Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Lam, after graduating from the University of Toronto in Canada returned to Hong Kong in November 2019 and joined PanAm Ltd. (a company

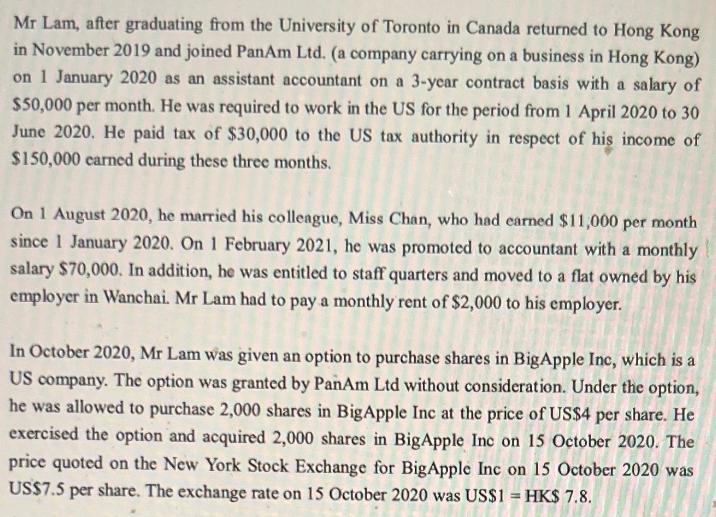

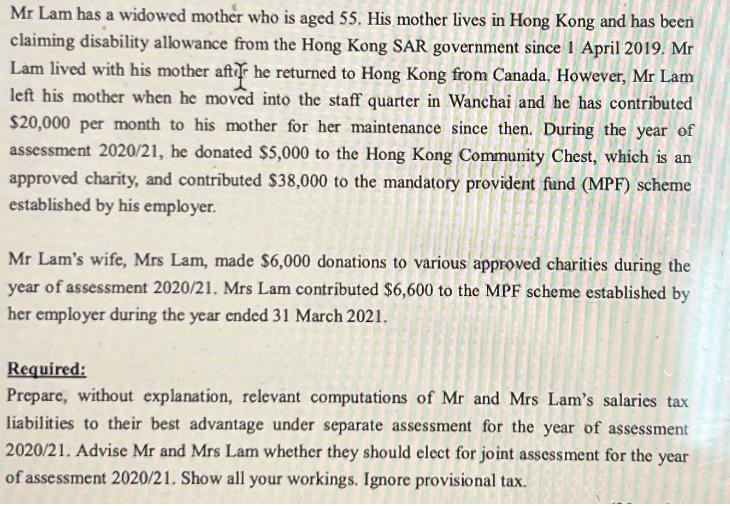

Mr Lam, after graduating from the University of Toronto in Canada returned to Hong Kong in November 2019 and joined PanAm Ltd. (a company carrying on a business in Hong Kong) on 1 January 2020 as an assistant accountant on a 3-year contract basis with a salary of $50,000 per month. He was required to work in the US for the period from 1 April 2020 to 30 June 2020. He paid tax of $30,000 to the US tax authority in respect of his income of $150,000 earned during these three months. On 1 August 2020, he married his colleague, Miss Chan, who had earned $11,000 per month since 1 January 2020. On 1 February 2021, he was promoted to accountant with a monthly salary $70,000. In addition, he was entitled to staff quarters and moved to a flat owned by his employer in Wanchai. Mr Lam had to pay a monthly rent of $2,000 to his employer. In October 2020, Mr Lam was given an option to purchase shares in BigApple Inc, which is a US company. The option was granted by PanAm Ltd without consideration. Under the option, he was allowed to purchase 2,000 shares in BigApple Inc at the price of US$4 per share. He exercised the option and acquired 2,000 shares in BigApple Inc on 15 October 2020. The price quoted on the New York Stock Exchange for BigApple Inc on 15 October 2020 was US$7.5 per share. The exchange rate on 15 October 2020 was US$1 = HK$ 7.8. ber 2020 w S$1 = HK Mr Lam has a widowed mother who is aged 55. His mother lives in Hong Kong and has been claiming disability allowance from the Hong Kong SAR government since 1 April 2019. Mr Lam lived with his mother aft he returned to Hong Kong from Canada. However, Mr Lam left his mother when he moved into the staff quarter in Wanchai and he has contributed $20,000 per month to his mother for her maintenance since then. During the year of assessment 2020/21, he donated $5,000 to the Hong Kong Community Chest, which is an approved charity, and contributed $38,000 to the mandatory provident fund (MPF) scheme established by his employer. Mr Lam's wife, Mrs Lam, made $6,000 donations to various approved charities during the year of assessment 2020/21. Mrs Lam contributed $6,600 to the MPF scheme established by her employer during the year ended 31 March 2021. Required: Prepare, without explanation, relevant computations of Mr and Mrs Lam's salaries tax liabilities to their best advantage under separate assessment for the year of assessment 2020/21. Advise Mr and Mrs Lam whether they should elect for joint assessment for the year of assessment 2020/21. Show all your workings. Ignore provisional tax.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the salaries tax liabilities for Mr and Mrs Lam under separate assessment for the year of assessment 202021 we will consider the relevant ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started