Answered step by step

Verified Expert Solution

Question

1 Approved Answer

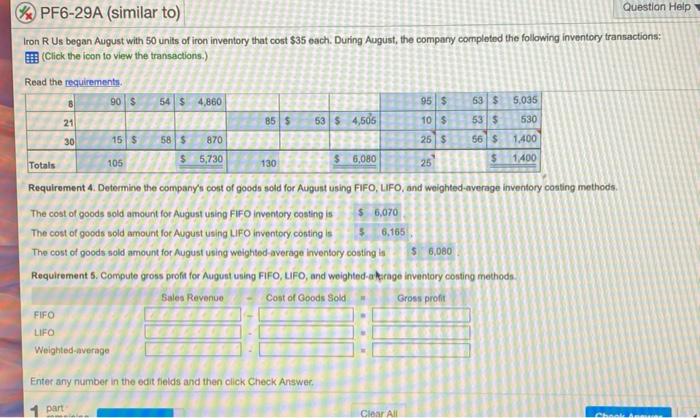

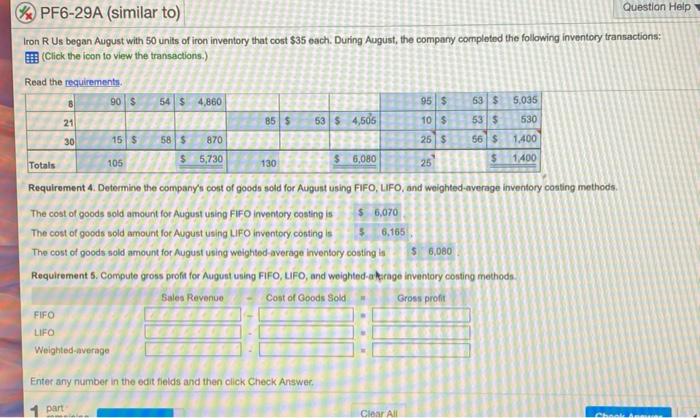

Help! 8 21 10$ 530 30 25$ 56 $ * PF6-29A (similar to) Question Help Iron R Us began August with 50 units of iron

Help!

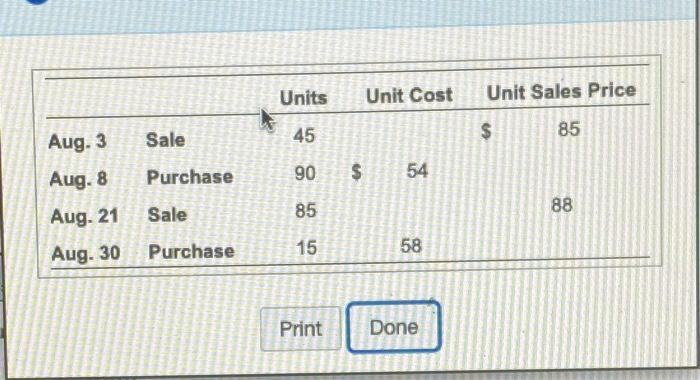

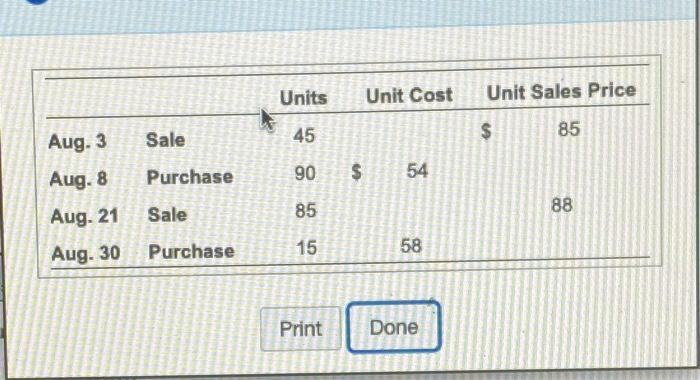

8 21 10$ 530 30 25$ 56 $ * PF6-29A (similar to) Question Help Iron R Us began August with 50 units of iron inventory that cost $35 each. During August, the company completed the following inventory transactions: Click the icon to view the transactions.) Read the requirements 90 $ 54$ 4,860 95 $ 53 $ 5,035 855 53 $ 4,505 53 $ 15 $ 58$ 870 1.400 $ 5,730 Totals $ 6,080 1,400 Requirement 4. Determine the company's cost of goods sold for August using FIFO, LIFO, and weighted-average inventory conting methods. The cost of goods sold amount for August using FIFO Inventory costing is $ 6,070 The cost of goods sold amount for August using LIFO inventory costings 3 6,165 The cost of goods sold amount for August using weighted average inventory costing is $ 6,080 Requirement 5. Compute grons profa for Augunt uning FIFO, LIFO, and weighted average inventory costing methods Sales Revenue Cost of Goods Sold Gross profit 105 $ 130 25 FIFO LIFO Weighted average Enter any number in the edit fields and then click Check Answer part Clear Al Units Unit Cost Unit Sales Price 45 Sale 85 $ Aug. 3 Aug. 8 Purchase 90 $ 54 Sale Aug. 21 85 88 Purchase Aug. 30 15 1 58 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started