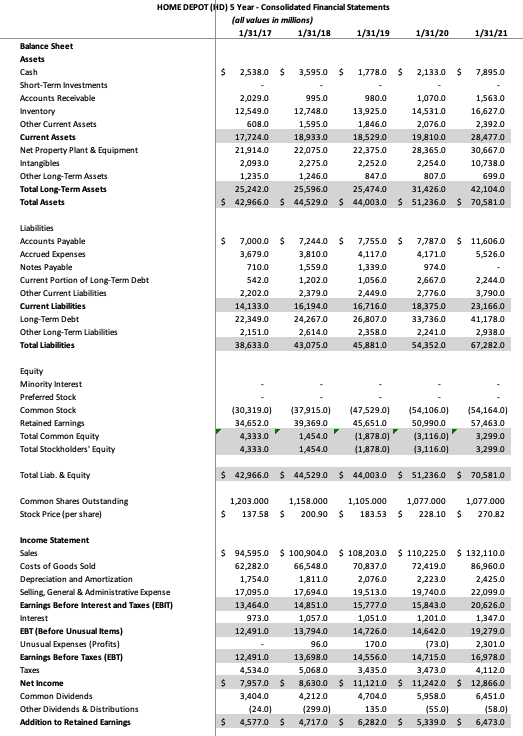

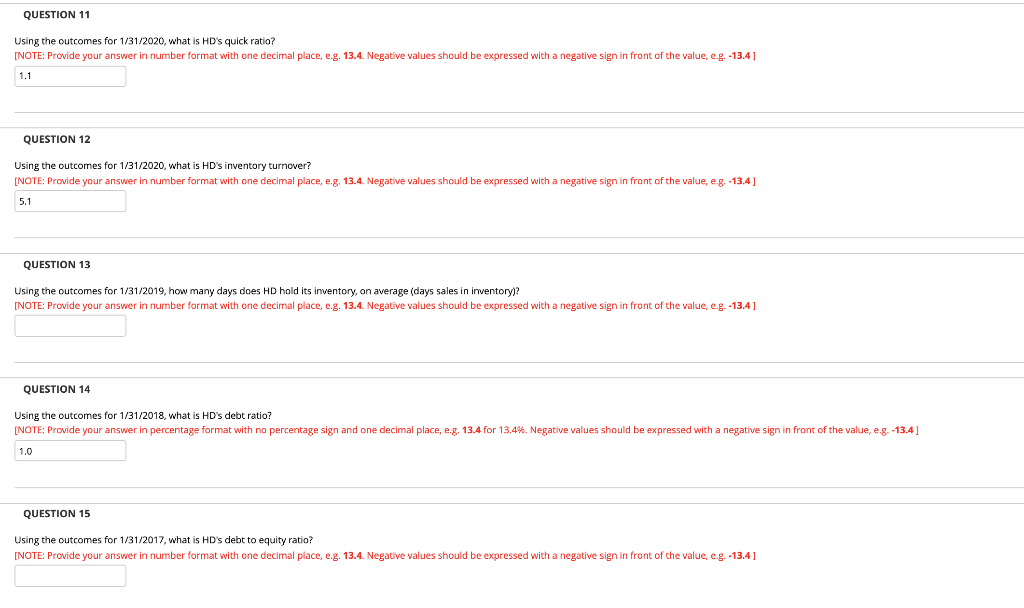

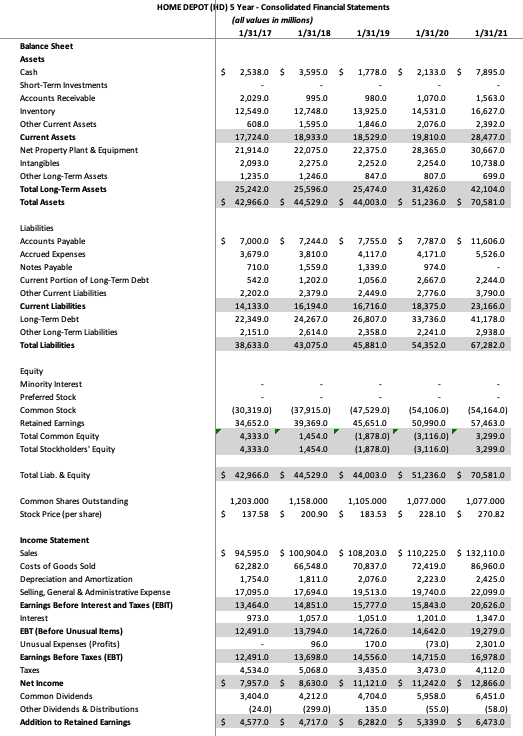

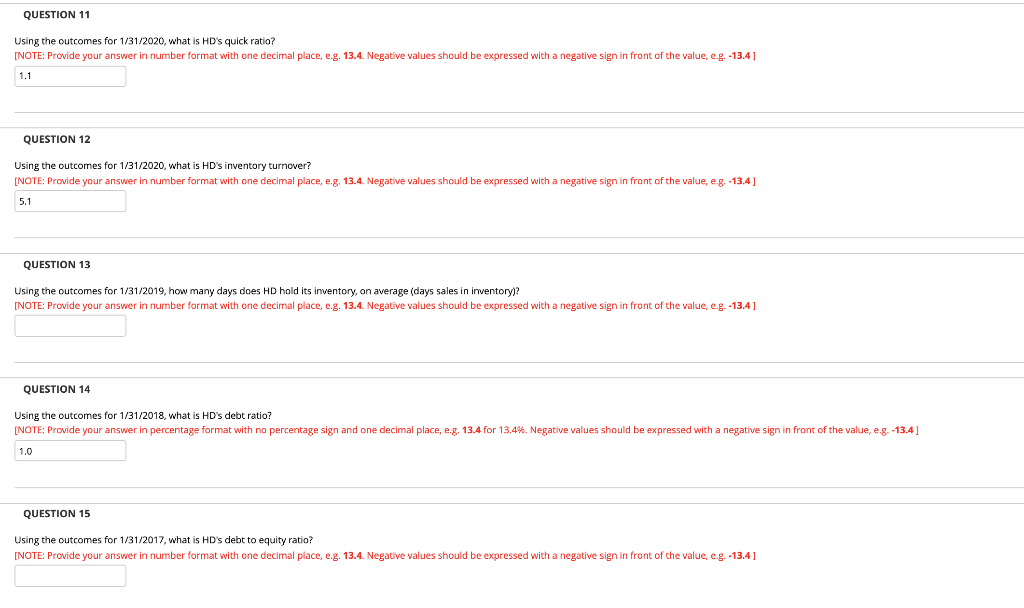

HOME DEPOT (HD) 5 Year - Consolidated Financial Statements (all values in millions) 1/31/17 1/31/18 1/31/19 1/31/20 1/31/21 $ 2,538.0 $ 3,595.0 $ 1,778.0 $ 2,133.0 $ 7,895.0 Balance Sheet Assets Cash Short-Term Investments Accounts Receivable Inventory Other Current Assets Current Assets Net Property Plant & Equipment Intangibles Other Long-Term Assets Total Long-Term Assets Total Assets 2,029.0 995.0 980.0 1,070.0 12,549.0 12,748.0 13,925.0 14,531,0 608.0 1,595.0 1,846.0 2,076.0 17,724.0 18,933.0 18,529.0 19,810.0 21,914.0 22,075.0 22,375.0 28,365.0 2,093.0 2,275.0 2,252.0 2,254.0 1,235.0 1,246.0 847.0 807.0 25.242.0 25,596.0 25,474.0 31,426.0 $ 42,966.0 $ 44,529.0 $ 44,003.0 $ 51,236.0 1,563.0 16,627.0 2,392.0 28,477.0 30,667.0 10,738.0 699.0 42,104.0 $ 70,581.0 $ Liabilities Accounts Payable Accrued Expenses Notes Payable Current Portion of Long-Term Debt Other Current Liabilities Current Liabilities Long-Term Debt Other Long-Term Liabilities Total Liabilities 7,000.0 $ 3,679.0 710.0 542.0 2,202.0 14,133.0 22,349.0 2,151.0 38,633.0 7,244.0 $ 3,810.0 1,559.0 1,202.0 2,379.0 16,194.0 24,267.0 2,614.0 43,075.0 7,755.0 $ 4,1170 1,339.0 1,056.0 2,449.0 16,716.0 26,807.0 2,358.0 45,881.0 7,787,0 $ 11,606.0 4,171.0 5,526.0 974.0 2,667.0 2.244.0 2,776.0 