Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Modern Enterprises Ltd is considering the purchase of a new computer system for its Research and Development Division, which would cost Rs 35 lakh.

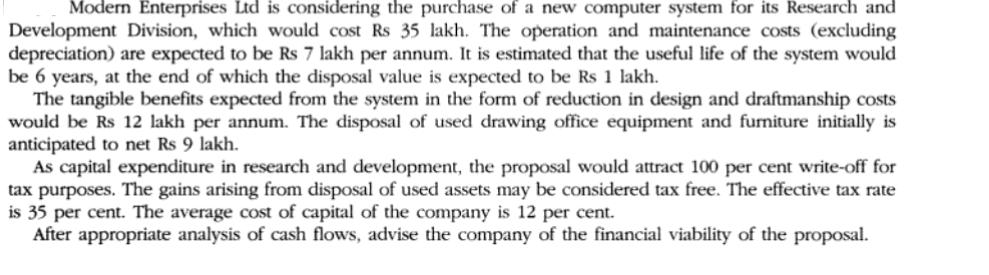

Modern Enterprises Ltd is considering the purchase of a new computer system for its Research and Development Division, which would cost Rs 35 lakh. The operation and maintenance costs (excluding depreciation) are expected to be Rs 7 lakh per annum. It is estimated that the useful life of the system would be 6 years, at the end of which the disposal value is expected to be Rs 1 lakh. The tangible benefits expected from the system in the form of reduction in design and draftmanship costs would be Rs 12 lakh per annum. The disposal of used drawing office equipment and furniture initially is anticipated to net Rs 9 lakh. As capital expenditure in research and development, the proposal would attract 100 per cent write-off for tax purposes. The gains arising from disposal of used assets may be considered tax free. The effective tax rate is 35 per cent. The average cost of capital of the company is 12 per cent. After appropriate analysis of cash flows, advise the company of the financial viability of the proposal.

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Investment in 0th year 3500 Cost of new computer system 900 Less Net re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started