Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly provide answers step by step. Occidental Exports has income before tax of $660,000 for the year ended December 31. The company's income tax rate

Kindly provide answers step by step.

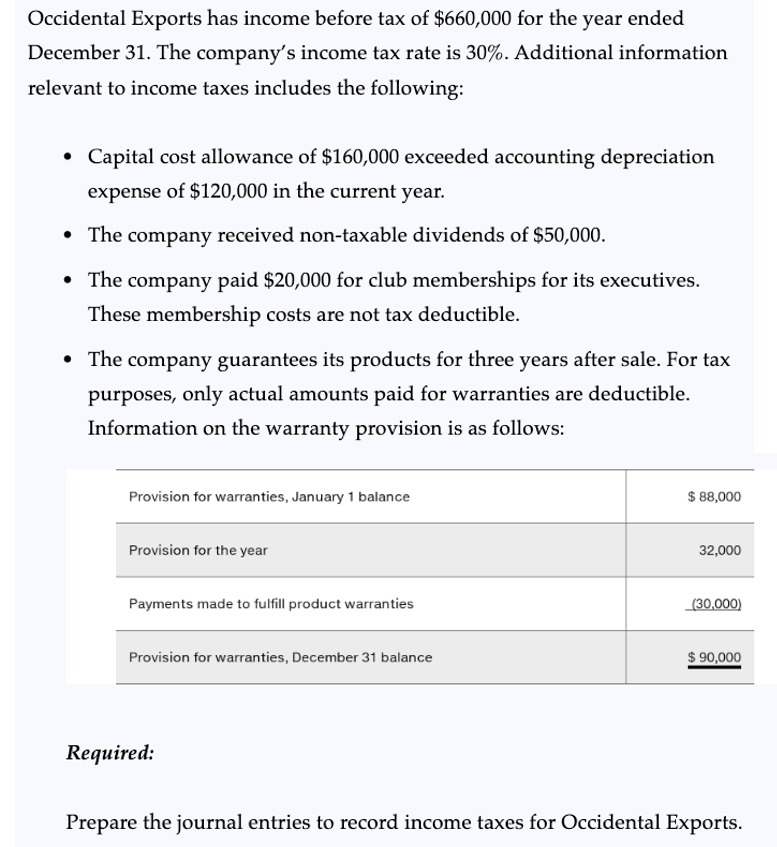

Occidental Exports has income before tax of $660,000 for the year ended December 31. The company's income tax rate is 30%. Additional information relevant to income taxes includes the following: - Capital cost allowance of \$160,000 exceeded accounting depreciation expense of $120,000 in the current year. - The company received non-taxable dividends of $50,000. - The company paid $20,000 for club memberships for its executives. These membership costs are not tax deductible. - The company guarantees its products for three years after sale. For tax purposes, only actual amounts paid for warranties are deductible. Information on the warranty provision is as follows: Required: Prepare the journal entries to record income taxes for Occidental ExportsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started