Question

Lakewood Village: Estimating Costs and Benefits: An Economic Analysis of Asset Replacement INTRODUCTION The following case study involves a series of analyses supporting a capital

Lakewood Village: Estimating Costs and Benefits: An Economic Analysis of Asset Replacement

INTRODUCTION The following case study involves a series of analyses supporting a capital budgeting decision to replace an asset within a municipality. The Town of Lakewood Village provides water to residential customers and is considering replacing aging and potentially inaccurate water meters to increase revenues. The costs of the project are known, but the city needs to estimate and analyze incremental revenues to determine if the project is worth undertaking. BACKGROUND Two important processes in municipal finance are capital budgeting and resource allocation. In many cases, resource allocation involves expenditures that do not directly generate revenue such as road improvement, park maintenance, and sidewalk construction. In these cases, the decision to expend resources often depends on engineering reports or qualitative factors. For example, the consideration of road improvement would be predicated on an engineer evaluation as to whether the roads meet the towns standards, and any recommended plan of action detailing construction parameters and costs. Performing a rigorous cost-benefit analysis in these situations is difficult because the benefits are often intangible, indirect, or difficult to measure. Thus, while sidewalks may be a desirable project to undertake, the incremental effect on property values and the likelihood of subsequent increase in property tax revenues are difficult to quantify. In contrast, some municipal expenditures can have direct revenue effects due to their impact on efficiencyeither in the reduction of costs and/or in the collection of revenue. Capital expenditures of this type are of special interest to municipalities who own and operate their utilities. The current case will examine an asset replacement project using data from a municipal water company owned and operated by the Town of Lakewood Village. The goal of the case is to perform an economic analysis of the program and evaluate the financial implications of the decision. 1 Under-reporting water usage is detrimental to both revenues and expensesfor the unbilled water, the municipality incurs the costs of acquiring or producing the water, treating, and delivering it, while receiving no revenues. Further, as less and less water usage is billed, as with any free good, customers have incentives to consume more and conserve less, exacerbating the situation. PROPOSED WATER METER REPLACEMENT PROGRAM Typically, water providers install meters at each service address, read meters monthly, and charge customers according to their usage. In residential settings where flow rates are low compared to commercial customers, most meters are positive displacement (PD) meters. These meters operate by allowing a specific amount of water to physically displace a measuring component, which moves a piston or oscillating disc that moves a magnet driving the register. While these devices are simple, they can slow down as they become worn or become encrusted with minerals or debris. Thus, it is well known that these types of meters become less accurate over time and underreport water usage.1 While it is technically possible to clean a meter, labor costs to clean a meter exceeds the cost of the meter, making it economically unfeasible. Thus, the decision that municipalities face is whether to replace old meters. To determine whetheror more specifically whenreplacement is justified, a financial analysis should be done to assess the costs and benefits and, most importantly, critically evaluate the return on the utilitys invested capital. Lakewood Village is a (Type-A) General Law Municipality located in Denton County on a peninsula of Lewisville Lake north of Dallas. The town was incorporated in 1977. The development of the town occurred in two stages, the original Lakewood Village starting in the 1960s and the Shores of Lakewood Village, a subdivision of custom homes created in 1997. Neither area is built-out, that is, new custom homes are currently being built in each part of town. It is not uncommon to find new and old houses adjacently located. Lakewood Villages population nearly doubled from 545 in 2010 to 1,056 in 2020. The average home value is $496,000, and the median family income is $112,000. Lakewood Village began the process of identifying, prioritizing, and allocating funds for capital expenditures for the next fiscal year. At this time, it was pointed out that many of the water meters for the houses built in the towns first stage of development were 30 to 40 years old and thus far out of warranty. As a result, the town decided to undertake an economic analysis to evaluate the financial viability of a meter replacement program. The goal of the study was twofold. First, develop a model to estimate how much water and associated revenues were being lost due to inaccurate meters. Second, assess whether the recoverable revenues were sufficient to pay back the required capital expenditures in a timely manner and generate an acceptable return on investment. DATA COLLECTION AND ANALYSIS The town utilizes standard PD water meters for all residential connections. These meters were warranted by the manufacturer to be accurate within 2% of actual flow for 15 years or 1.5 million gallons of usage. To assess the financial viability of the project, data was collected on 100 connections: 50 homes with old or outof-warranty meters and 50 homes with new meters that were still in the original warranty period.2 For each sub-sample of the 100 accounts, two pieces of demographic data were collected: the size of the household (PEOPLE) and the size of the property (ACRE). In Texas, water consumption is highly seasonal: during the fall, winter, and early spring, usage is lowest, while during the summer, when temperatures often exceed 100 degrees, demand is significantly greater. To simplify the analysis while still recognizing this variability for each of the 100 accounts, two months of water meter readings were tabulated for August (peak period) and November (off-peak). The relevant data is shown in Exhibit 1(See spreadsheet WaterMeter). 2 The average age of the old and new meter samples was 27.94 years and 11.08 years respectively, significantly different at the p

