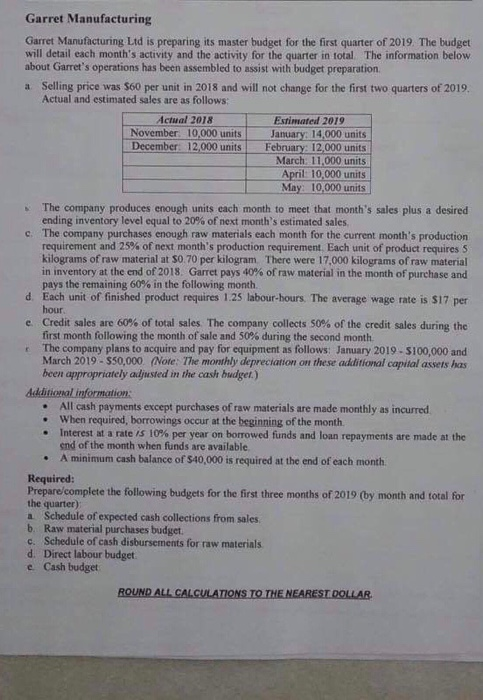

Garret Manufacturing Garret Manufacturing Ltd is preparing its master budget for the first quarter of 2019. The budget will detail each month's activity and the activity for the quarter in total. The information below about Garret's operations has been assembled to assist with budget preparation Selling price was $60 per unit in 2018 and will not change for the first two quarters of 2019 Actual and estimated sales are as follows: a Actual 2018 Estimated 2019 November 10,000 unitsJanuary: 14.000 units December: 12,000 units February: 12,000 units March 11,000 units April: 10,000 units May 10,000 units The company produces enough units each month to meet that month's sales plus a desired ending inventory level equal to 20% of next month's estimated sales. The company purchases enough raw materials each month for the current month's production requirement and 25% of next month's production requirement Each unit of product requires s kilograms of raw material at S0.70 per kilogram There were 17,000 kilograms of raw material in inventory at the end of 2018 Garret pays 40% of raw material in the month of purchase and pays the remaining 60% in the following month. s C. d. Each unit of finished product requires 1.25 labour-hours. The average wage rate is $17 per e Credit sales are 60% of total sales The company collects S0% of the credit sales during the r The company plans to acquire and pay for equipment as follows: January 2019-S100,000 and hour first month following the month of sale and 50% during the second month. March 2019 $50,000 (Note: The monthly depreciation on these additional capital assets has been appropriately adjusted in the cash budget) Additional information All cash payments except purchases of raw materials are made monthly as incurred When required, borrowings occur at the beginning of the month Interest at a rate is 10% per year on borrowed funds and loan repayments are made at the end of the month when funds are available A minimum cash balance of $40,000 is required at the end of each month. . . Required: Prepare/complete the following budgets for the first three months of 2019 (by month and total for the quarter) a. Schedule of expected cash collections from sales b. Raw material purchases budget. c. Schedule of cash disbursements for raw materials d. Direct labour budget e Cash budget