3,790.0 18,375.0 23,166.0 33,736.0 41,178.0 2,241.0 2,938.0 54,352.0 67,282.0 Equity Minority interest Preferred Stock Common Stock Retained Earnings Total Common Equity Total Stockholders' Equity (30,319.0) 34,652.0 4,333.0 4,333.0 (37,915.0) 39,369.0 1,454.0 1,454.0 (47,529.0) 45,651.0 (1,878.0) (1,878.0) (54,106.0) 50,990.0 (3,116.0) (3,116.0) (54,164.0) 57,463.0 3,299.0 3,299.0 Total Liab. & Equity $ 42,966.0 $ 44,529.0 $ 44,003.0 $ 51,236.0 $ 70,581.0 Common Shares Outstanding Stock Price (per share) 1,203.000 137.58 1,158.000 200.90 1,105.000 183.53 1,077.000 228.10 $ 1,077.000 270.82 $ $ $ $ Income Statement Sales Costs of Goods Sold Depreciation and Amortization Selling, General & Administrative Expense Earnings Before Interest and Taxes (EBIT) Interest EBT (Before Unusual Items) Unusual Expenses (Profits) Earnings Before Taxes (EBT) Taxes Net Income Common Dividends Other Dividends & Distributions Addition to Retained Earnings $ 94,595.0 $ 100,904.0 $ 108,203.0 $ 110,225.0 $ 132,110.0 62,282.0 66,548.0 70,837.0 72,419.0 86,960.0 1,754.0 1,811.0 2,076.0 2,223.0 2,425.0 17,095.0 17,694.0 19,513.0 19,740.0 22,099.0 13,464.0 14,851.0 15,777.0 15,843.0 20,626.0 973.0 1,057.0 1,051.0 1,201.0 1,347.0 12,491.0 13,794.0 14,726.0 14,642.0 19,279.0 96.0 170.0 (73.0) 2,301.0 12,491.0 13,698.0 14,556.0 14,715.0 16,978.0 4,534.0 5,068.0 3,435.0 3,473.0 4,112.0 $ 7,957.0 $ 8,630,0 $ 11,121,0 $ 11,242.0 $ 12,866.0 3,4040 