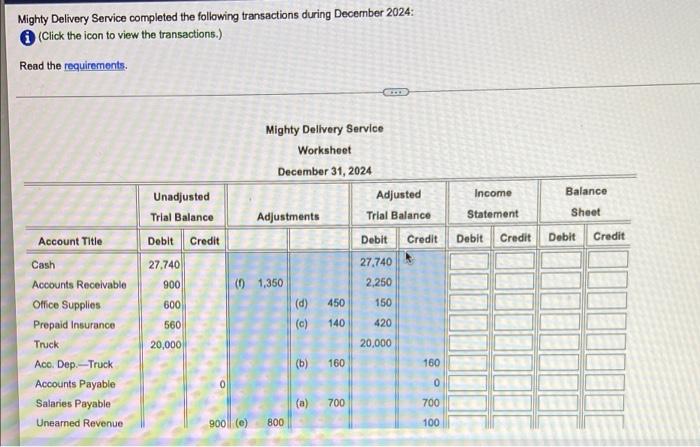

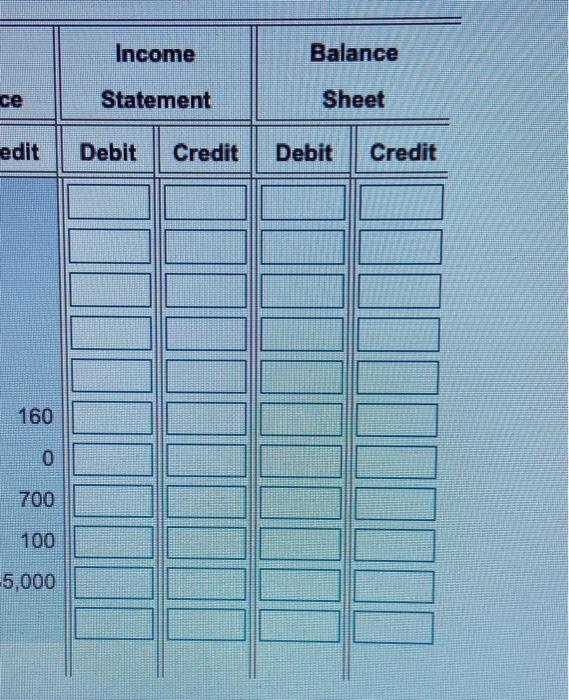

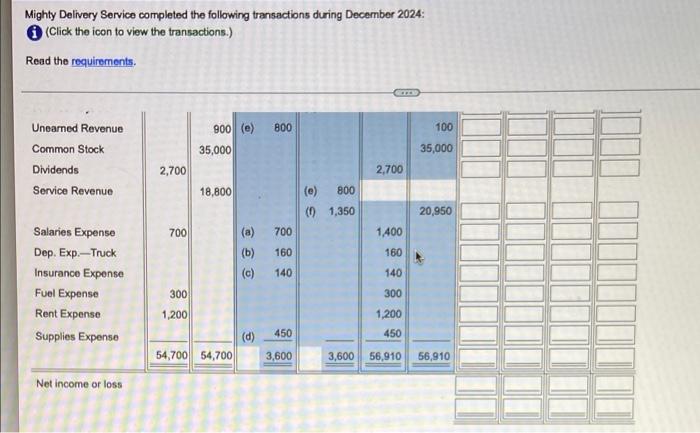

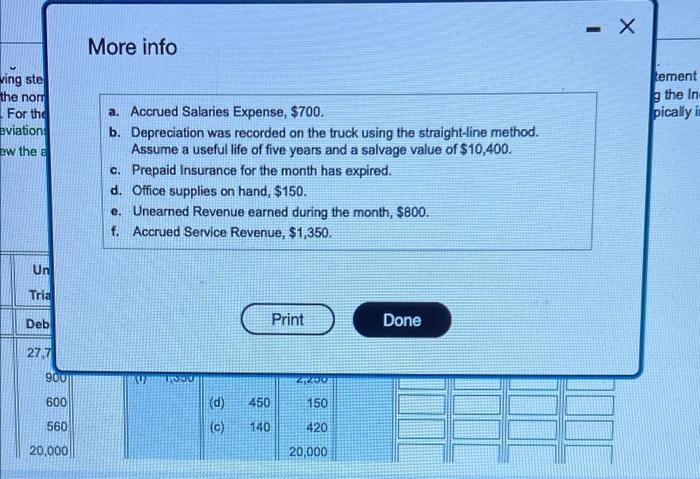

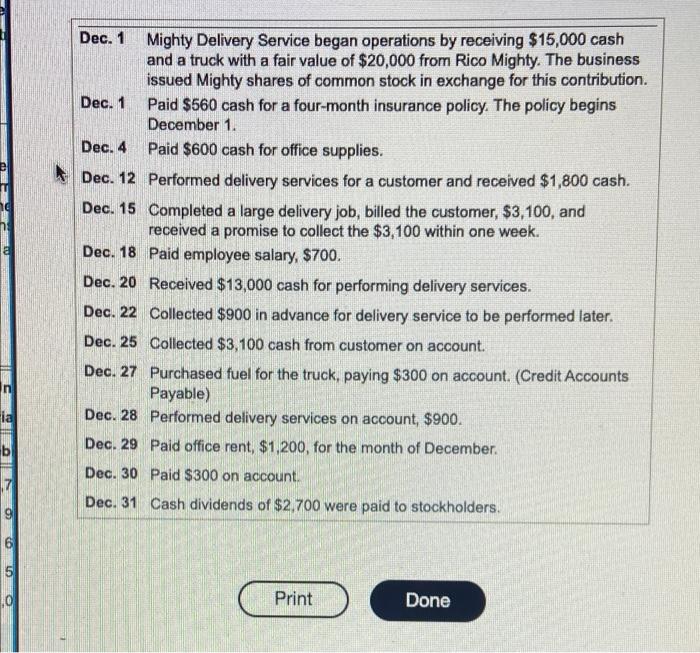

Mighty Delivery Service completed the following transactions during December 2024: (Click the icon to view the transactions.) Read the requirements Income Balance Statement Sheet Account Title Debit Credit Debit Credit Cash Accounts Receivable Office Supplies Prepaid Insurance Truck ACO. Dop. Truck Accounts Payable Salaries Payable Uneamed Revenue Mighty Delivery Service Worksheet December 31, 2024 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Debit Credit Debit Credit 27,740 27.740 900 (0 1,350 2,250 600 (d) 450 150 560 (c) 140 420 20,000 20,000 (b) 160 160 0 (a) 700 700 900 (e) 800 100 Income Balance ce Statement Sheet edit Debit Credit Debit Credit 160 0 700 100 5,000 Mighty Delivery Service completed the following transactions during December 2024: (Click the icon to view the transactions.) Read the requirements 800 100 Unearned Revenue Common Stock 900 (e) 35,000 35,000 2,700 2,700 Dividends Service Revenue 18,800 (c) 800 (0) 1,350 20,950 700 700 (a) (b) 1400 160 160 140 140 Salaries Expense Dep. Exp-Truck Insurance Expense Fuel Expense Rent Expense Supplies Expense 300 300 1,200 1,200 450 (d) 450 54,700 54,700 3,600 3,600 56,910 56,910 Net income or loss More info ving ste tement g the in pically in the non For the eviations ew the a. Accrued Salaries