must use headings from this list. thanks!

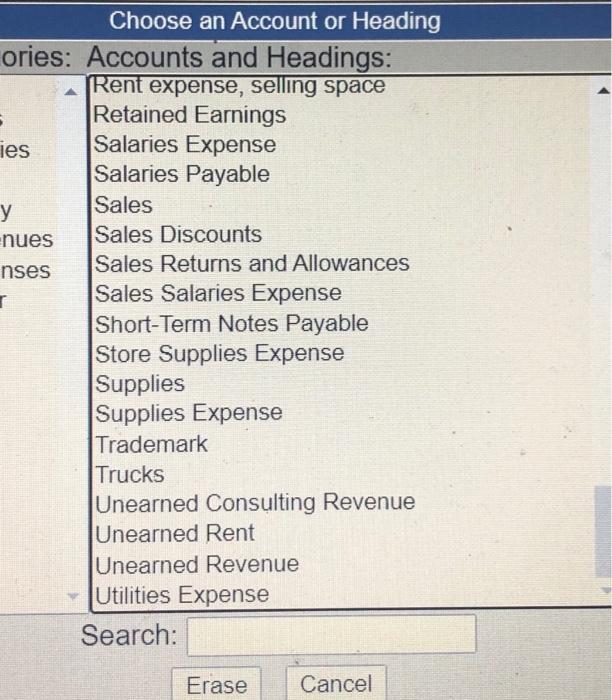

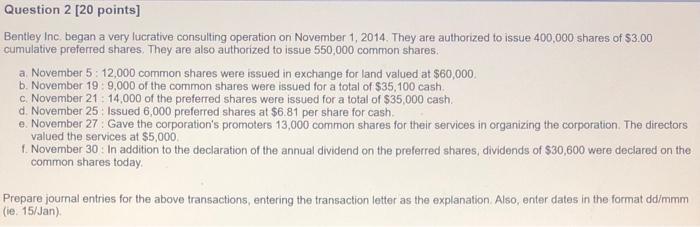

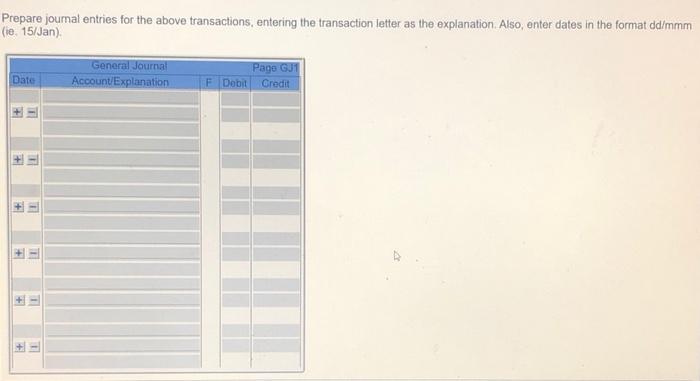

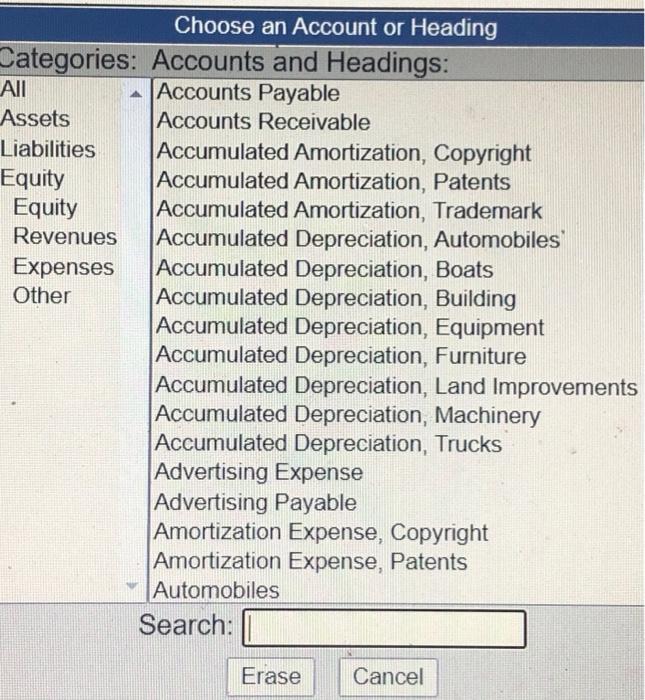

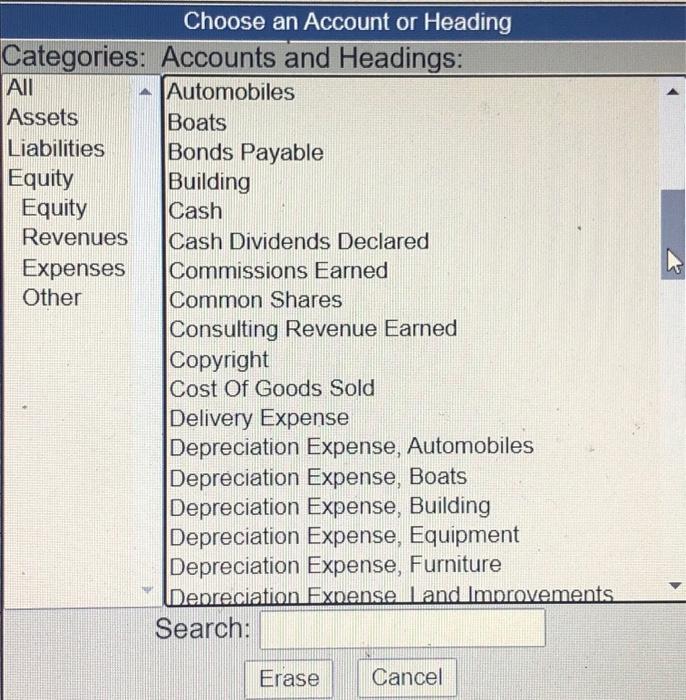

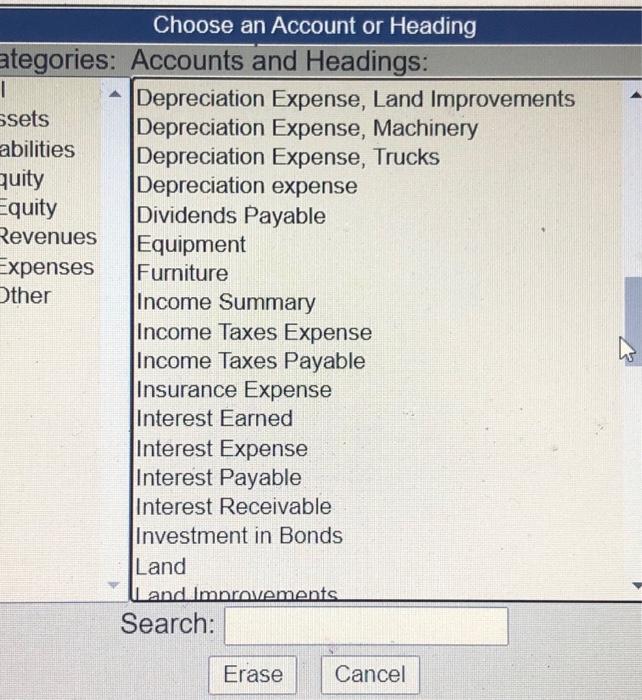

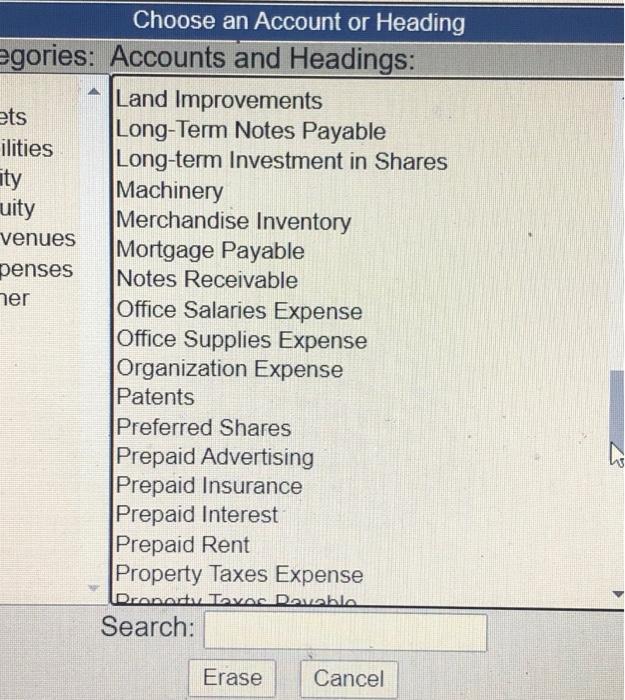

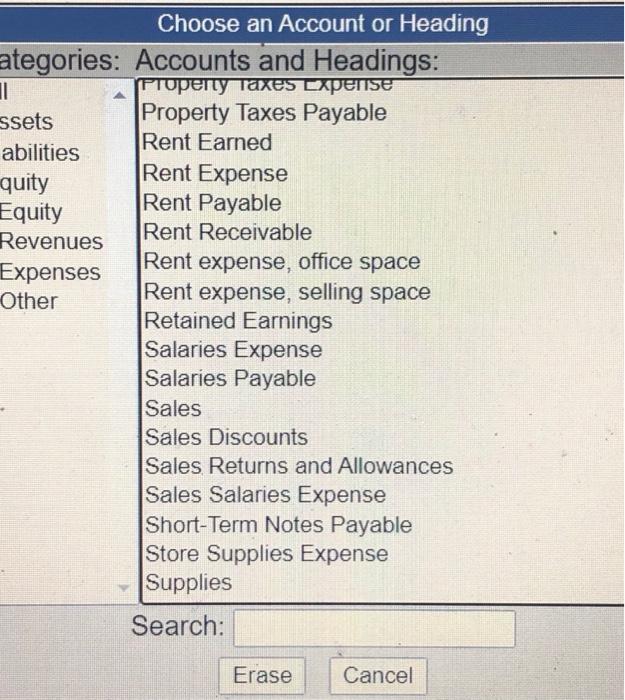

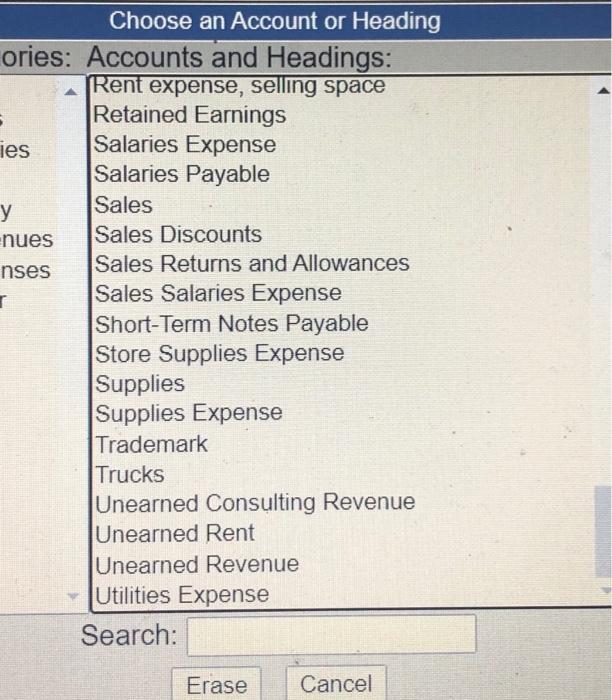

Question 2 [20 points] Bentley Inc began a very lucrative consulting operation on November 1, 2014. They are authorized to issue 400,000 shares of 3.00 cumulative preferred shares. They are also authorized to issue 550,000 common shares a November 5: 12,000 common shares were issued in exchange for land valued at $60,000 b. November 199,000 of the common shares were issued for a total of $35,100 cash. c. November 21 14,000 of the preferred shares were issued for a total of $35,000 cash. d. November 25: Issued 6,000 preferred shares at $6.81 per share for cash. e November 27 Gave the corporation's promoters 13,000 common shares for their services in organizing the corporation. The directors valued the services at $5,000 1. November 30. In addition to the declaration of the annual