Question

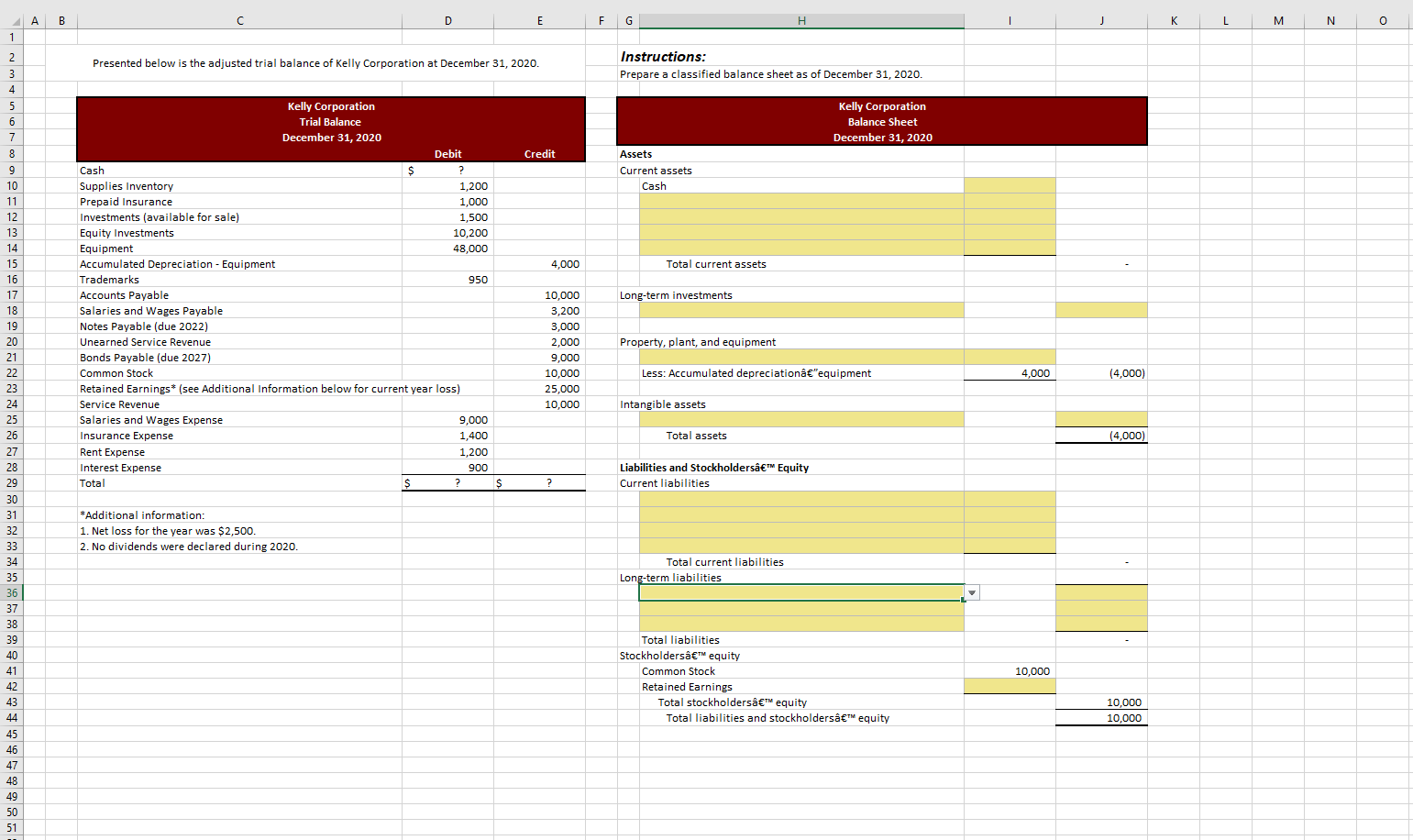

Intermediate accounting 1 Classified Balance Sheet The adjusted trial balance of Kelly Corporation at December 31, 2020 is given in the spreadsheet. You are asked

Intermediate accounting 1

Classified Balance Sheet

The adjusted trial balance of Kelly Corporation at December 31, 2020 is given in the spreadsheet. You are asked to prepare a classified balance sheet as of December 31, 2020.

Reference the appropriate cells in the trial balance whenever possible in the balance sheet.

Complete the Assets section of the balance sheet (do not complete the cash calculation) by completing the cells with the gold backgrounds.

- Select the correct accounts from the drop-down lists in column H.

- Enter the correct values in column I and column J.

- There may be extra rows in the current assets section of the balance sheet.

Complete the Long-term investments section of the balance sheet.

- Select the correct account from the drop-down list in cell H18.

- Enter the correct value in cell J18.

Complete the Property, plant, and equipment section of the balance sheet.

- Select the correct account from the drop-down list in cell H21.

- Enter the correct value in cell I21.

Complete the Intangible assets section of the balance sheet.

- Select the correct account from the drop-down list in cell H25.

- Enter the correct value in cell J25.

Complete the Current liabilities section of the balance sheet.

- Select the correct accounts from the drop-down lists in column H.

- Enter the correct values in column I.

Complete the Long-term liabilities section of the balance sheet.

- Select the correct accounts from the drop-down lists in column H.

- Enter the correct values in column J.

Calculate the correct value of Retained Earnings and enter the amount in cell I42 within the Stockholder's equity section of the balance sheet. Additional information is available in cells C31:C33.

Calculate the resulting cash balance in cell I10 of the Current assets section of the balance sheet.

Drop down menu:

Accounts payable

Accumulated depreciation-equipment

Bonds payable (due 2027)

Cash

Common stock

Equipment

Equity investments

Insurance expense

Interest expense

Investments (available for sale)

Notes payable (due 2022)

Prepaid insurance

Rent expense

Retained earnings

Salaries and wages expense

Salaries and wages payable

Service revenue

Supplies inventory

Trademarks

Unearned service revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started