Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help on the second question, thanks in advance Sry, all the information given is in the image, so no specific data. The two things

Need help on the second question, thanks in advance

Need help on the second question, thanks in advance

Sry, all the information given is in the image, so no specific data.

The two things I want to figure out is 1) what does it mean by "the manager outperform the market" in this specific case, what is the underlying economic meaning? 2) what is the null hypothesis should I set here?

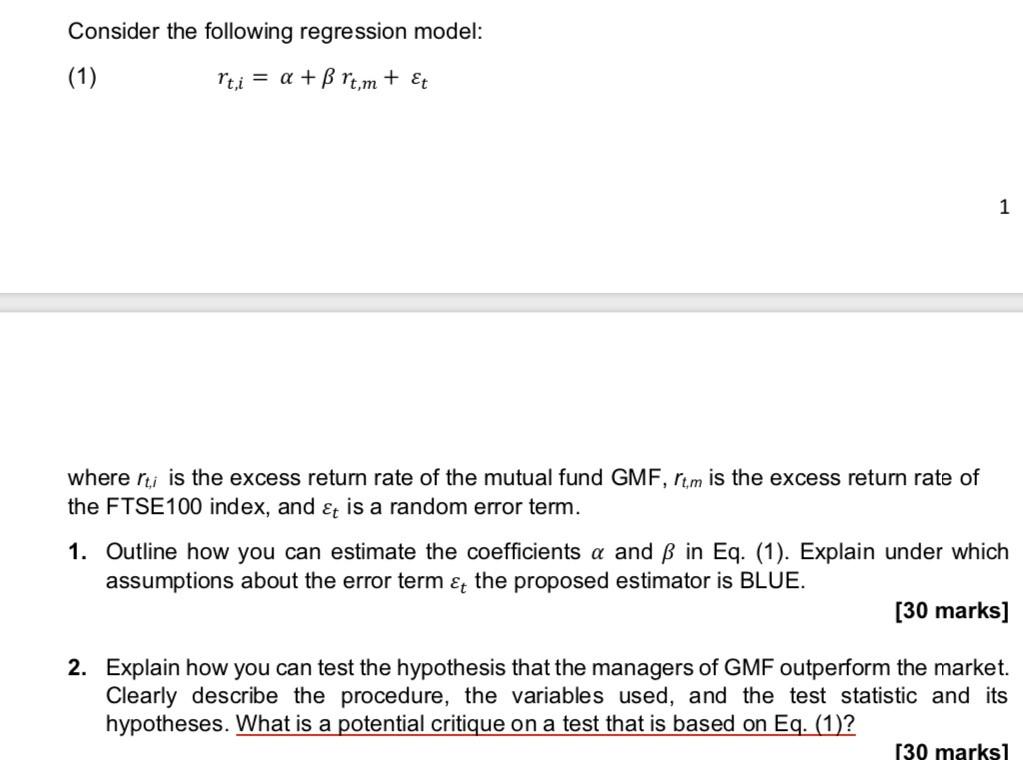

Consider the following regression model: (1) rt,i = a + rt,m + t 1 where rti is the excess return rate of the mutual fund GMF, rtm is the excess return rate of the FTSE100 index, and &t is a random error term. 1. Outline how you can estimate the coefficients a and in Eq. (1). Explain under which assumptions about the error term &t the proposed estimator is BLUE. [30 marks] 2. Explain how you can test the hypothesis that the managers of GMF outperform the market. Clearly describe the procedure, the variables used, and the test statistic and its hypotheses. What is a potential critique on a test that is based on Eq. (1)? 130 marks1 Consider the following regression model: (1) rt,i = a + rt,m + t 1 where rti is the excess return rate of the mutual fund GMF, rtm is the excess return rate of the FTSE100 index, and &t is a random error term. 1. Outline how you can estimate the coefficients a and in Eq. (1). Explain under which assumptions about the error term &t the proposed estimator is BLUE. [30 marks] 2. Explain how you can test the hypothesis that the managers of GMF outperform the market. Clearly describe the procedure, the variables used, and the test statistic and its hypotheses. What is a potential critique on a test that is based on Eq. (1)? 130 marks1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started