dividend on the preferred shares, dividends of $30,600 were declared on the common shares today, Prepare journal entries for the above transactions, entering the transaction letter as the explanation Also, enter dates in the format dd/mmm (ie. 15/Jan) Prepare journal entries for the above transactions, entering the transaction letter as the explanation. Also, enter dates in the format dd/mmm (ie 15/Jan) Date General Journal Account Explanation Pago GUT F Dobit Credit + + - + - + + 1 + Choose an Account or Heading Categories: Accounts and Headings: All Accounts Payable Assets Accounts Receivable Liabilities Accumulated Amortization, Copyright Equity Accumulated Amortization, Patents Equity Accumulated Amortization, Trademark Revenues Accumulated Depreciation, Automobiles Expenses Accumulated Depreciation, Boats Other Accumulated Depreciation, Building Accumulated Depreciation, Equipment Accumulated Depreciation, Furniture Accumulated Depreciation, Land Improvements Accumulated Depreciation, Machinery Accumulated Depreciation, Trucks Advertising Expense Advertising Payable Amortization Expense, Copyright Amortization Expense, Patents Automobiles Search: Erase Cancel Choose an Account or Heading Categories: Accounts and Headings: All Automobiles Assets Boats Liabilities Bonds Payable Equity Building Equity Cash Revenues Cash Dividends Declared Expenses Commissions Earned Other Common Shares Consulting Revenue Earned Copyright Cost Of Goods Sold Delivery Expense Depreciation Expense, Automobiles Depreciation Expense, Boats Depreciation Expense, Building Depreciation Expense, Equipment Depreciation Expense, Furniture Depreciation Expense Land Improvements Search: Erase Cancel Choose an Account or Heading ategories: Accounts and Headings: 1 Depreciation Expense, Land Improvements ssets Depreciation Expense, Machinery abilities Depreciation Expense, Trucks quity Depreciation expense Equity Dividends Payable Revenues Equipment Expenses Furniture Other Income Summary Income Taxes Expense Income Taxes Payable Insurance Expense Interest Earned Interest Expense Interest Payable Interest Receivable Investment in Bonds Land Land Improvements Search: Erase Cancel Choose an Account or Heading egories: Accounts and Headings: Land Improvements ets Long-Term Notes Payable ilities Long-term Investment in Shares ity Machinery uity Merchandise Inventory venues Mortgage Payable penses Notes Receivable her Office Salaries Expense Office Supplies Expense Organization Expense Patents Preferred Shares Prepaid Advertising Prepaid Insurance Prepaid Interest Prepaid Rent Property Taxes Expense Dronartu Layoc Davobla Search: w Erase Cancel Choose an Account or Heading ategories: Accounts and Headings: 11 Propeny Taxes [Xperise ssets Property Taxes Payable Rent Earned abilities quity Rent Expense Rent Payable Equity Revenues Rent Receivable Expenses Rent expense, office space Other Rent expense, selling space Retained Earnings Salaries Expense Salaries Payable Sales Sales Discounts Sales Returns and Allowances Sales Salaries Expense Short-Term Notes Payable Store Supplies Expense Supplies Search: Erase Cancel Choose an Account or Heading ories: Accounts and Headings: Rent expense, selling space Retained Earnings ies Salaries Expense Salaries Payable Sales -nues Sales Discounts nses Sales Returns and Allowances Sales Salaries Expense r Short-Term Notes Payable Store Supplies Expense Supplies Supplies Expense Trademark Trucks Unearned Consulting Revenue Unearned Rent Unearned Revenue Utilities Expense Search: Erase Cancel

must use headings from this list. thanks!

must use headings from this list. thanks!