In Lakewood Village, the average residential water rates are approximately $3 per 1,000 gallons of usage. Thus, if the water loss could be billed and collected, the additional revenues per house would be estimated to be $3 * LOSSi 1000. METER REPLACEMENT COST To quantify the costs of the meter replacement program, firm bids were negotiated and bulk discounts relating to purchase orders were obtained. Although not required, as a preventive measure, the town undertook the process of replacing the curb-stops (shut-off valves) at the same time.3 The meter replacement costs per house were as follows: Meter $ 48 Curb-stop $ 44 Labor $ 60

In Lakewood Village, the average residential water rates are approximately $3 per 1,000 gallons of usage. Thus, if the water loss could be billed and collected, the additional revenues per house would be estimated to be $3 * LOSSi 1000. METER REPLACEMENT COST To quantify the costs of the meter replacement program, firm bids were negotiated and bulk discounts relating to purchase orders were obtained. Although not required, as a preventive measure, the town undertook the process of replacing the curb-stops (shut-off valves) at the same time.3 The meter replacement costs per house were as follows: Meter $ 48 Curb-stop $ 44 Labor $ 60

| Disposal4 Labor | $ 0 $ 60 |

| =============== Total Cost $ 152 Disposal4 $ 0 =============== Labor $ 60 Disposal4 $ 0 | |

| Total Cost | $ 152 |

3 The curb-stop is a lockable valve adjacent to the meter that shuts off water to the house. It allows for water repairs to be undertaken at a particular house without shutting off water to a section of the neighborhood or the entire street. It is also used by the town to lock the meter and discontinue service for delinquent accounts. 4 As part of the contract, the plumbing contractors installation costs included a discount for allowing them to keep the old brass meters that were to be discarded. Thus, there were no disposal costs. NEXT STEPS Now that Lakewood Village has collected the data and developed a model to estimate how much water and associated revenues were being lost due to inaccurate meters. The town would like to use this data and model to move to their second step of analysis, assess whether the recoverable revenues were sufficient to pay back the required capital expenditures in a timely manner, and generate an acceptable return on investment. You have been asked to conduct the analysis on behalf of the town and make a recommendation as to whether the town should accept this meter replacement project.

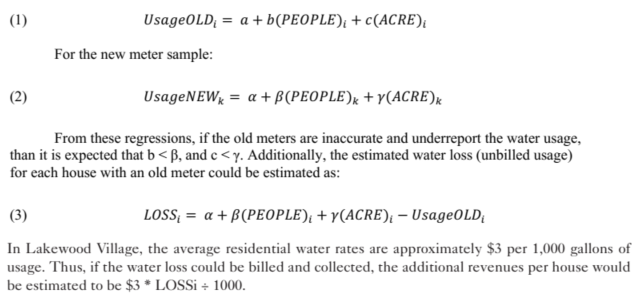

UsageOLDi=a+b(PEOPLE)i+c(ACRE)i For the new meter sample: UsageNEWk=+(PEOPLE)k+(ACRE)k From these regressions, if the old meters are inaccurate and underreport the water usage, than it is expected that bStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started