Answered step by step

Verified Expert Solution

Question

1 Approved Answer

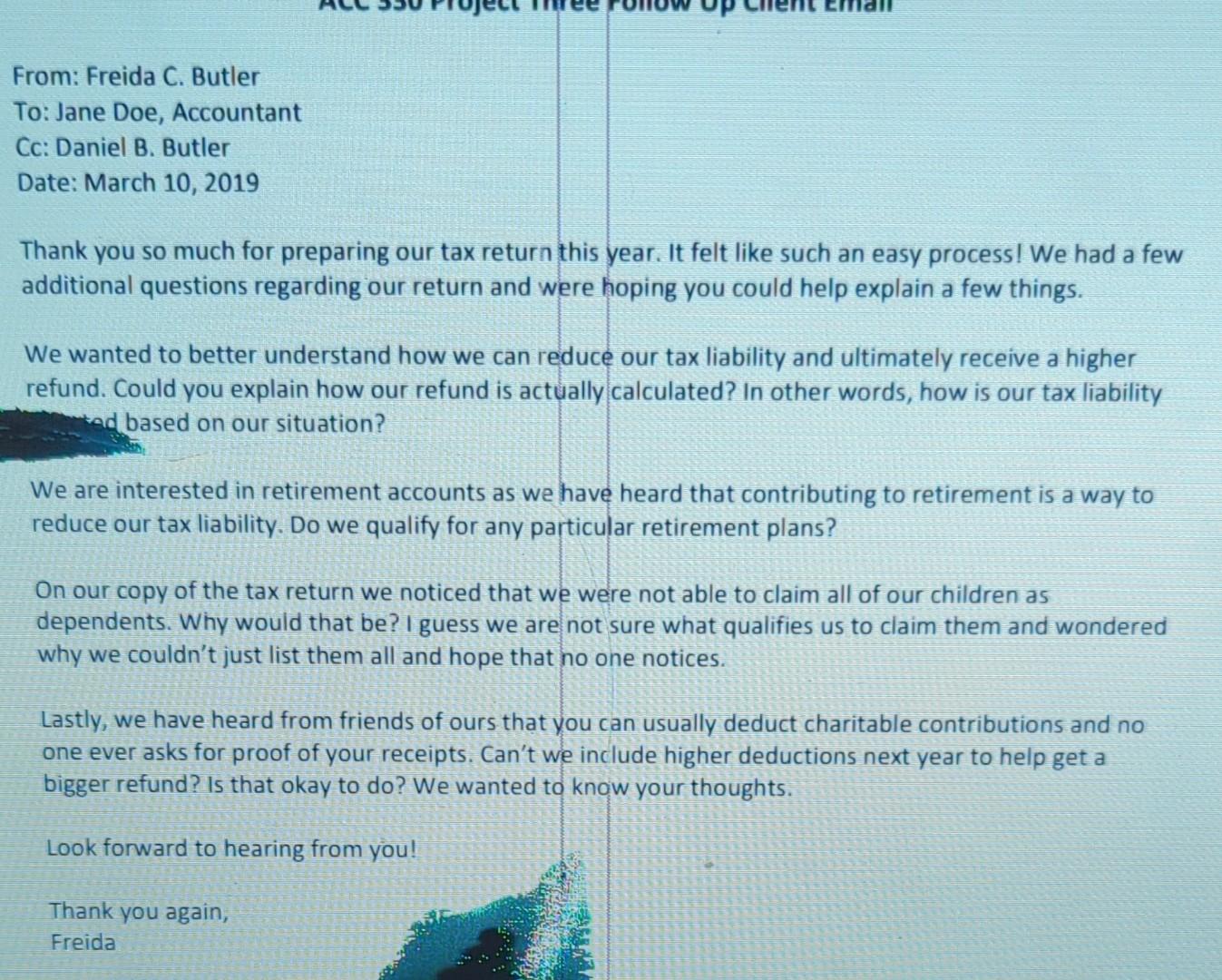

I know it's only one question per post so can you help me with the last question? advise me of the penalties that could come

I know it's only one question per post so can you help me with the last question? advise me of the penalties that could come about for reporting false information on charitable contributions thank you

To: Jane Doe, Accountant Cc: Daniel B. Butler Date: March 10, 2019 Thank you so much for preparing our tax return this year. It felt like such an easy process! We had a few additional questions regarding our return and were hoping you could help explain a few things. We wanted to better understand how we can reduce our tax liability and ultimately receive a higher refund. Could you explain how our refund is actually calculated? In other words, how is our tax liability bad based on our situation? We are interested in retirement accounts as we have heard that contributing to retirement is a way to reduce our tax liability. Do we qualify for any particular retirement plans? On our copy of the tax return we noticed that we were not able to claim all of our children as dependents. Why would that be? I guess we are not sure what qualifies us to claim them and wondered why we couldn't just list them all and hope that no one notices. Lastly, we have heard from friends of ours that you can usually deduct charitable contributions and no one ever asks for proof of your receipts. Can't we include higher deductions next year to help get a bigger refund? Is that okay to do? We wanted to know your thoughts. Look forward to hearing from youStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started