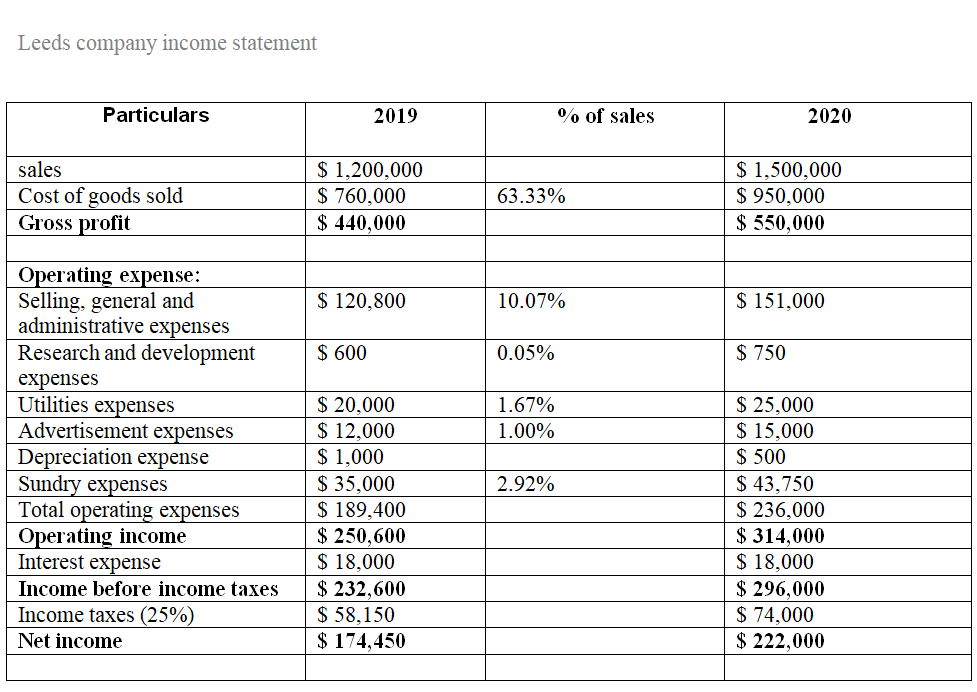

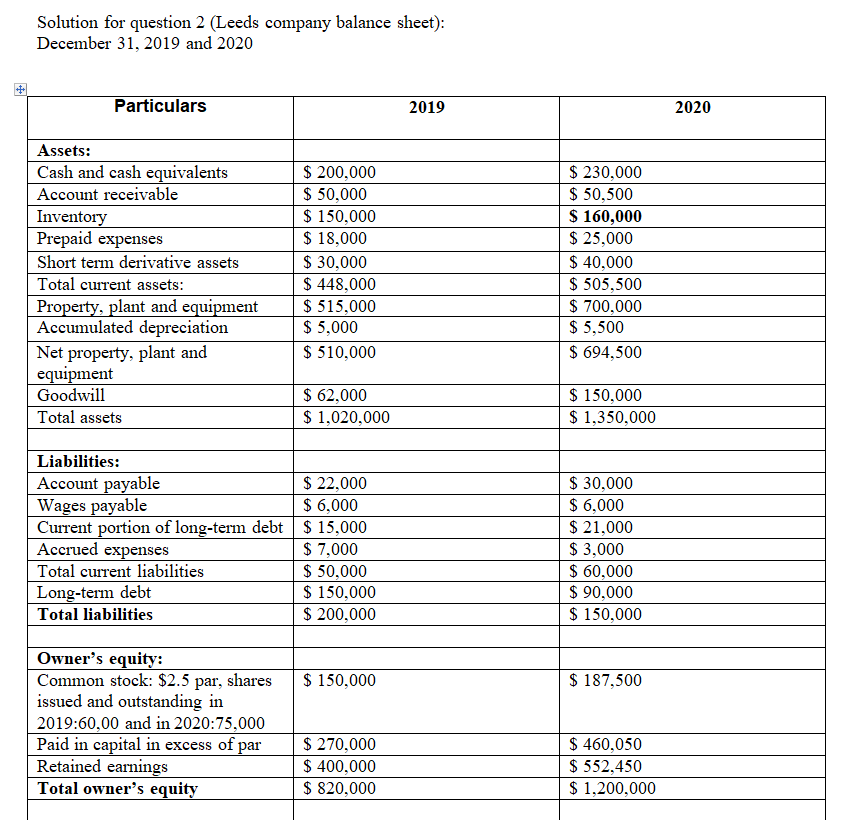

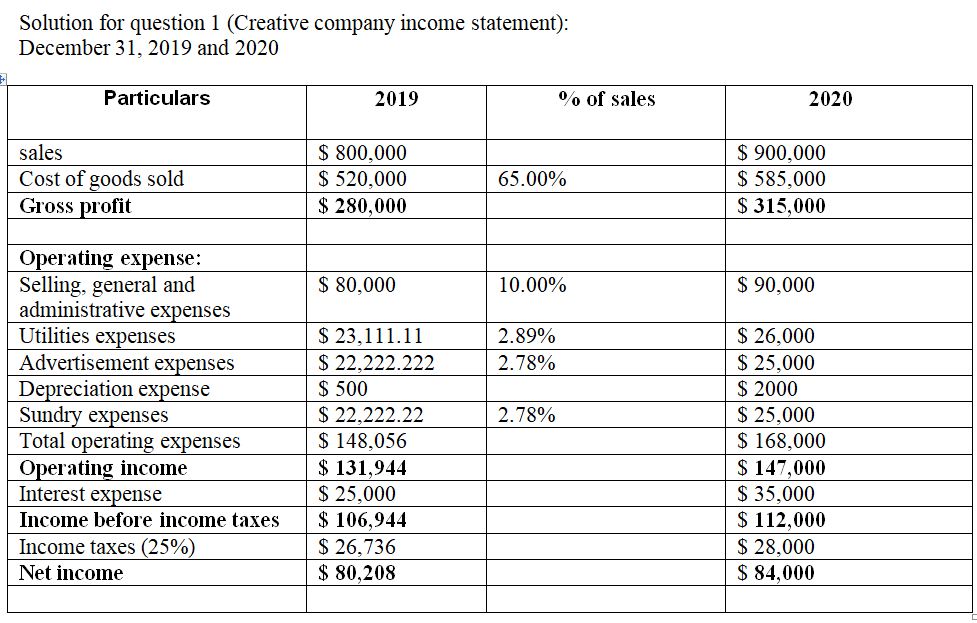

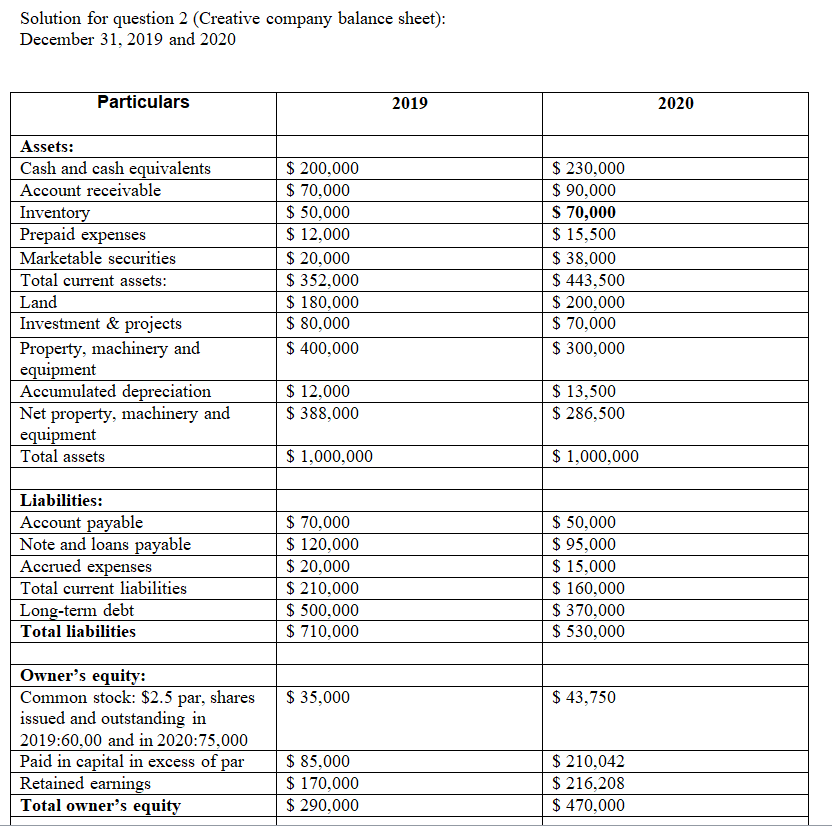

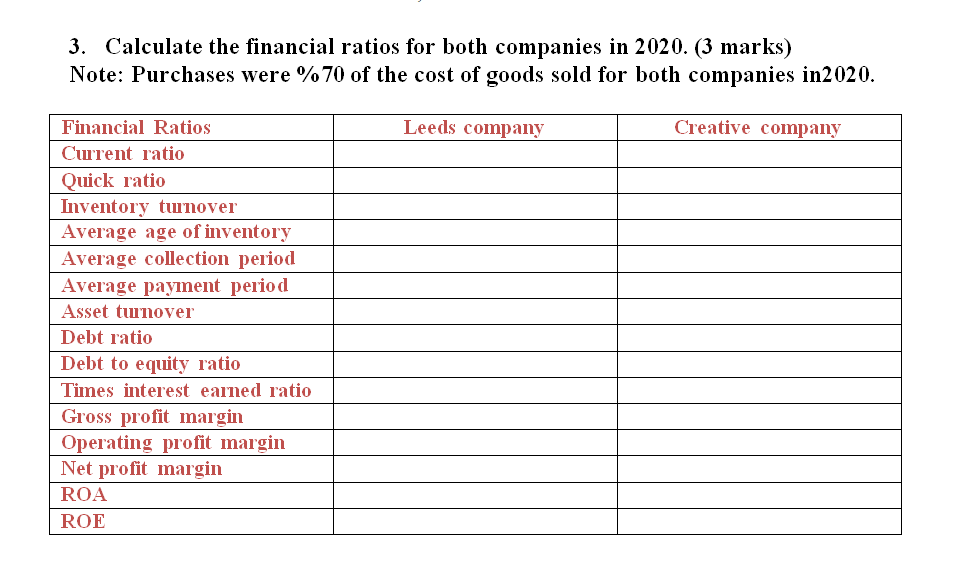

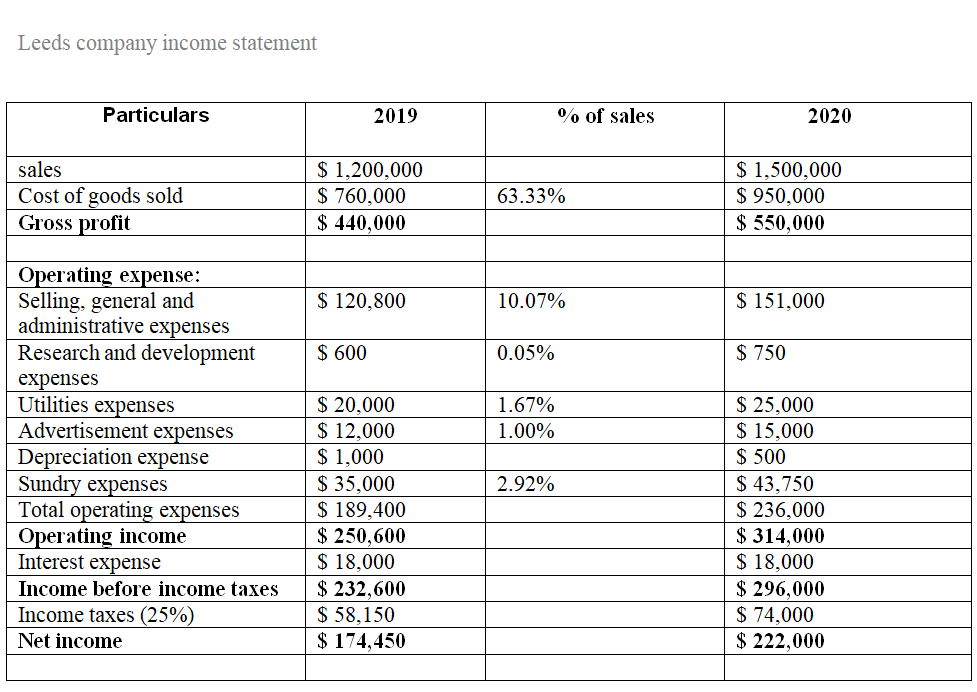

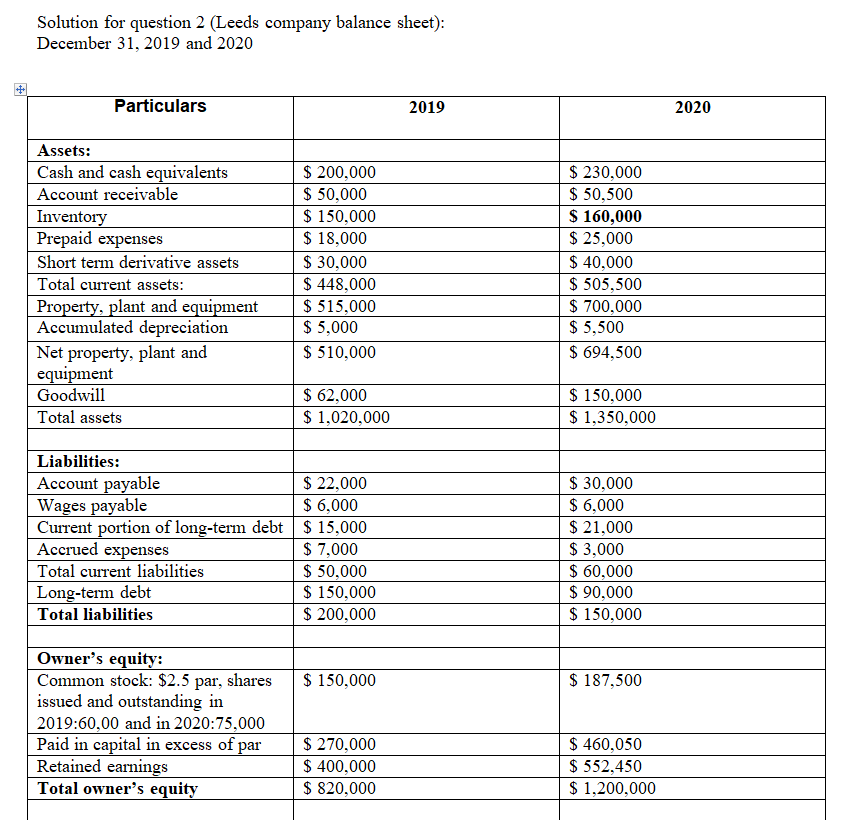

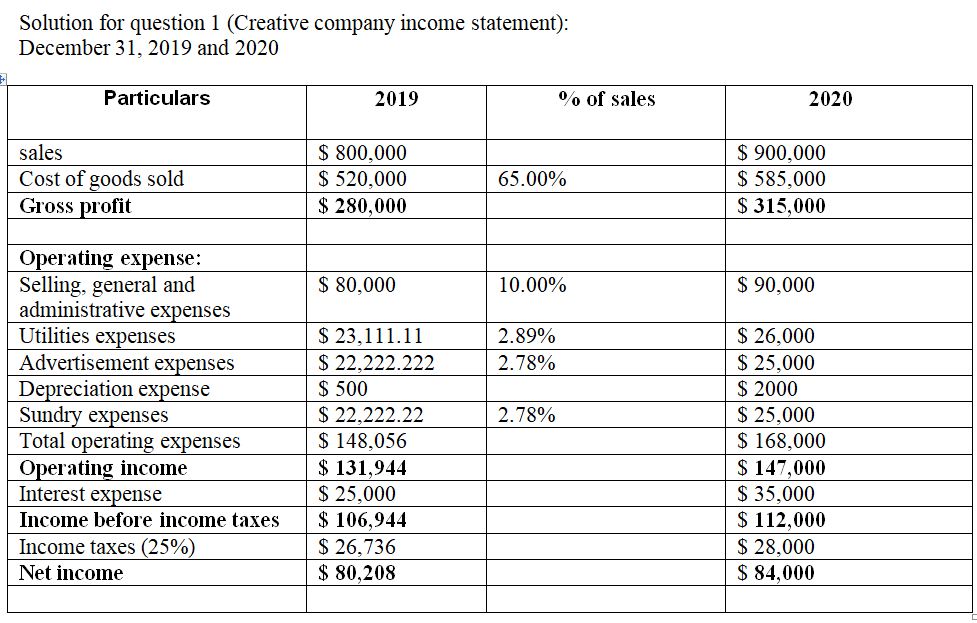

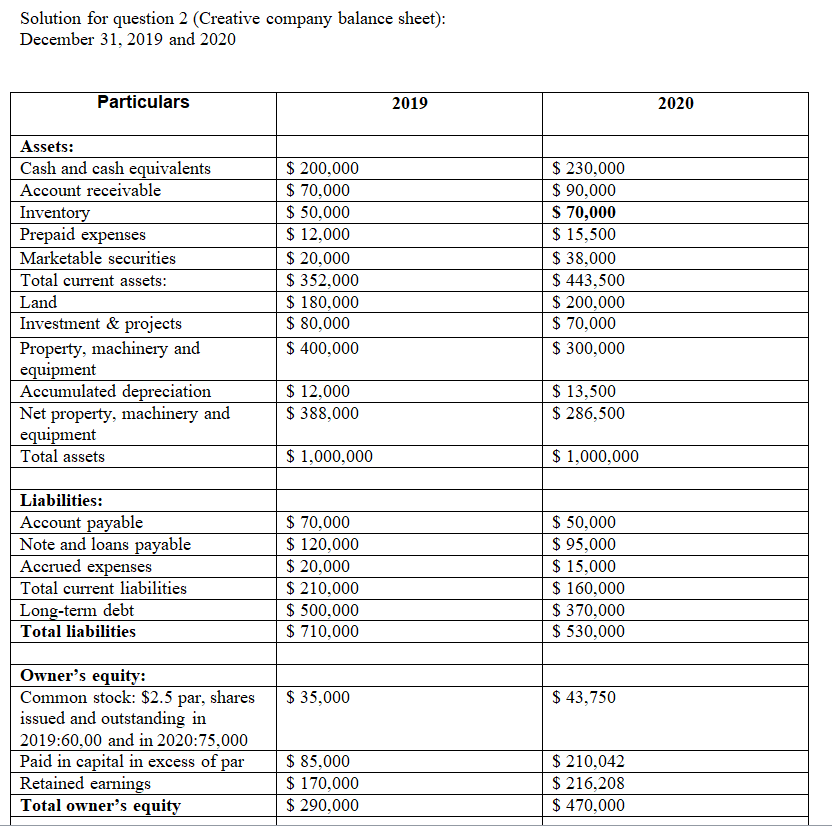

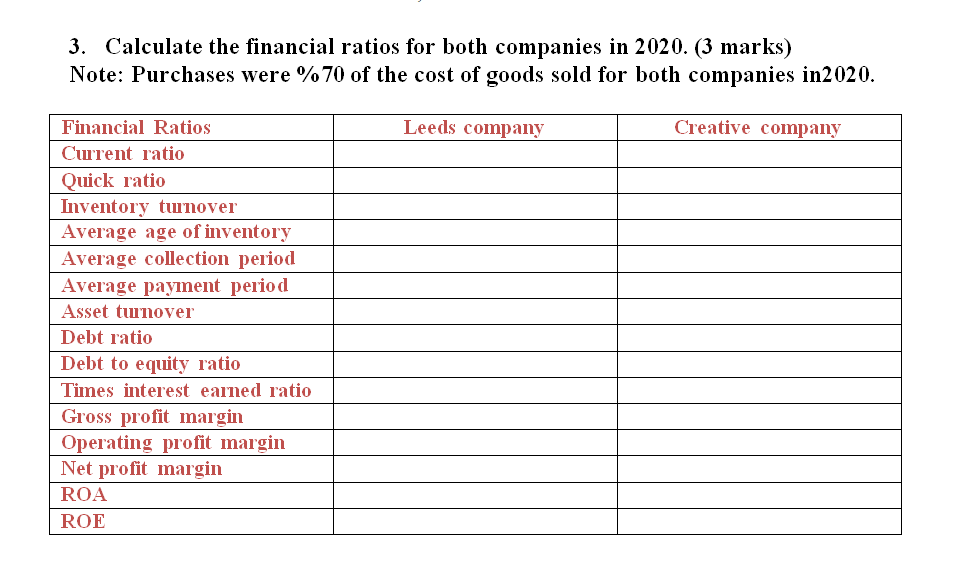

Leeds company income statement Particulars 2019 % of sales 2020 sales Cost of goods sold Gross profit $ 1,200,000 $ 760,000 $ 440,000 63.33% $ 1,500,000 $ 950,000 $ 550,000 $ 120.800 10.07% $ 151,000 $ 600 0.05% $ 750 1.67% 1.00% Operating expense: Selling, general and administrative expenses Research and development expenses