Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi im doing an assignment on myobx can someone identify the journal entries for the transacfions shown. thanks for this assignment on myob i have

hi im doing an assignment on myobx can someone identify the journal entries for the transacfions shown. thanks

for this assignment on myob i have trouble understanding transaction on the 16 july how do you enter this as a purc

haze tranzaction when they ask this.

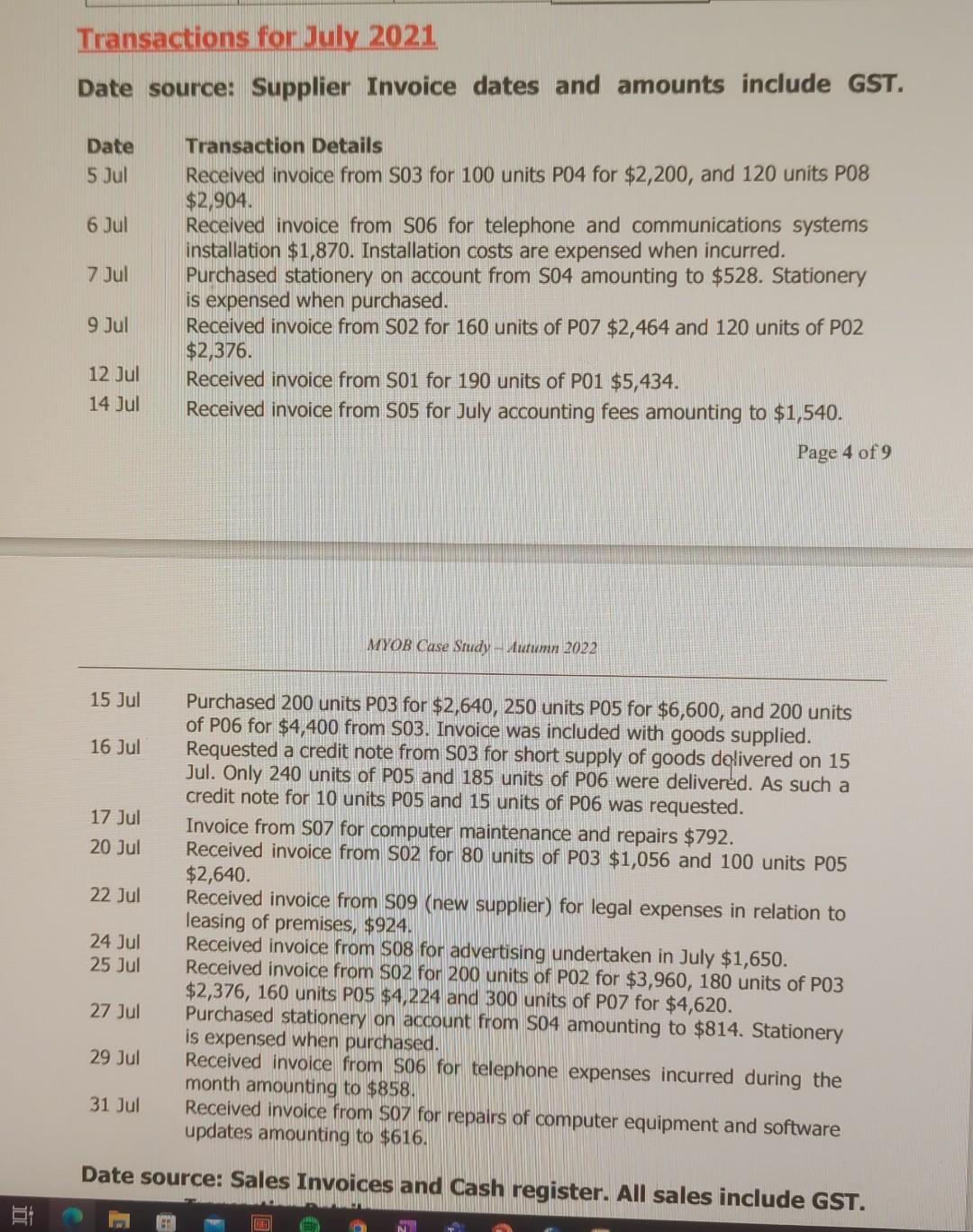

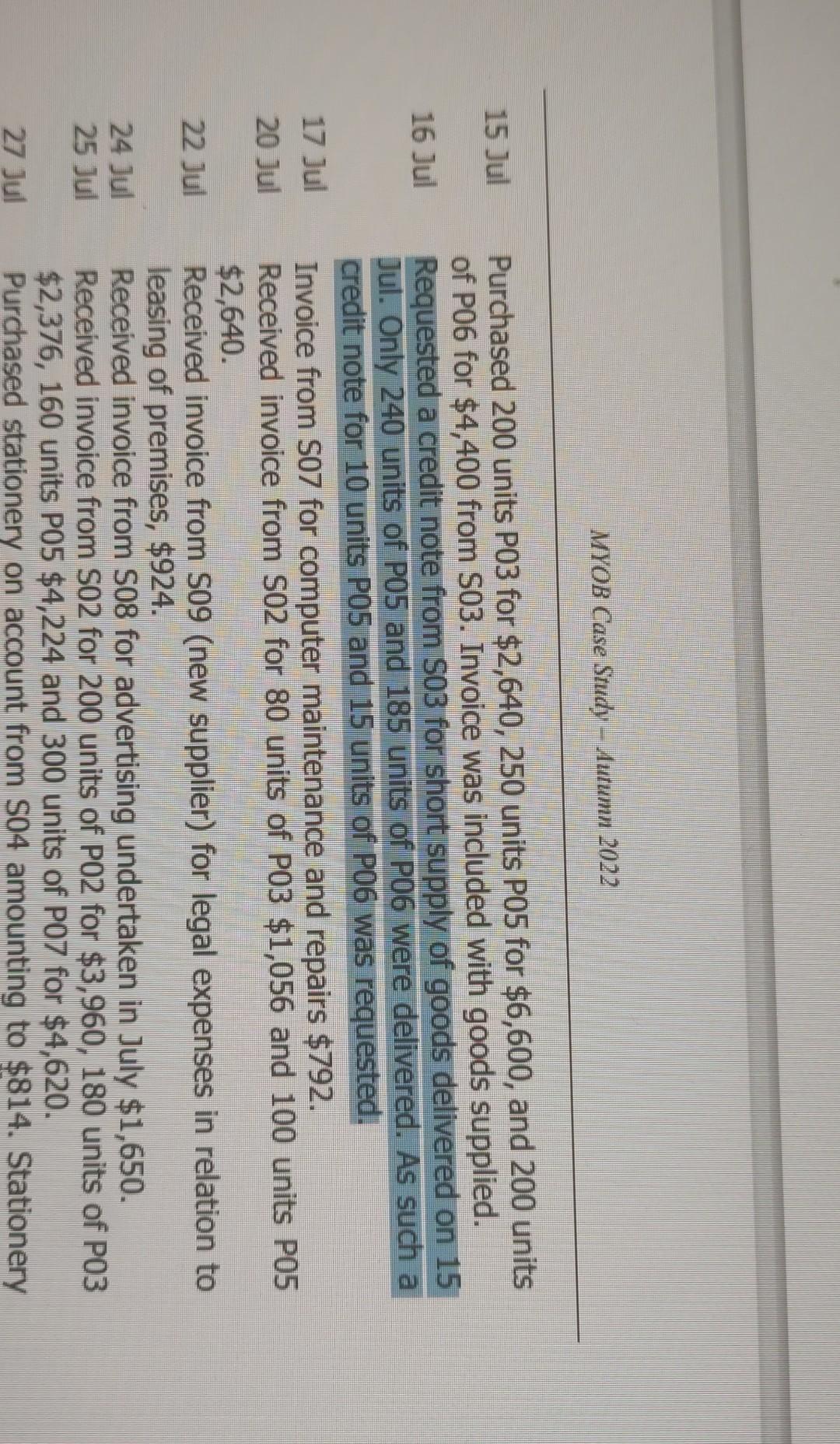

Transactions for July 2021 Date source: Supplier Invoice dates and amounts include GST. Date 5 Jul 6 Jul 7 Jul Transaction Details Received invoice from S03 for 100 units P04 for $2,200, and 120 units P08 $2,904. Received invoice from S06 for telephone and communications systems installation $1,870. Installation costs are expensed when incurred. Purchased stationery on account from S04 amounting to $528. Stationery is expensed when purchased. Received invoice from S02 for 160 units of P07 $2,464 and 120 units of P02 $2,376. Received invoice from S01 for 190 units of P01 $5,434. Received invoice from S05 for July accounting fees amounting to $1,540. 9 Jul 12 Jul 14 Jul Page 4 of 9 MYOB Case Study - unumn 2022 15 Jul 16 Jul 17 Jul 20 Jul 22 Jul Purchased 200 units P03 for $2,640, 250 units P05 for $6,600, and 200 units of P06 for $4,400 from S03. Invoice was included with goods supplied. Requested a credit note from S03 for short supply of goods delivered on 15 Jul. Only 240 units of P05 and 185 units of P06 were delivered. As such a credit note for 10 units P05 and 15 units of P06 was requested. Invoice from S07 for computer maintenance and repairs $792. Received invoice from S02 for 80 units of PO3 $1,056 and 100 units P05 $2,640. Received invoice from S09 (new supplier) for legal expenses in relation to leasing of premises, $924. Received invoice from S08 for advertising undertaken in July $1,650. Received invoice from S02 for 200 units of PO2 for $3,960, 180 units of PO3 $2,376, 160 units P05 $4,224 and 300 units of P07 for $4,620. Purchased stationery on account from S04 amounting to $814. Stationery is expensed when purchased. Received invoice from S06 for telephone expenses incurred during the month amounting to $858. Received invoice from $07 for repairs of computer equipment and software updates amounting to $616. 24 Jul 25 Jul 27 Jul 29 Jul 31 Jul Date source: Sales Invoices and Cash register. All sales include GST. D MYOB Case Study - Autumn 2022 15 Jul 16 Jul 17 Jul 20 Jul Purchased 200 units P03 for $2,640, 250 units P05 for $6,600, and 200 units of P06 for $4,400 from S03. Invoice was included with goods supplied. Requested a credit note from S03 for short supply of goods delivered on 15 Jul. Only 240 units of PO5 and 185 units of P06 were delivered. As such a credit note for 10 units P05 and 15 units of PO6 was requested. Invoice from S07 for computer maintenance and repairs $792. Received invoice from SO2 for 80 units of P03 $1,056 and 100 units P05 $2,640. Received invoice from S09 (new supplier) for legal expenses in relation to leasing of premises, $924. Received invoice from S08 for advertising undertaken in July $1,650. Received invoice from SO2 for 200 units of PO2 for $3,960, 180 units of P03 $2,376, 160 units P05 $4,224 and 300 units of PO7 for $4,620. Purchased stationery on account from S04 amounting to $814. Stationery 22 Jul 24 Jul 25 Jul 27 JulStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started