Answered step by step

Verified Expert Solution

Question

1 Approved Answer

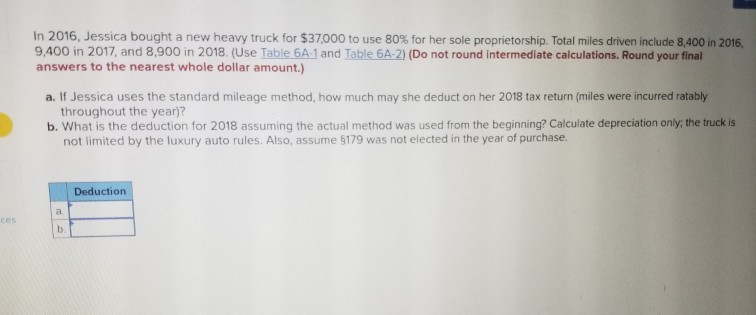

In 2016, Jessica bought a new heavy truck for $37,000 to use 80% for her sole proprietorship. Total miles driven include 8,400 in 2016, 9,400

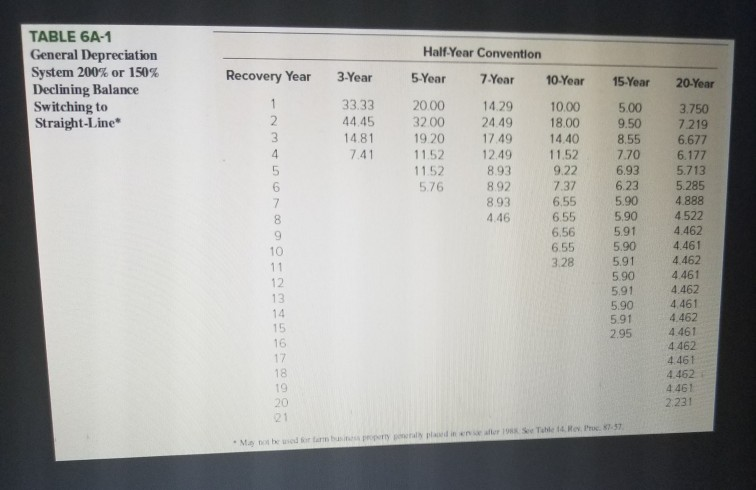

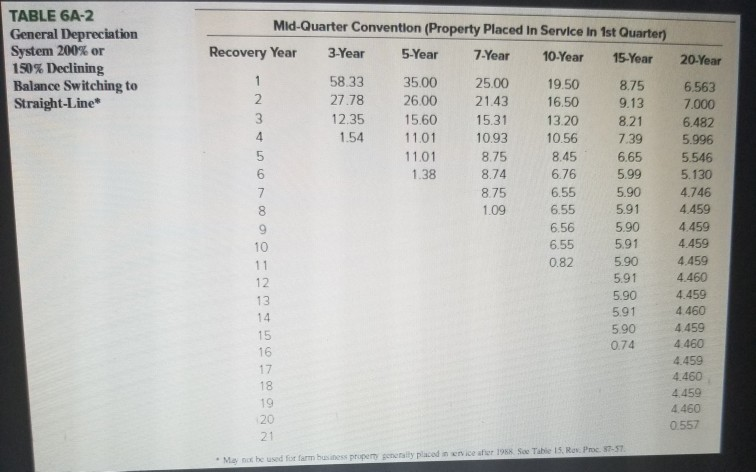

In 2016, Jessica bought a new heavy truck for $37,000 to use 80% for her sole proprietorship. Total miles driven include 8,400 in 2016, 9,400 in 2017, and 8,900 in 2018. (Use Table 6A-1 and Table 6A-2) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. If Jessica uses the standard mileage method, how much may she deduct on her 2018 tax return (miles were incurred ratably throughout the year)? b. What is the deduction for 2018 assuming the actual method was used from the beginning? Calculate depreciation only: the truck is not limited by the luxury auto rules. Also, assume 5179 was not elected in the year of purchase. Deduction 97735 177, 1 8 8 2 6 6 6 6 6 6 6 6 6 6 6 6 72617285444444444444 376655444444444444442 5 5987665555555552 0227 4523 08419766663 9993236 24449994 Y 44728884 C7-21 226 29115 351 3484 Y 3447 3- 341 y 123456789012345678901 TABLE 6A-2 General Depreciation System 200% or 150% Declining Balance Switching to Straight-Line* Mid-Quarter Convention (Property Placed in Service In 1st Quarter) Recovery Year 3-Year 5Year 7Year 10-Year 15-Year 20-Year 58.33 35.00 25.00 19.50 8.75 6563 27.78 2600 2143 16.50 9.13 7000 12.35 15.60 15.31 13.20821 6.482 1.54 11.01 1093 10.56 7.39 5.996 8.45 6.65 5.546 6.76 5.99 5.130 6.555.90 4.746 4.459 8.75 8.74 8.75 1.09 1.38 6.55 5.90 4 6.55 5.91 4.459 5.90 4.459 10 5.91 4 460 4.459 not be used for farm business properry genctally placed n erv ice afr 1988 See Table 15, Ros. Proc. 87-57

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started