Expense, $700. b. Depreciation was recorded on the truck using the straight-line method. Assume a useful life of five years and a salvage value of $10,400. c. Prepaid Insurance for the month has expired. d. Office supplies on hand, $150. e. Unearned Revenue earned during the month, $800. Accrued Service Revenue, $1,350. Un Tria Deb Print Done 27,7 900 VOU 200 600 (d) 450 150 560 140 420 20,000 20,000 Dec. 1 Mighty Delivery Service began operations by receiving $15,000 cash and a truck with a fair value of $20,000 from Rico Mighty. The business issued Mighty shares of common stock in exchange for this contribution. Dec. 1 Paid $560 cash for a four-month insurance policy. The policy begins December 1. Dec. 4 Paid $600 cash for office supplies. Dec. 12 Performed delivery services for a customer and received $1,800 cash. Dec. 15 Completed a large delivery job, billed the customer, $3,100, and received a promise to collect the $3,100 within one week. Dec. 18 Paid employee salary, $700. Dec. 20 Received $13,000 cash for performing delivery services. Dec. 22 Collected $900 in advance for delivery service to be performed later. Dec. 25 Collected $3,100 cash from customer on account. Dec. 27 Purchased fuel for the truck, paying $300 on account. (Credit Accounts Payable) Dec. 28 Performed delivery services on account, $900. Dec. 29 Paid office rent, $1,200, for the month of December Dec. 30 Paid $300 on account Dec. 31 Cash dividends of $2,700 were paid to stockholders. ISCO ia b 7 9 OOOO 5 . Print Done