Answered step by step

Verified Expert Solution

Question

1 Approved Answer

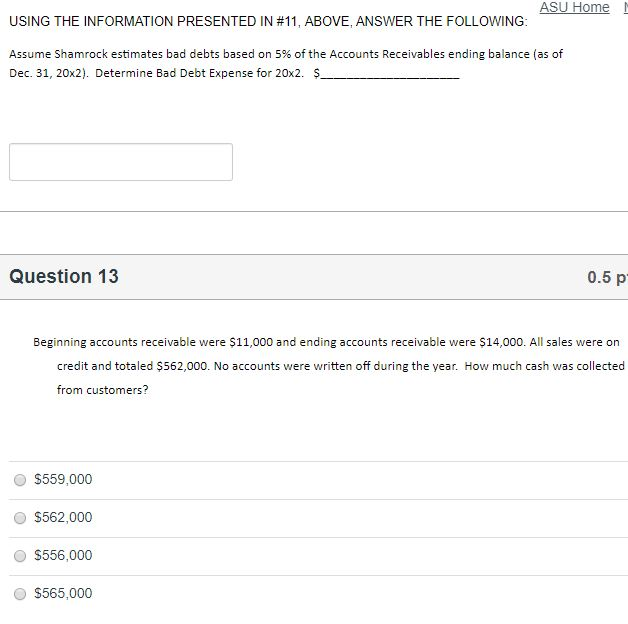

I dont need the ending balance just theother two thanks ASU Home ! USING THE INFORMATION PRESENTED IN #11, ABOVE, ANSWER THE FOLLOWING: Assume Shamrock

I dont need the ending balance just theother two

thanks

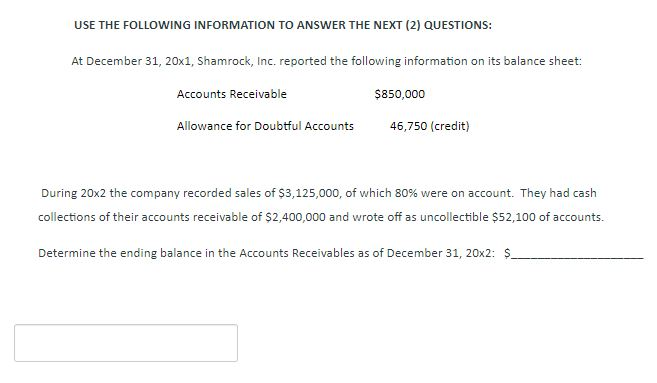

ASU Home ! USING THE INFORMATION PRESENTED IN #11, ABOVE, ANSWER THE FOLLOWING: Assume Shamrock estimates bad debts based on 5% of the Accounts Receivables ending balance (as of Dec 31, 20x2). Determine Bad Debt Expense for 20x2. $. Question 13 0.5 p Beginning accounts receivable were $11,000 and ending accounts receivable were $14,000. All sales were on credit and totaled $562,000. No accounts were written off during the year. How much cash was collected from customers? $559,000 $562,000 $556,000 $565,000 USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (2) QUESTIONS: At December 31, 20x1, Shamrock, Inc. reported the following information on its balance sheet: Accounts Receivable $850,000 Allowance for Doubtful Accounts 46,750 (credit) During 20x2 the company recorded sales of $3,125,000, of which 80% were on account. They had cash collections of their accounts receivable of $2,400,000 and wrote off as uncollectible $52,100 of accounts. Determine the ending balance in the Accounts Receivables as of December 31, 20x2: $___Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started