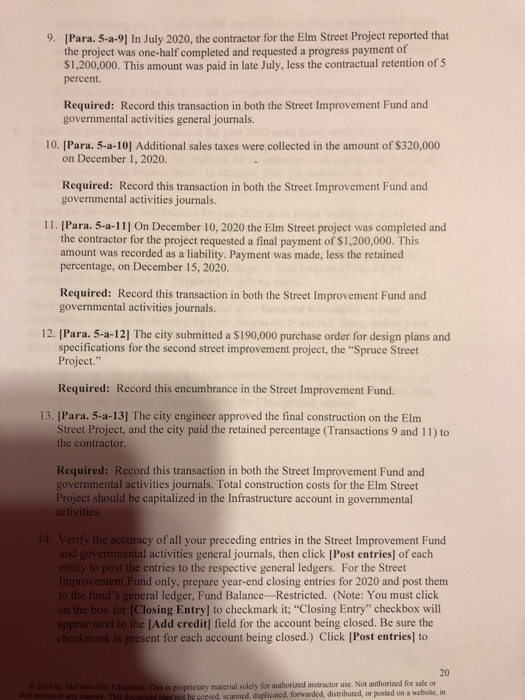

IPara. 5-a-91 In July 2020, the contractor for the Elm Street Project reported that the project was one-half completed and requested a progress payment of S1,200,000. This amount was paid in late July, less the contractual retention of 5 percent. 9. Required: Record this transaction in both the Street Improvement Fund and governmental activities general journals. 10. [Para. 5-a-10] Additional sales taxes were collected in the amount of $320,000 on December 1, 2020. Required: Record this transaction in both the Street Improvement Fund and governmental activities journals. 11. [Para. 5-a-11] On December 10, 2020 the Elm Street project was completed and the contractor for the project requested a final payment of $1,200,000. This amount was recorded as a liability. Payment was made, less the retained percentage, on December 15, 2020. Required: Record this transaction in both the Street Improvement Fund and governmental activities journals. 2. [Para. 5-a-12] The city submitted a $190,000 purchase order for design plans and specifications for the second street improvement project, the "Spruce Street Project." Required: Record this encumbrance in the Street Improvement Fund. 13. IPara. 5-a-13] The city engineer approved the final construction on the Elm Street Project, and the city paid the retained percentage (Transactions 9 and 11) to the contractor Required: Record this transaction in both the Street Improvement Fund and governmental activities journals. Total construction costs for the Elm Street ct should be capitalized in the Infrastructure account in governmental ccuracy of all your preceding entries in the Street Improvement Fund ntal activities general journals, then click [Post entries] of each entries to the respective general ledgers. For the Street t Fund only, prepare year-end closing entries for 2020 and post them eral ledger, Fund Balance-Restricted. (Note: You must click Closing Entry] to checkmark it; "Closing Entry" checkbox will e lAdd credit] field for the account being closed. Be sure the present for each account being closed.) Click (Post entries] to 20 proprictary material solely for authorized instructor use. Not authorized for sale or be copied, scanned, duplicated, forwarded, distributed, or posted on a websitc, in IPara. 5-a-91 In July 2020, the contractor for the Elm Street Project reported that the project was one-half completed and requested a progress payment of S1,200,000. This amount was paid in late July, less the contractual retention of 5 percent. 9. Required: Record this transaction in both the Street Improvement Fund and governmental activities general journals. 10. [Para. 5-a-10] Additional sales taxes were collected in the amount of $320,000 on December 1, 2020. Required: Record this transaction in both the Street Improvement Fund and governmental activities journals. 11. [Para. 5-a-11] On December 10, 2020 the Elm Street project was completed and the contractor for the project requested a final payment of $1,200,000. This amount was recorded as a liability. Payment was made, less the retained percentage, on December 15, 2020. Required: Record this transaction in both the Street Improvement Fund and governmental activities journals. 2. [Para. 5-a-12] The city submitted a $190,000 purchase order for design plans and specifications for the second street improvement project, the "Spruce Street Project." Required: Record this encumbrance in the Street Improvement Fund. 13. IPara. 5-a-13] The city engineer approved the final construction on the Elm Street Project, and the city paid the retained percentage (Transactions 9 and 11) to the contractor Required: Record this transaction in both the Street Improvement Fund and governmental activities journals. Total construction costs for the Elm Street ct should be capitalized in the Infrastructure account in governmental ccuracy of all your preceding entries in the Street Improvement Fund ntal activities general journals, then click [Post entries] of each entries to the respective general ledgers. For the Street t Fund only, prepare year-end closing entries for 2020 and post them eral ledger, Fund Balance-Restricted. (Note: You must click Closing Entry] to checkmark it; "Closing Entry" checkbox will e lAdd credit] field for the account being closed. Be sure the present for each account being closed.) Click (Post entries] to 20 proprictary material solely for authorized instructor use. Not authorized for sale or be copied, scanned, duplicated, forwarded, distributed, or posted on a websitc, in