Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Ganesh Inamdar is dealing in wholesale business. His capital investment as on 1/04/2019 was Rs.18, 90,000. His balance in capital Account as on

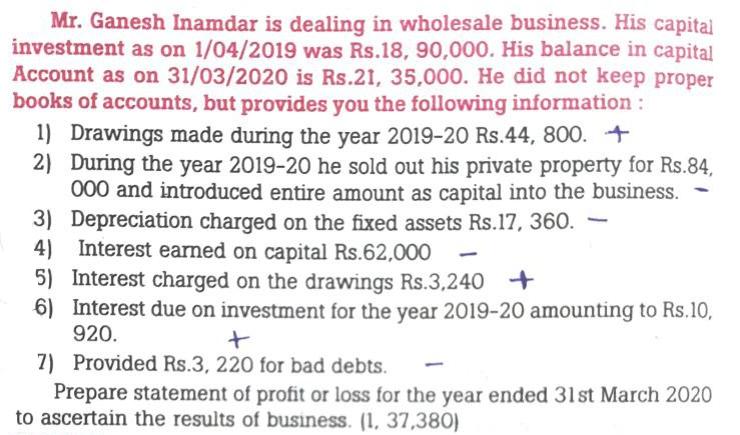

Mr. Ganesh Inamdar is dealing in wholesale business. His capital investment as on 1/04/2019 was Rs.18, 90,000. His balance in capital Account as on 31/03/2020 is Rs.21, 35,000. He did not keep proper books of accounts, but provides you the following information : 1) Drawings made during the year 2019-20 Rs.44, 800. + 2) During the year 2019-20 he sold out his private property for Rs.84, 000 and introduced entire amount as capital into the business. 3) Depreciation charged on the fixed assets Rs.17, 360. 4) Interest earned on capital Rs.62,000 5) Interest charged on the drawings Rs.3,240 + 6) Interest due on investment for the year 2019-20 amounting to Rs.10, 920. - 1 + 7) Provided Rs.3, 220 for bad debts. Prepare statement of profit or loss for the year ended 31st March 2020 to ascertain the results of business. (1, 37,380)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started