4,212,0 4,704.0 5,958.0 6,4510 (24.0) (299.0) 135.0 (55.0) (58.0) $ 4,577.0 $ 4,717,0 $ 6,282.0 $ 5,339.0 $ 6,473.0 QUESTION 11 Using the outcomes for 1/31/2020, what is HD's quick ratio? [NOTE: Provide your answer in number format with one decimal place, e.g. 13.4. Negative values should be expressed with a negative sign in front of the value, e.g.-13.4] 1.1 QUESTION 12 Using the outcomes for 1/31/2020, what is HD's inventory turnover? [NOTE: Provide your answer in number format with one decimal place, e.g, 13.4. Negative values should be expressed with a negative sign in front of the value, e.g.-13.4] 5.1 QUESTION 13 Using the outcomes for 1/31/2019, how many days does HD hold its inventory, on average (days sales in inventory)? [NOTE: Provide your answer in number format with one decimal place, e.g. 13.4. Negative values should be expressed with a negative sign in front of the value, e.g.-13.4] QUESTION 14 Using the outcomes for 1/31/2018, what is HD's debt ratio? [NOTE: Provide your answer in percentage format with no percentage sign and one decimal place, e.g, 13.4 for 13.4%. Negative values should be expressed with a negative sign in front of the value, e.g.-13.4] 1.0 QUESTION 15 Using the outcomes for 1/31/2017, what is HD's debt to equity ratio? [NOTE: Provide your answer in number format with one decimal place, e.g. 13.4. Negative values should be expressed with a negative sign in front of the value, e.g.-13.4]