Answered step by step

Verified Expert Solution

Question

1 Approved Answer

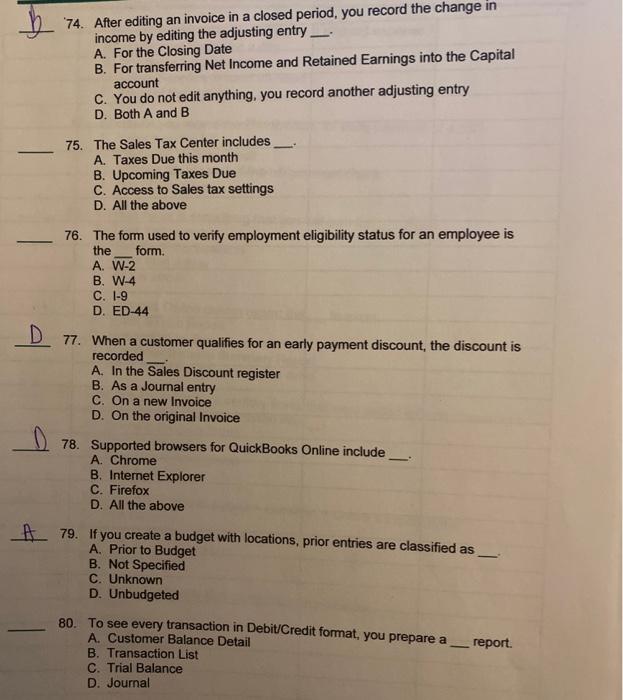

need 75, 76 and 80. if any others i have are wrong please correct me 74. After editing an invoice in a closed period, you

need 75, 76 and 80. if any others i have are wrong please correct me

74. After editing an invoice in a closed period, you record the change in income by editing the adjusting entry - A. For the Closing Date B. For transferring Net Income and Retained Earnings into the Capital account C. You do not edit anything, you record another adjusting entry D. Both A and B - 75. The Sales Tax Center includes A. Taxes Due this month B. Upcoming Taxes Due C. Access to Sales tax settings D. All the above 76. The form used to verify employment eligibility status for an employee is the form. A. W-2 B W-4 C. 1-9 D. ED-44 D 77. When a customer qualifies for an early payment discount, the discount is recorded A. In the Sales Discount register B. As a Journal entry C. On a new Invoice D. On the original Invoice D 78. Supported browsers for QuickBooks Online include A. Chrome B. Internet Explorer C. Firefox D. All the above # 79. If you create a budget with locations, prior entries are classified as A. Prior to Budget B. Not Specified C. Unknown D. Unbudgeted 80. To see every transaction in Debit/Credit format, you prepare a A. Customer Balance Detail report. B. Transaction List C. Trial Balance D. Journal Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started