Utilities expenses Advertisement expenses Depreciation expense Sundry expenses Total operating expenses Operating income Interest expense Income before income taxes Income taxes (25%) Net income 2.92% $ 20,000 $ 12,000 $1,000 $ 35,000 $ 189,400 $ 250,600 $ 18,000 $ 232,600 $ 58,150 $ 174,450 $ 25,000 $ 15,000 $ 500 $ 43,750 $ 236,000 $ 314,000 $ 18,000 $ 296,000 $ 74,000 $ 222,000 Solution for question 2 (Leeds company balance sheet): December 31, 2019 and 2020 Particulars 2019 2020 Assets: Cash and cash equivalents Account receivable Inventory Prepaid expenses Short term derivative assets Total current assets: Property, plant and equipment Accumulated depreciation Net property, plant and equipment Goodwill Total assets $ 200,000 $ 50,000 $ 150,000 $ 18,000 $ 30,000 $ 448.000 $ 515,000 $5,000 $ 510,000 $ 230,000 $ 50,500 $ 160,000 $ 25,000 $ 40,000 $ 505,500 $ 700,000 $ 5,500 $ 694,500 $ 62,000 $ 1,020,000 $ 150,000 $ 1,350,000 Liabilities: Account payable $ 22,000 Wages payable $ 6,000 Current portion of long-term debt $ 15,000 Accrued expenses $ 7,000 Total current liabilities $ 50.000 Long-term debt $ 150,000 Total liabilities $ 200,000 $ 30,000 $ 6,000 $ 21,000 $ 3,000 $ 60,000 $ 90,000 $ 150,000 $ 150,000 $ 187,500 Owner's equity: Common stock: $2.5 par, shares issued and outstanding in 2019:60,00 and in 2020:75,000 Paid in capital in excess of par Retained earnings Total owner's equity $ 270,000 $ 400,000 $ 820,000 $ 460,050 $ 552,450 $ 1,200,000 Solution for question 1 (Creative company income statement): December 31, 2019 and 2020 Particulars 2019 % of sales 2020 sales Cost of goods sold Gross profit $ 800,000 $ 520,000 $ 280,000 65.00% $ 900,000 $ 585,000 $ 315,000 $ 80,000 10.00% $ 90,000 2.89% 2.78% Operating expense: Selling, general and administrative expenses Utilities expenses Advertisement expenses Depreciation expense Sundry expenses Total operating expenses Operating income Interest expense Income before income taxes Income taxes (25%) Net income 2.78% $ 23,111.11 $ 22.222.222 $ 500 $ 22,222.22 $ 148,056 $ 131,944 $ 25,000 $ 106,944 $ 26,736 $ 80,208 $ 26,000 $ 25,000 $ 2000 $ 25,000 $ 168,000 $ 147,000 $ 35,000 $ 112,000 $ 28,000 $ 84,000 Solution for question 2 (Creative company balance sheet): December 31, 2019 and 2020 Particulars 2019 2020 Assets: Cash and cash equivalents Account receivable Inventory Prepaid expenses Marketable securities Total current assets: Land Investment & projects Property, machinery and equipment Accumulated depreciation Net property, machinery and equipment Total assets $ 200,000 $ 70,000 $ 50,000 $ 12,000 $ 20,000 $352,000 $ 180,000 $ 80,000 $ 400,000 $ 230,000 $ 90,000 $ 70,000 $ 15,500 $ 38,000 $ 443,500 $ 200,000 $ 70,000 $ 300,000 $ 12,000 $ 388,000 $ 13,500 $ 286,500 $ 1,000,000 $ 1,000,000 Liabilities: Account payable Note and loans payable Accrued expenses Total current liabilities Long-term debt Total liabilities $ 70,000 $ 120,000 $ 20,000 $ 210,000 $ 500,000 $ 710,000 $ 50,000 $ 95,000 $ 15,000 $ 160,000 $ 370,000 $ 530,000 $ 35,000 $ 43,750 Owner's equity: Common stock: $2.5 par, shares issued and outstanding in 2019:60,00 and in 2020:75,000 Paid in capital in excess of par Retained earnings Total owner's equity $ 85,000 $ 170,000 $ 290,000 $ 210,042 $ 216,208 $ 470,000 3. Calculate the financial ratios for both companies in 2020. (3 marks) Note: Purchases were %70 of the cost of goods sold for both companies in 2020. Leeds company Creative company Financial Ratios Current ratio Quick ratio Inventory turnover Average age of inventory Average collection period Average payment period Asset turnover Debt ratio Debt to equity ratio Times interest earned ratio Gross profit margin Operating profit margin Net profit margin ROA ROE