Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Interest rates on 4-year Treasury securities are currently 6.05%, while 6-year Treasury securities yield 7.5%. The data has been collected in the Microsoft Excel

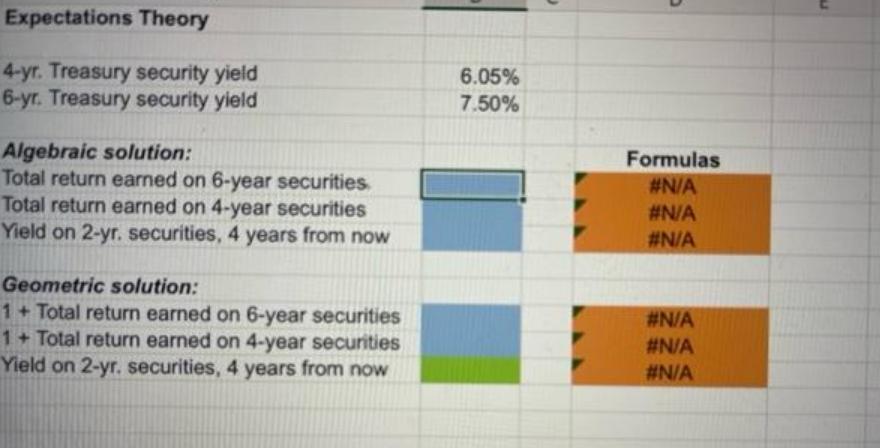

Interest rates on 4-year Treasury securities are currently 6.05%, while 6-year Treasury securities yield 7.5%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round your intermediate calculations. Round your answer to two decimal places. % Expectations Theory 4-yr. Treasury security yield 6-yr. Treasury security yield Algebraic solution: Total return earned on 6-year securities. Total return earned on 4-year securities Yield on 2-yr. securities, 4 years from now Geometric solution: 1+ Total return earned on 6-year securities 1+ Total return earned on 4-year securities Yield on 2-yr. securities, 4 years from now 6.05% 7.50% Formulas #N/A #N/A #N/A #N/A #N/A #N/A

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

It is given that 4 Year T security Yield 655 6 Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started