Answered step by step

Verified Expert Solution

Question

1 Approved Answer

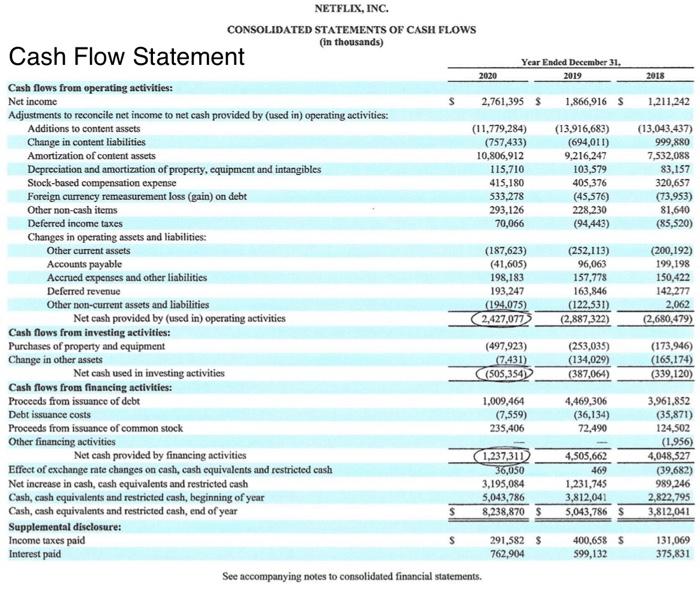

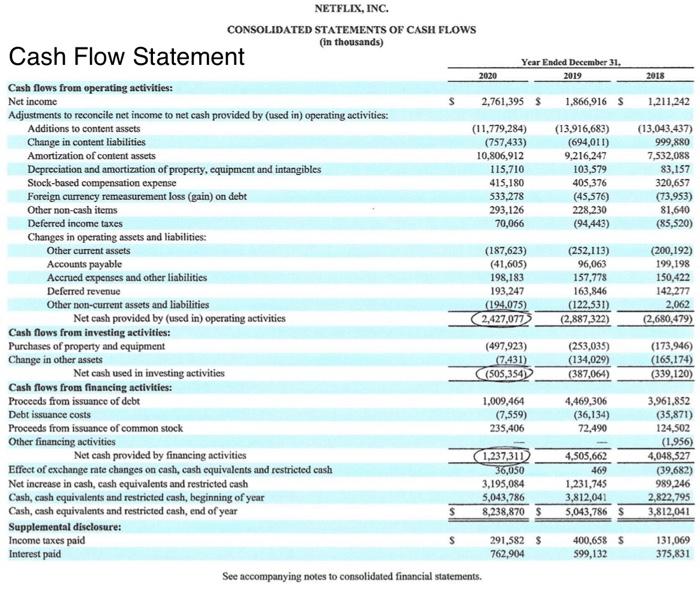

[Netflix's Cash Flow Questions] Look at Netflix's detailed cash flow statement and answer the following questions. 1. Did the cash balance increase or decrease at

[Netflix's Cash Flow Questions]

2018 1.211.242 (13,043,437) 999,880 7,532,088 83,157 320,657 (73.953) 81,640 (85,520) NETFLIX, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Cash Flow Statement Year Ended December 31. 2020 2019 Cash flows from operating activities: Nct income 2,761,395 $ 1,866,916 S Adjustments to reconcile net income to net cash provided by (used in) operating activities: Additions to content assets (11,779,284) (13,916,683) Change in content liabilities (757,433) (694,011) Amortization of content assets 10,806,912 9,216,247 Depreciation and amortization of property, equipment and intangibles 115.710 103,579 Stock-based compensation expense 415,180 405,376 Foreign currency remeasurement loss (gain) on debt 533,278 (45,576) Other non-cash items 293,126 228,230 Deferred income taxes 70,066 (94,443) Changes in operating assets and liabilities: Other current assets (187,623) (252,113) Accounts payable (41,605) 96,063 Accrued expenses and other liabilities 198,183 157,778 Deferred revenue 193,247 163,846 Other non-current assets and liabilities (194.075) (122,531) Net cash provided by (used in) operating activities 2,427,077 (2,887,322) Cash flows from investing activities: Purchases of property and equipment (497,923) (253,035) Change in other assets (7.431) (134,029) Net cash used in investing activities (505,354) (387,064) Cash flows from financing activities: Proceeds from issuance of debt 1,009,464 4,469,306 Debt issuance costs (7,559) (36,134) Proceeds from issuance of common stock 235,406 72.490 Other financing activities Net cash provided by financing activities 1,237,311 4,505,662 Effect of exchange rate changes on cash, cash equivalents and restricted cash 36,050 469 Net increase in cash, cash equivalents and restricted cash 3,195,084 1,231,745 Cash, cash equivalents and restricted cash, beginning of year 5,043,786 3,812,041 Cash, cash equivalents and restricted cash, end of year 8,238,870 S 5,043,786 S Supplemental disclosure: Income taxes paid 291,582 $ 400,658 $ Interest paid 762,904 599,132 See accompanying notes to consolidated financial statements. (200,192) 199.198 150,422 142,277 2,062 (2.680,479) (173,946) (165,174) (339,120) 3,961,852 (35,871) 124,502 (1.956) 4,048,527 (39,682) 989.246 2,822,795 3,812,041 131,069 375,831 Look at Netflix's detailed cash flow statement and answer the following questions.

1. Did the cash balance increase or decrease at Netflix company over the year? What makes the cash flow statement so important to Netflix?

2. Did the Netflix company pay any dividends in the current year? What section or category of the cash flow statement did you look at and what was the amount?

3. How much did Netflix company spend in cash on capital expenditures (fixed asset purchases) in the current and previous years? Give an example of a capital expenditure/fixed asset purchase that Netflix company may have purchased and explain how it would be used to help Netflix company make money.

The picture shows the Cash Flow Statement of Netflix Company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started