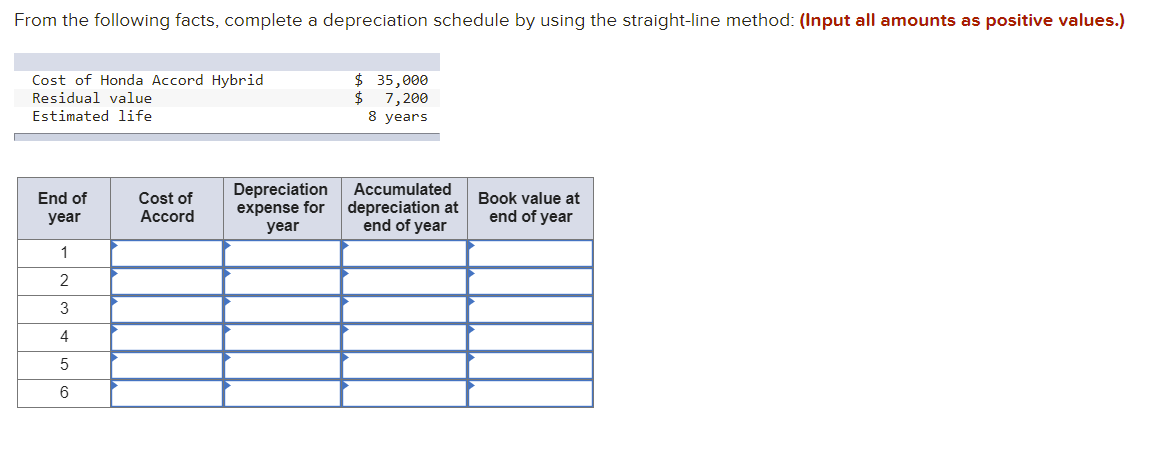

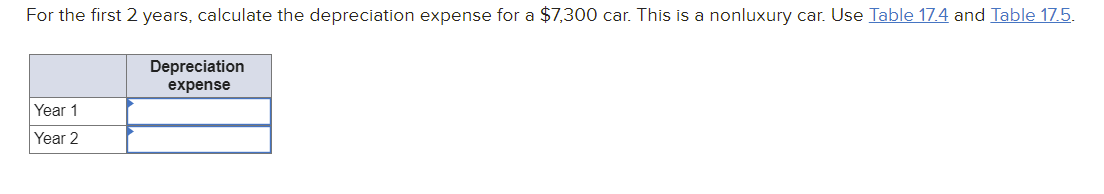

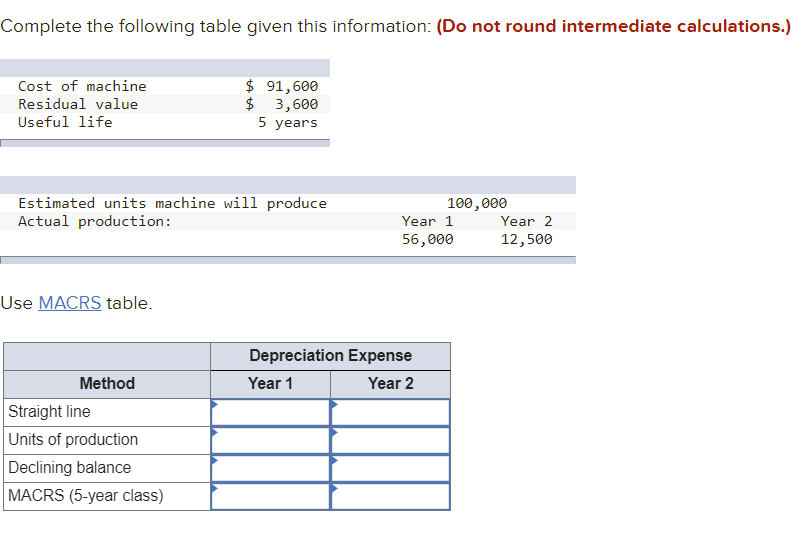

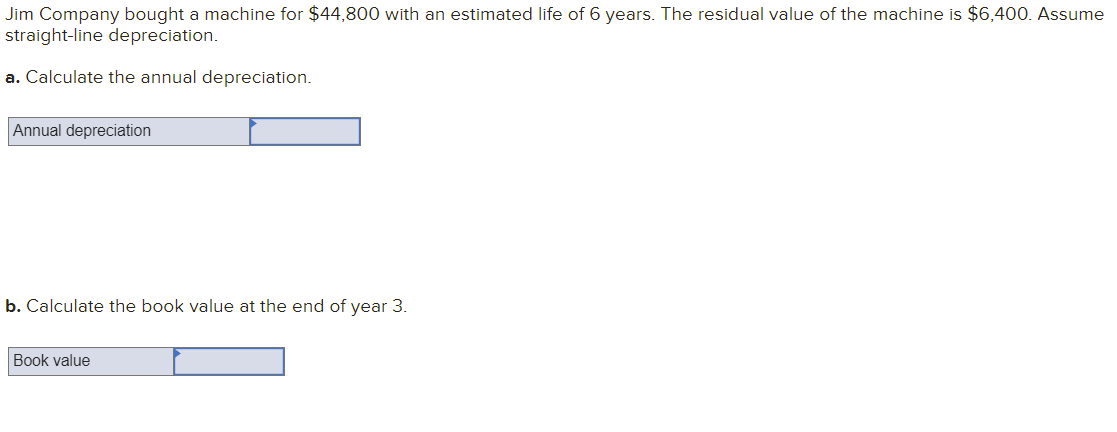

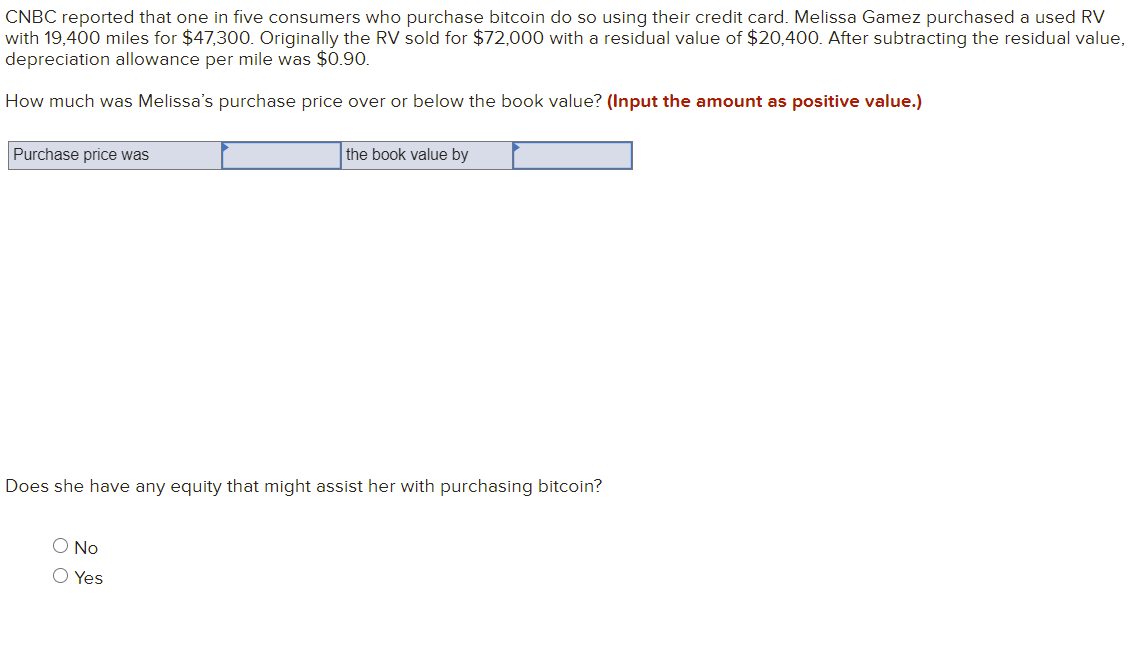

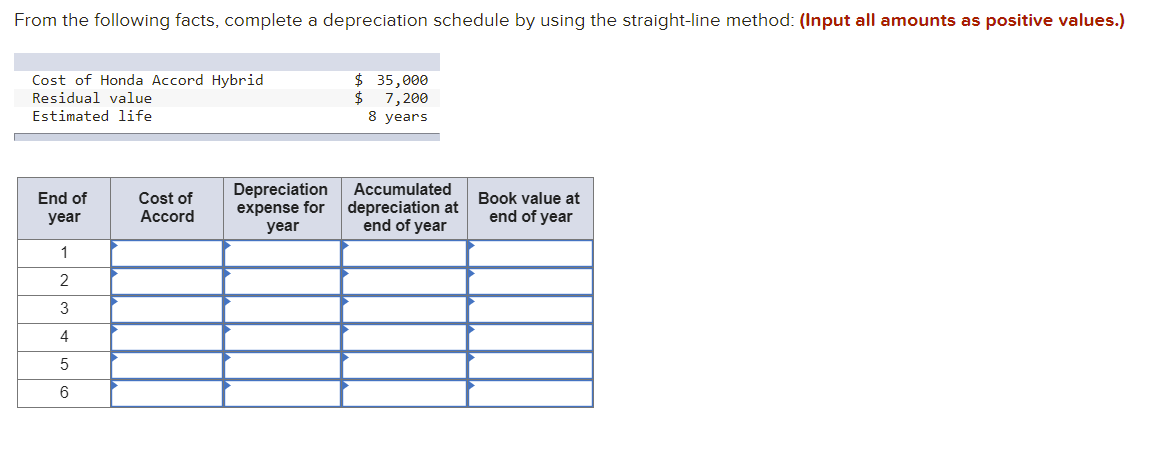

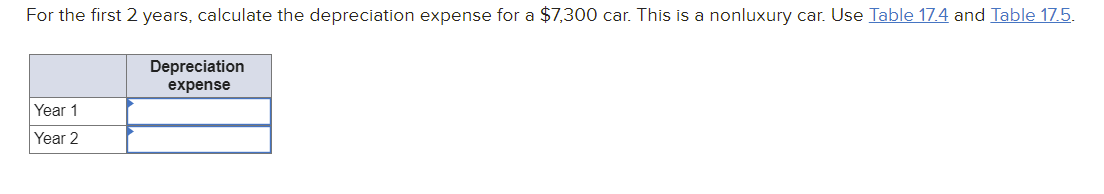

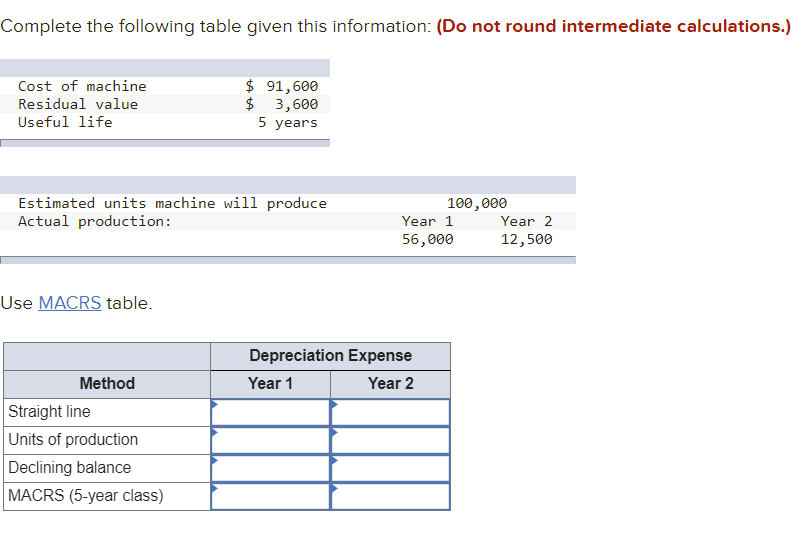

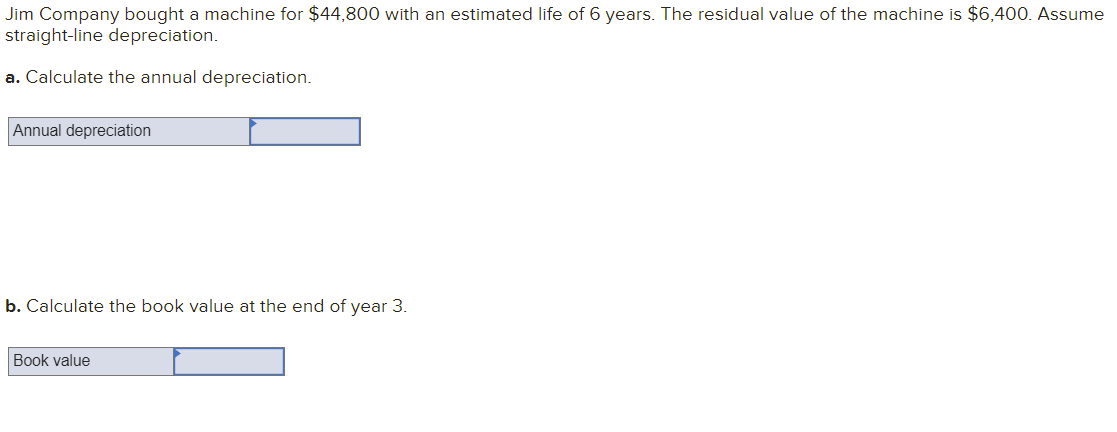

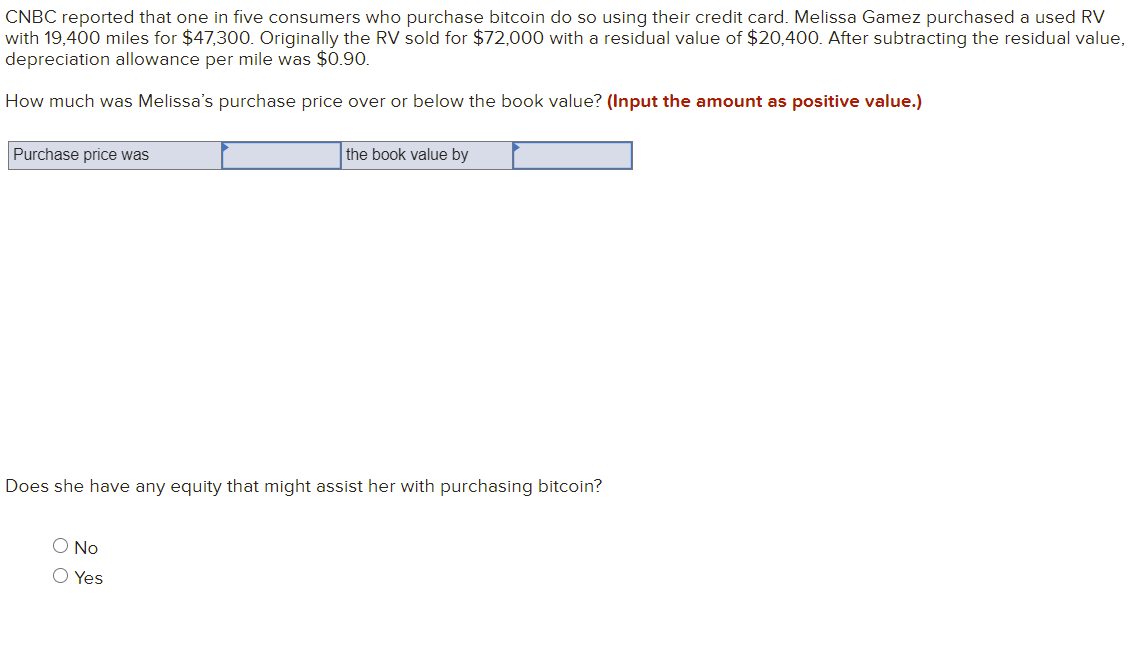

From the following facts, complete a depreciation schedule by using the straight-line method: (Input all amounts as positive values.) Cost of Honda Accord Hybrid Residual value Estimated life $ 35,000 $ 7,200 8 years End of year Cost of Accord Depreciation expense for year Accumulated depreciation at end of year Book value at end of year 1 2 3 4 5 6 For the first 2 years, calculate the depreciation expense for a $7,300 car. This is a nonluxury car. Use Table 17.4 and Table 17.5. Depreciation expense Year 1 Year 2 Complete the following