Answered step by step

Verified Expert Solution

Question

1 Approved Answer

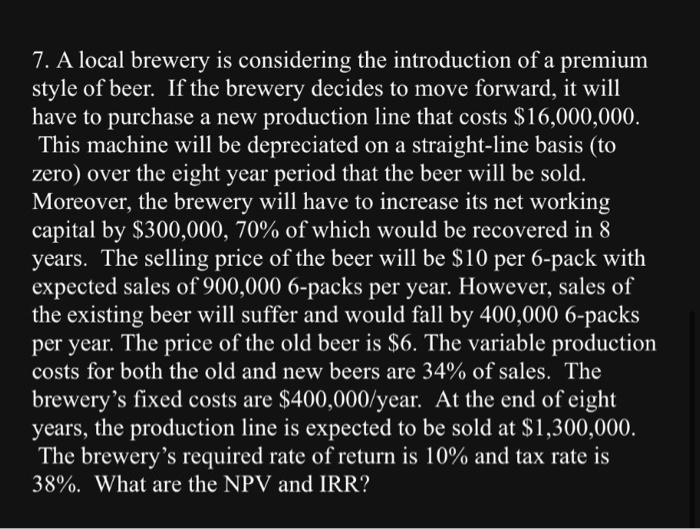

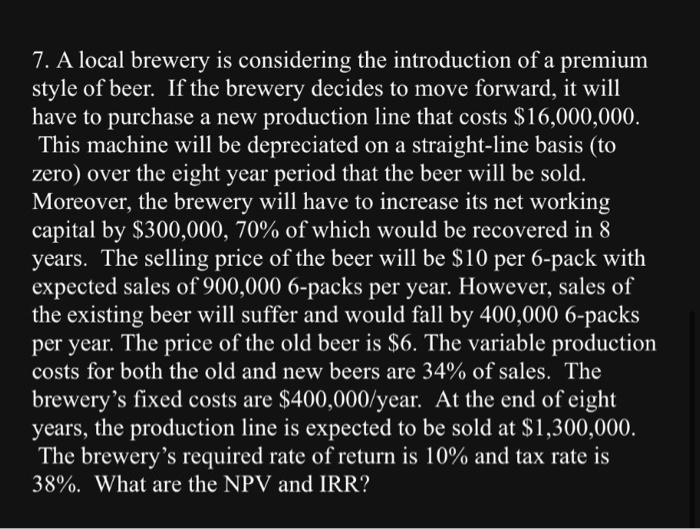

MUST SHOW WORK ON BA II CALCULATOR OR DOWNVOTE 7. A local brewery is considering the introduction of a premium style of beer. If the

MUST SHOW WORK ON BA II CALCULATOR OR DOWNVOTE

7. A local brewery is considering the introduction of a premium style of beer. If the brewery decides to move forward, it will have to purchase a new production line that costs $16,000,000. This machine will be depreciated on a straight-line basis (to zero) over the eight year period that the beer will be sold. Moreover, the brewery will have to increase its net working capital by $300,000,70% of which would be recovered in 8 years. The selling price of the beer will be $10 per 6-pack with expected sales of 900,000 6-packs per year. However, sales of the existing beer will suffer and would fall by 400,000 6-packs per year. The price of the old beer is $6. The variable production costs for both the old and new beers are 34% of sales. The brewery's fixed costs are $400,000 /year. At the end of eight years, the production line is expected to be sold at $1,300,000. The brewery's required rate of return is 10% and tax rate is 38%. What are the NPV and IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started