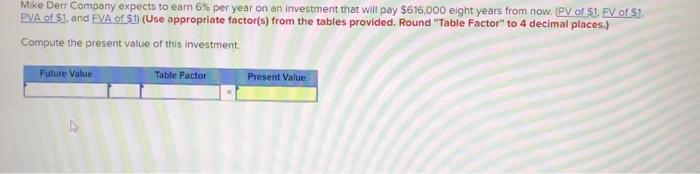

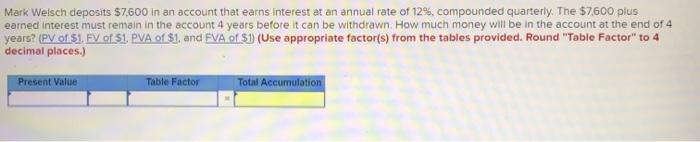

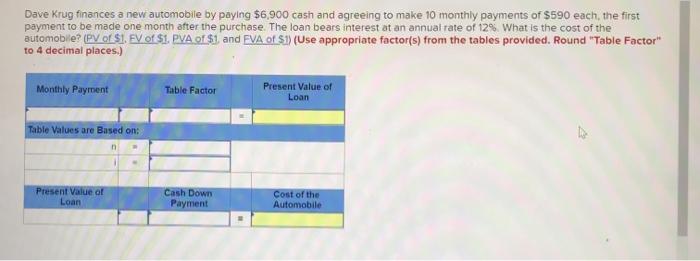

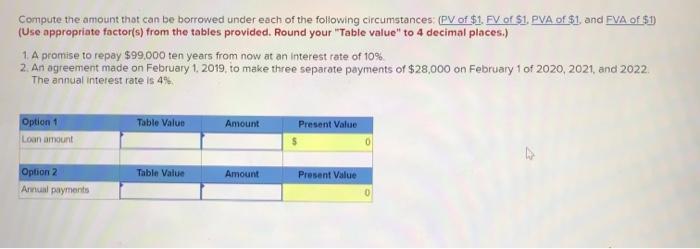

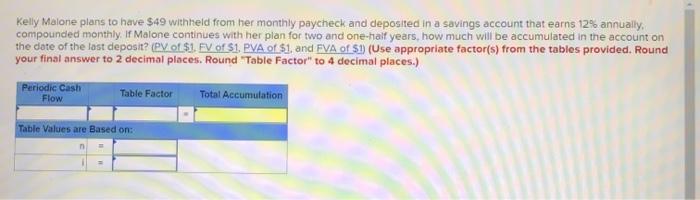

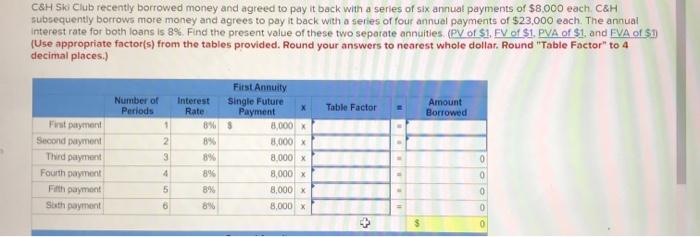

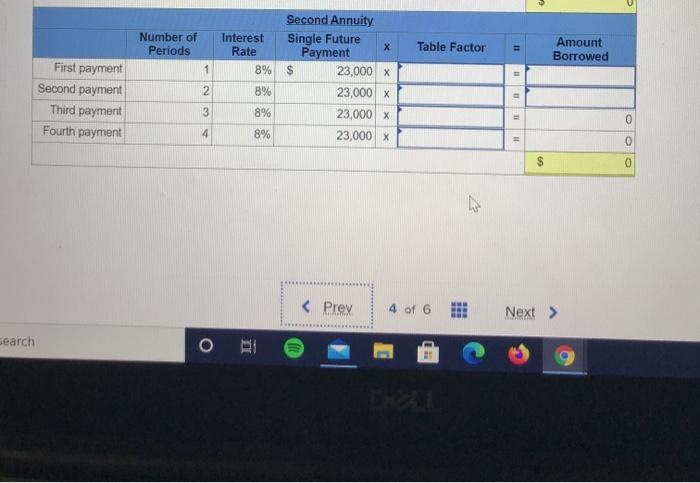

Mike Derr Company expects to earn 6% per year on an investment that will pay $616,000 eight years from now. (PV of $1. FV of $1. PVA of $1. and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Compute the present value of this investment Future Value Table Factor Present Value Mark Welsch deposits $7.600 in an account that earns interest at an annual rate of 12%, compounded quarterly. The $7,600 plus earned interest must remain in the account 4 years before it can be withdrawn. How much money will be in the account at the end of 4 years? (PV of $1. FV of S1, PVA of $1, and EVA of $1(Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Present Value Table Factor Total Accumulation Dave Krug finances a new automobile by paying $6,900 cash and agreeing to make 10 monthly payments of $590 each, the first payment to be made one month after the purchase. The loan bears interest at an annual rate of 12% What is the cost of the automobile? PV of SI. FV of $1. PVA of $1 and FVA of S1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Monthly Payment Table Factor Present Value of Loan Table Values are Based on: n Present Value of Loan Cash Down Payment Cost of the Automobile Compute the amount that can be borrowed under each of the following circumstances (PV of $1. FV of $1. PVA of $1 and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "Table value" to 4 decimal places.) 1. A promise to repay $99.000 ten years from now at an interest rate of 10% 2. An agreement made on February 1, 2019, to make three separate payments of $28,000 on February 1 of 2020, 2021, and 2022 The annual interest rate is 4% Option 1 Loan amount Table Value Amount Present Value 0 Table Value Amount Present Value Option 2 Arual payments Kelly Malone plans to have $49 withheld from her monthly paycheck and deposited in a savings account that earns 12% annually, compounded monthly. If Malone continues with her plan for two and one-half years, how much will be accumulated in the account on the date of the last deposit? (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to 2 decimal places. Round Table Factor" to 4 decimal places.) Periodic Cash Flow Table Factor Total Accumulation Table Values are Based on: C&H Sk Club recently borrowed money and agreed to pay it back with a series of six annual payments of $8.000 each. C&H subsequently borrows more money and agrees to pay it back with a series of four annual payments of $23,000 each. The annual interest rate for both loans is 8% Find the present value of these two separate annuities (PV of $1. FV of $1. PVA of $1. and EVA of $1 (Use appropriate factor(s) from the tables provided. Round your answers to nearest whole dollar. Round "Table Factor" to 4 decimal places.) Table Factor Amount Borrowed Number of Periods 1 2 First Annuity Interest Single Future Rate Payment 8%$ 8.000 x 8% 3,000 8% 8,000 89 8.000 x 8% 8.000 89% 8.000 X First payment Second payment Third payment Fourth payment Fifth payment Sixth payment 0 4 0 5 0 6 0 + 0 Number of Periods Table Factor Interest Rate 8% Amount Borrowed 1 $ 1 Second Annuity Single Future Payment 23,000 X 23,000 X 23,000 x 23,000 X 2 First payment Second payment Third payment Fourth payment 8% 3 8% 0 4 8% 0 Search