table given this information: (Do not round intermediate calculations.) Cost of machine Residual value Useful life $ 91,600 $ 3,600 5 years Estimated units machine will produce Actual production: 100,000 Year 1 Year 2 56,000 12,500 Use MACRS table. Depreciation Expense Year 1 Year 2 Method Straight line Units of production Declining balance MACRS (5-year class) Jim Company bought a machine for $44,800 with an estimated life of 6 years. The residual value of the machine is $6,400. Assume straight-line depreciation. a. Calculate the annual depreciation. Annual depreciation b. Calculate the book value at the end of year 3. Book value CNBC reported that one in five consumers who purchase bitcoin do so using their credit card. Melissa Gamez purchased a used RV with 19,400 miles for $47,300. Originally the RV sold for $72,000 with a residual value of $20,400. After subtracting the residual value, depreciation allowance per mile was $0.90. How much was Melissa's purchase price over or below the book value? (Input the amount as positive value.) Purchase price was the book value by Does she have any equity that might assist her with purchasing bitcoin? O No O Yes From the following facts, complete a depreciation schedule by using the straight-line method: (Input all amounts as positive values.) Cost of Honda Accord Hybrid Residual value Estimated life $ 35,000 $ 7,200 8 years End of year Cost of Accord Depreciation expense for year Accumulated depreciation at end of year Book value at end of year 1 2 3 4 5 6 For the first 2 years, calculate the depreciation expense for a $7,300 car. This is a nonluxury car. Use Table 17.4 and Table 17.5. Depreciation expense Year 1 Year 2 Complete the following table given this information: (Do not round intermediate calculations.) Cost of machine Residual value Useful life $ 91,600 $ 3,600 5 years Estimated units machine will produce Actual production: 100,000 Year 1 Year 2 56,000 12,500 Use MACRS table. Depreciation Expense Year 1 Year 2 Method Straight line Units of production Declining balance MACRS (5-year class) Jim Company bought a machine for $44,800 with an estimated life of 6 years. The residual value of the machine is $6,400. Assume straight-line depreciation. a. Calculate the annual depreciation. Annual depreciation b. Calculate the book value at the end of year 3. Book value CNBC reported that one in five consumers who purchase bitcoin do so using their credit card. Melissa Gamez purchased a used RV with 19,400 miles for $47,300. Originally the RV sold for $72,000 with a residual value of $20,400. After subtracting the residual value, depreciation allowance per mile was $0.90. How much was Melissa's purchase price over or below the book value? (Input the amount as positive value.) Purchase price was the book value by Does she have any equity that might assist her with purchasing bitcoin? O No O Yes