Question: is urgent. please answer all questions Question Three (B) You have just collected your lump sum from the sale of your building which amounts to

is urgent. please answer all questions

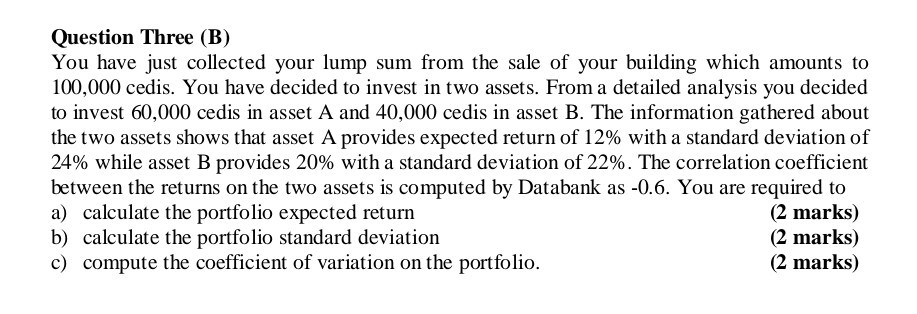

Question Three (B) You have just collected your lump sum from the sale of your building which amounts to 100,000 cedis. You have decided to invest in two assets. From a detailed analysis you decided to invest 60,000 cedis in asset A and 40,000 cedis in asset B. The information gathered about the two assets shows that asset A provides expected return of 12% with a standard deviation of 24% while asset B provides 20% with a standard deviation of 22%. The correlation coefficient between the returns on the two assets is computed by Databank as -0.6. You are required to a) calculate the portfolio expected return (2 marks) b) calculate the portfolio standard deviation (2 marks) c) compute the coefficient of variation on the portfolio. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts