I need answers for this table please

(Now prepare the liabilities section of the balance sheet for Johnson Pharmacies on M arch 1,2019) Liabilities table

arch 1,2019) Liabilities table

2019

2019

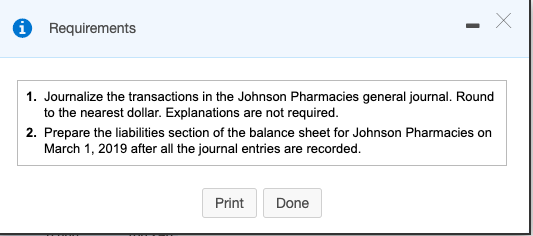

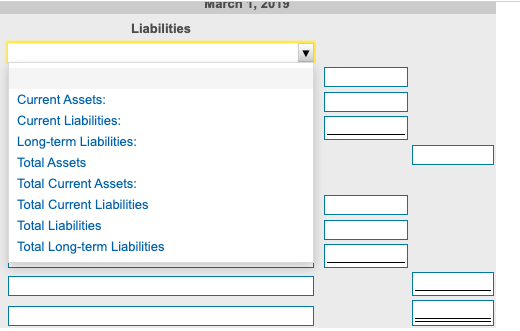

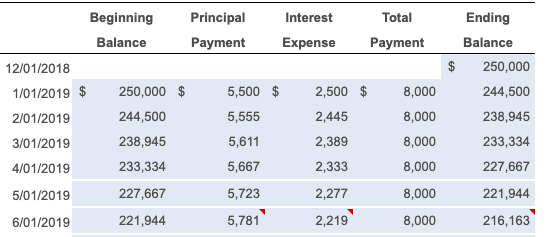

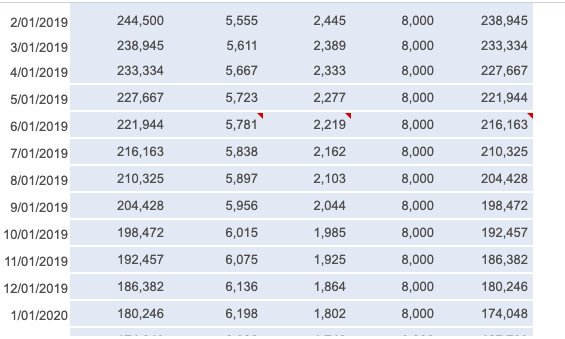

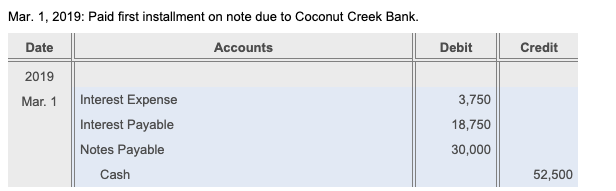

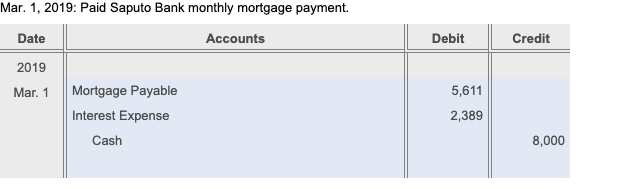

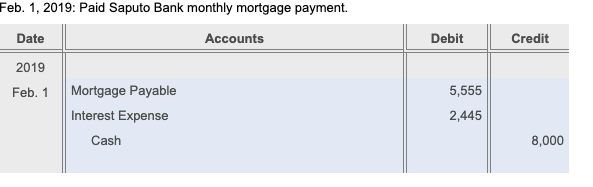

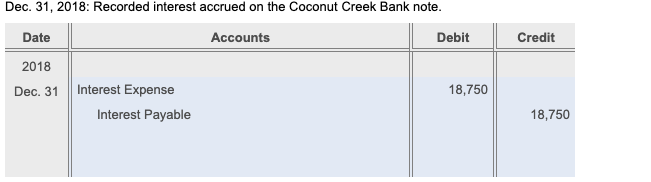

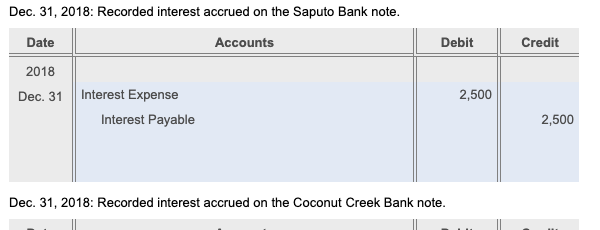

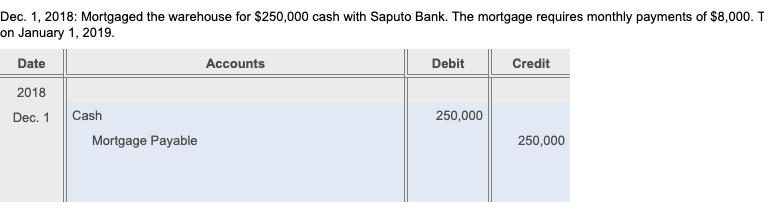

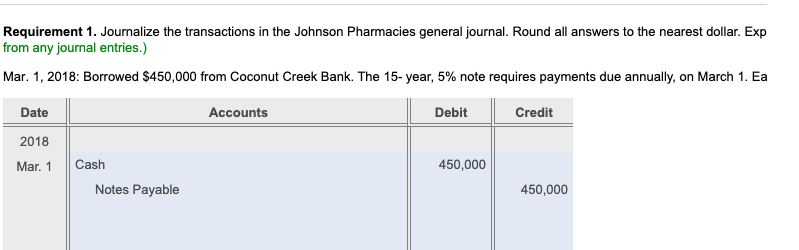

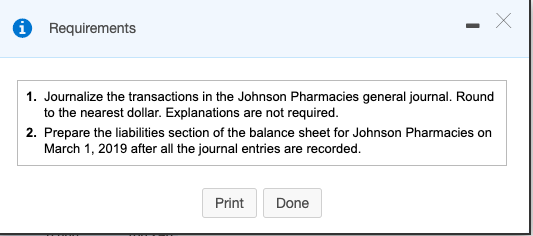

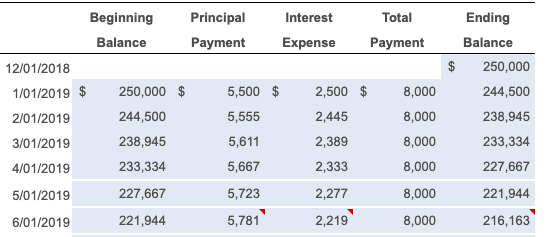

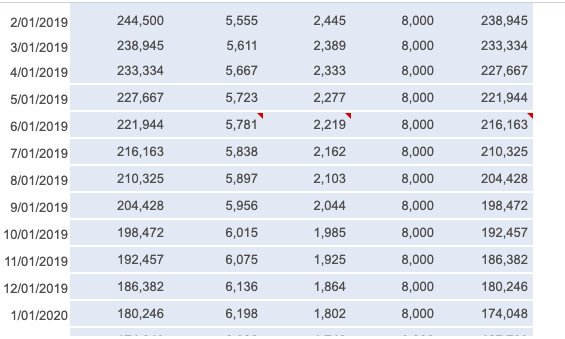

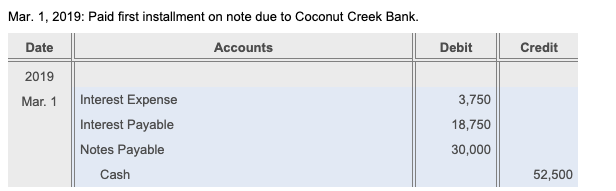

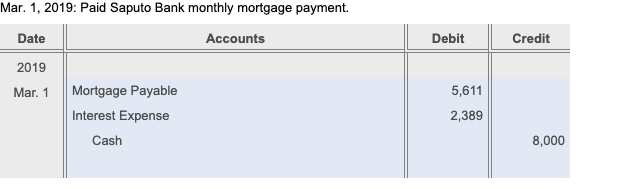

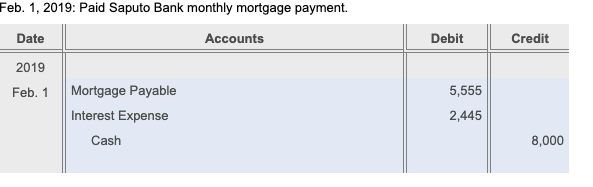

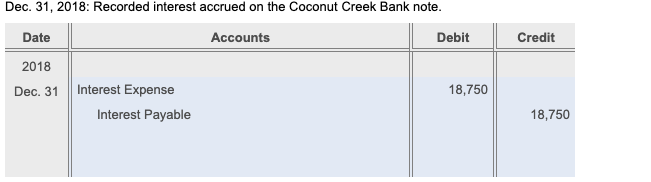

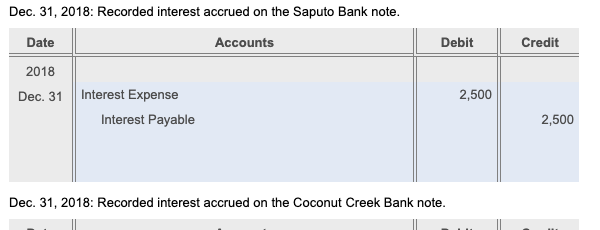

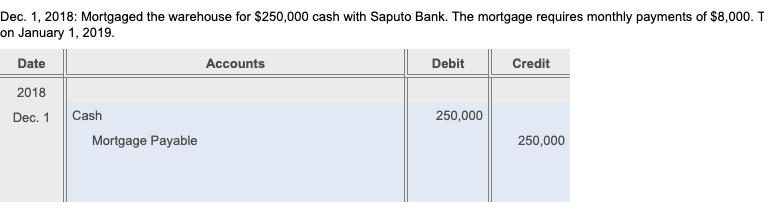

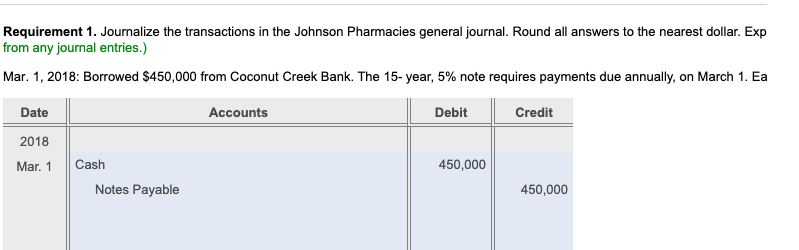

March 1, 2019 Liabilities Current Assets: Current Liabilities: Long-term Liabilities: Total Assets Total Current Assets: Total Current Liabilities Total Liabilities Total Long-term Liabilities Ending Balance Beginning Principal Interest Total Balance Payment Expense