Answered step by step

Verified Expert Solution

Question

1 Approved Answer

no need to explain thank you Mr. Ohno owns and operates a part-time service business that generates P80,000 annual taxable income. His federal tax rate

no need to explain thank you

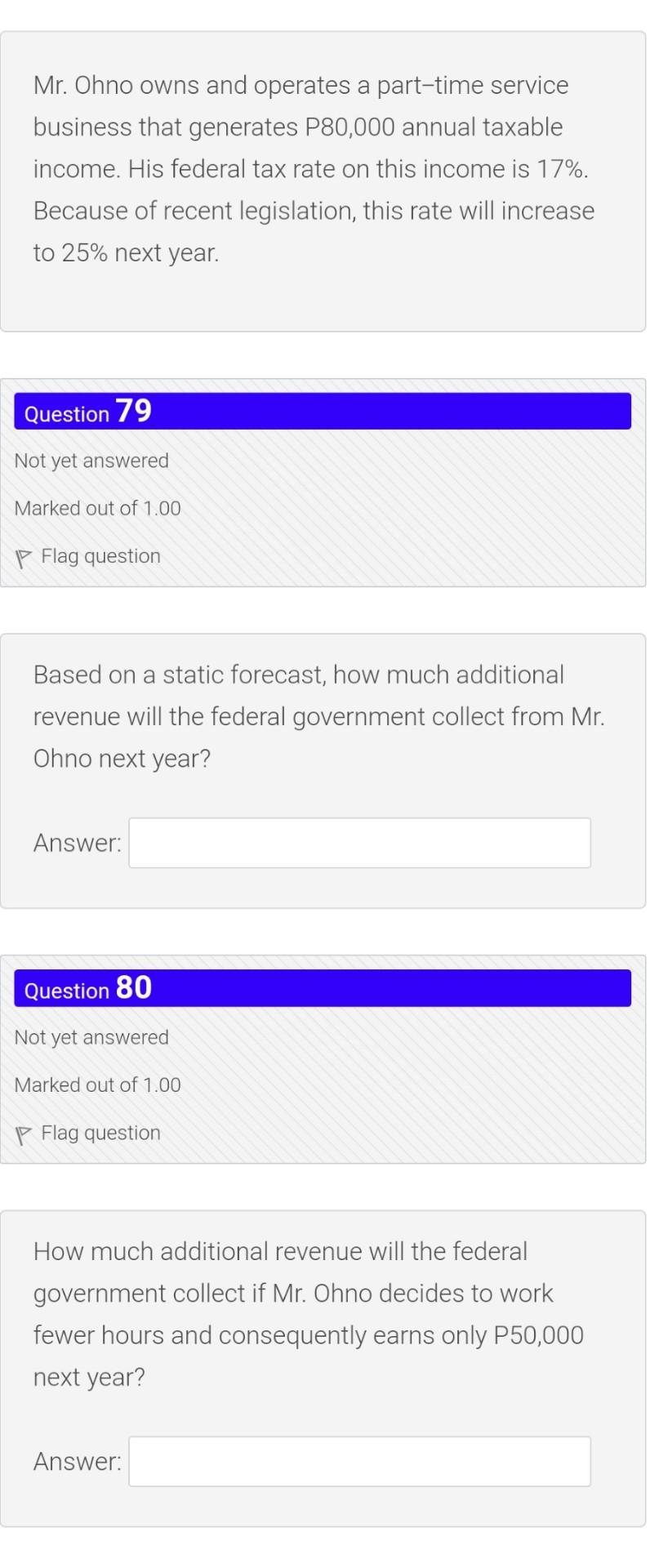

Mr. Ohno owns and operates a part-time service business that generates P80,000 annual taxable income. His federal tax rate on this income is 17%. Because of recent legislation, this rate will increase to 25% next year. Question 79 Not yet answered Marked out of 1.00 P Flag question Based on a static forecast, how much additional revenue will the federal government collect from Mr. Ohno next year? Answer: Question 80 Not yet answered Marked out of 1.00 P Flag question How much additional revenue will the federal government collect if Mr. Ohno decides to work fewer hours and consequently earns only P50,000 next yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started