Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need answers ASAP 1. Accountants recognize revenue when it is both realized and a. Accumulated. b. Recorded. c. Earned. d. Collected. 2. What is the

Need answers ASAP

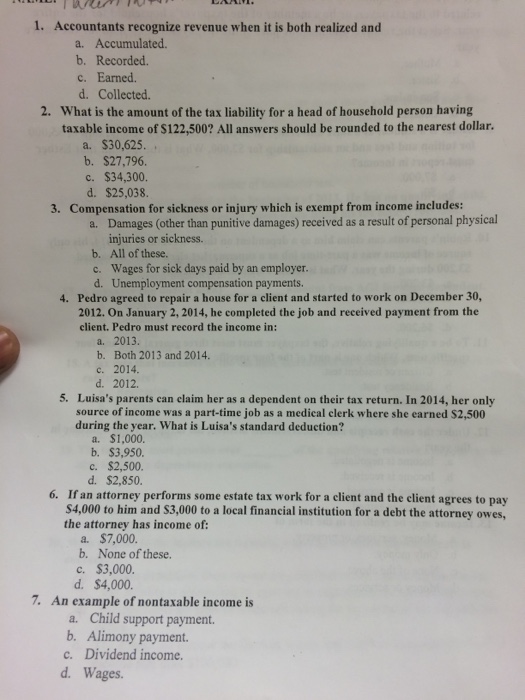

1. Accountants recognize revenue when it is both realized and a. Accumulated. b. Recorded. c. Earned. d. Collected. 2. What is the amount of the tax liability for a head of household person having taxable income of S122,500? All answers should be rounded to the nearest dollar. a. S30,625. b. $27,796. c. $34,300. d. $25,038. 3. Compensation for sickness or injury which is exempt from income includes: a. Damages (other than punitive damages) received as a result of personal physical injuries or sickness. b. All of these. c. Wages for sick days paid by an employer. d. Unemployment compensation payments. 4. Pedro agreed to repair a house for a client and started to work on December 30, 2012. On January 2, 2014, he completed the job and received payment from the client. Pedro must record the income in: a, 2013. b. Both 2013 and 2014. c. 2014. d. 2012. 5. Luisa's parents can claim her as a dependent on their tax return. In 2014, her only source of income was a part-time job as a medical clerk where she earned S2,500 during the year. What is Luisa's standard deduction? a. $1,000. b. S3,950. c. $2,500. d. $2,850. 6. If an attorney performs some estate tax work for a client and the client agrees to pay S4,000 to him and S3,000 to a local financial institution for a debt the attorney owes, the attorney has income of: a. $7,000. b. None of these c. $3,000. d, $4,000. 7. An example of nontaxable income is a. Child support payment. b. Alimony payment c. Dividend income d. Wages

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started