Payment 12/01/2018 1/01/2019 $ 250,000 $ 5,500 $ 2,500 $ 8,000 2/01/2019 244,500 5,555 2,445 8,000 3/01/2019 238,945 5,611 2,389 8,000 4/01/2019 233,334 5,667 2,333 8,000 250,000 244,500 238,945 233,334 227,667 5/01/2019 227,667 5,723 8,000 221,944 2,277 2,219 6/01/2019 221,944 5,781 8,000 216,163 2/01/2019 244,500 5,555 2.445 238,945 238,945 5,611 2.389 3/01/2019 4/01/2019 233,334 227,667 233,334 5,667 2.333 5/01/2019 5.723 227,667 221,944 216.163 2.277 2.219 8,000 8,000 8,000 8,000 8,000 8,000 8,000 6/01/2019 5.781 221,944 216 163 210,325 7/01/2019 5,838 2.162 8/01/2019 210,325 5,897 2,103 204,428 9/01/2019 204,428 5,956 2,044 8,000 198,472 10/01/2019 198,472 6,015 1,985 8,000 8,000 192,457 186,382 11/01/2019 192.457 6,075 1,925 12/01/2019 186,382 6.136 1,864 8,000 180 246 11/01/2020 180.246 6.198 1,802 8,000 174,048 Mar. 1, 2019: Paid first installment on note due to Coconut Creek Bank. Date Accounts Debit Credit 2019 Mar. 1 Interest Expense Interest Payable Notes Payable 3,750 18,750 30,000 Cash 52,500 Mar. 1, 2019: Paid Saputo Bank monthly mortgage payment. Accounts Date Debit Credit 5,611 2019 Mar. 1 Mortgage Payable Interest Expense Cash 2,389 8,000 Feb. 1, 2019: Paid Saputo Bank monthly mortgage payment. Date Accounts Debit Credit 2019 Feb. 1 Mortgage Payable Interest Expense Cash 5,555 2,445 8,000 Credit Dec. 31, 