Question

General Information: Country A exempts dividends from foreign subsidiaries from taxation and there are no withholding taxes between the three countries. All countries have signed

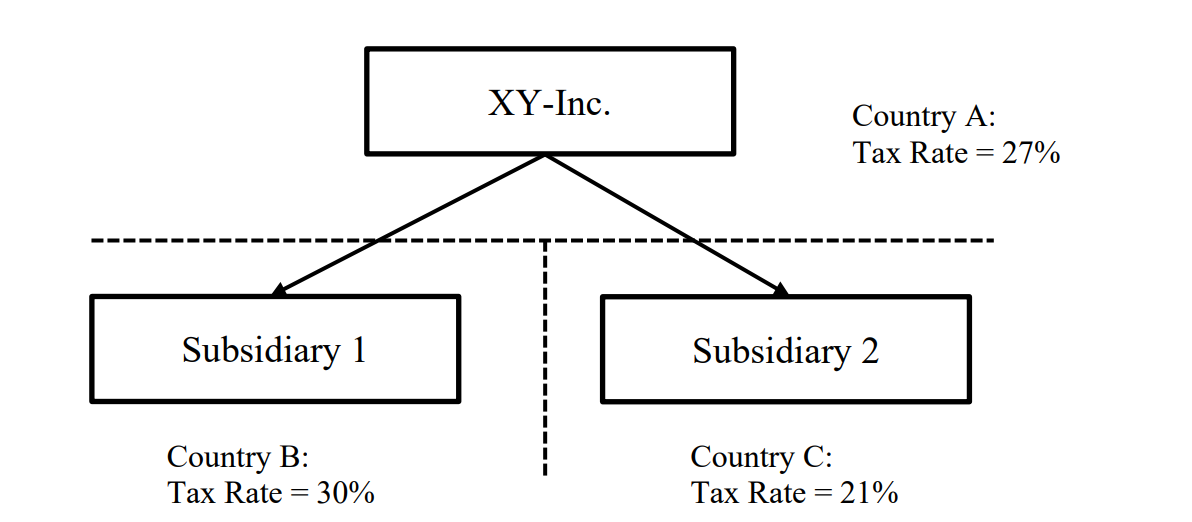

General Information: Country A exempts dividends from foreign subsidiaries from taxation and there are no withholding taxes between the three countries. All countries have signed double tax treaties.

a) Please assume that both subsidiaries are entirely financed by equity. Subsidiary 1 realizes a profit of 560. Subsidiary 2 realizes a profit of 250. The XY-Inc. realizes a profit of 425 in Country A. Please calculate the worldwide tax burden of the entire group. The CFO of the XY-Inc. asks for your tax advice as you are considered a tax expert. The CFO is uncertain about the internal financing structure debt or equity financing.

b) What would you recommend the CFO? How would you finance the subsidiaries?

c) How would your answers from question b) change if Country A applies a credit system?

d) Which regulations are implemented by high-tax countries such as Germany, Italy, Japan, and many others to prevent international profit shifting via holdings and debt financing? Briefly explain how these rules work.

XY-Inc. Country A: Tax Rate = 27% Subsidiary 1 Subsidiary 2 Country B: Tax Rate = 30% Country C: Tax Rate = 21%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started