Question

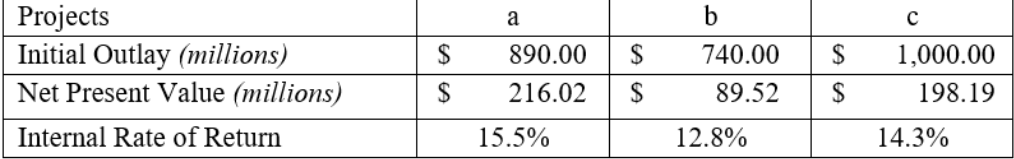

Igloo Ltd presents you with the final calculations of the following independent projects. Assume in this case the projects have equal lives and the required

Igloo Ltd presents you with the final calculations of the following independent projects. Assume in this case the projects have equal lives and the required rate of return is 10%

1. If Igloo Ltd has only $1,800 million dollars to invest, the project/s it should select is/are: (2 marks)

Select one:

a. Project b and c

b. Project c only

c. Project a and c

d. Project a only

e. Project a and b

2. Using the information supplied by Igloo Ltd above assume in this case the projects are mutually exclusive and that the project lengths are the following; Project a, 8 years. Project b, 3 years. Project c, 5 years. The required rate of return on investments is 10%. You would now advise Igloo Ltd to select (2 marks)

Select one:

a. Project b & c

b. Project b only

c. Project a only

d. Project c

e. Project a & b

a b $ $ 740.00 $ Projects Initial Outlay (millions) Net Present Value (millions) Internal Rate of Return 890.00 216.02 1,000.00 198.19 $ $ 89.52 $ 15.5% 12.8% 14.3%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started