2018: Recorded interest accrued on the Coconut Creek Bank note. Date Accounts Debit 2018 Dec. 31 Interest Expense 18,750 Interest Payable 18,750 Dec 31, 2018: Recorded interest accrued on the Saputo Bank note. Date Accounts Debit Credit 2018 Dec. 31 Interest Expense Interest Payable 2,500 2,500 Dec. 31, 2018: Recorded interest accrued on the Coconut Creek Bank note. Dec. 1, 2018: Mortgaged the warehouse for $250,000 cash with Saputo Bank. The mortgage requires monthly payments of $8,000. T on January 1, 2019. Date Accounts Debit Credit 2018 Dec. 1 250,000 Cash Mortgage Payable 250,000 Requirement 1. Journalize the transactions in the Johnson Pharmacies general journal. Round all answers to the nearest dollar. Exp from any journal entries.) Mar. 1, 2018: Borrowed $450,000 from Coconut Creek Bank. The 15-year, 5% note requires payments due annually, on March 1. Ea Date Accounts Debit Credit 2018 Mar. 1 450,000 Cash Notes Payable 450,000 March 1, 2018 Liabilities Requirements 1. Journalize the transactions in the Johnson Pharmacies general journal. Round to the nearest dollar. Explanations are not required. 2. Prepare the liabilities section of the balance sheet for Johnson Pharmacies on March 1, 2019 after all the journal entries are recorded. Print Done

arch 1,2019) Liabilities table

arch 1,2019) Liabilities table

2019

2019