Question

Hanover Agencies Limited (HAL) is a distributor of electrical products, located in Lucea Hanover. The company was incorporated on the 1st of January 2019 with

Hanover Agencies Limited (HAL) is a distributor of electrical products, located in Lucea Hanover. The company was incorporated on the 1st of January 2019 with a share capital of 6,000,000 $2 ordinary shares. On the date of the incorporation the company acquired two (2) delivery trucks at a cost of $4,000,000 each and decided to depreciate the trucks using the units of output method. The company planned to keep the trucks for a useful life of 200,000 miles each. The residual value of each truck is estimated to be $500,000 each after 200,000 miles. On the 1 March 2020 the company received a government grant of $3,000,000 to cover 60% of the cost of a new solar system. The solar system has a useful life of five years with no residual value. On June 1, 2020 the company decided to construct a new office complex in Green Island, Hanover and borrowed a loan from the International Bank of Commerce (IBC) of $100,000,000 at a nominal interest rate of 10%. The effective interest rate on the loan was however determined to be 12%. The Office complex will be rented to other businesses. Construction of the office complex began on 1 July 2020 and was completed on May 31,2021, at a construction costs of $156,000,000. Construction on the office complex was suspended during the month of January 2021. The company (HAL) invested 40% of the money received from IBC for the period October 1,2020 to 31 January 2021 at an interest rate of 8%. On January 1 2022, the company bought 1,600,000 of the ordinary share capital of Negril Limited at a price of $7,600,000 and 30% of the ordinary shares of Cove Limited for $400,000. The total share capital of Negril Limited was 2,000,000 $1 ordinary shares. At the date of the acquisition the retained earnings of Negril Limited was $76,000 and the general reserve balance was $123,000. Cove Limited is a small distribution company in Hanover with a share capital of 600,000 $1 ordinary shares. The purchase consideration for Negril Limited was satisfied by the issue of 3 ordinary shares in Hanover Agencies Limited for every 4 shares acquired in Negril Limited. At this date the market price of a share in HAL was $3.20. The balance on the purchase consideration represents an issue of $2,000,000 in 10% loans stocks by HAL to the shareholders of Negril Limited and a deferred cash payment, to be satisfied in 5 years time (appropriate discount rate 9%). On June 30, 2022 one of the delivery trucks is involved in an accident and is sold for $700,000. HCL replaces this truck with a new truck at a cost of $7,000,000. The residual value of this truck is $1,000,000 after using it for 200,000 miles. The CEO for Hanover Agencies Limited is the also the newly appointed CEO for a not-for-profit organization, Hanover Society for the Poor (HSP). He does not believe that financial statements should be prepared for HSP. He remarked that it is a complete waste of resources and time.

Question

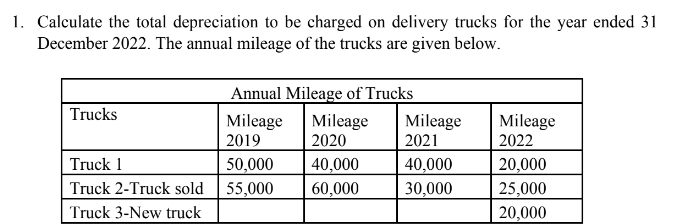

Calculate the total depreciation to be charged on delivery trucks for the year ended 31 December 2022. The annual mileage of the trucks are given below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started