Answered step by step

Verified Expert Solution

Question

1 Approved Answer

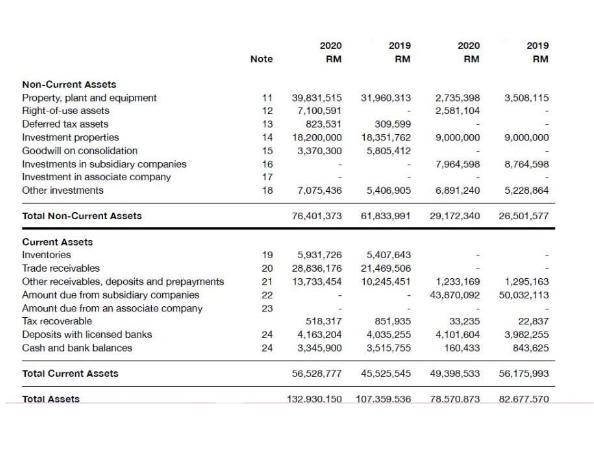

Non-Current Assets begin{tabular}{lrrrrrr} Property, plent and equipment & 11 & 39,831,515 & 31,960,313 & 2,735,398 & 3,508,115 Right-of-use assets & 12 & 7,100,591 &

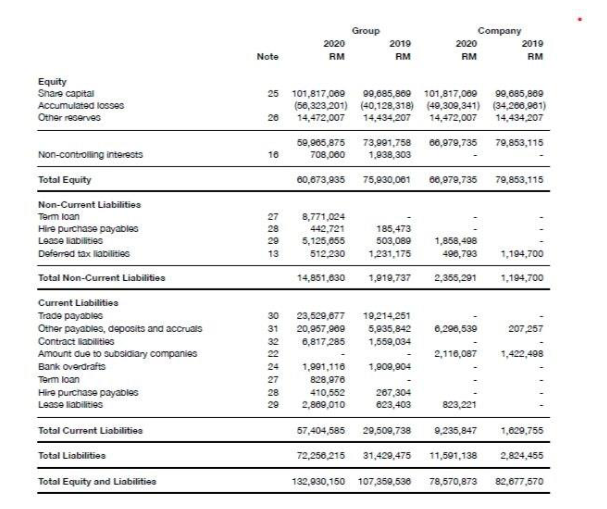

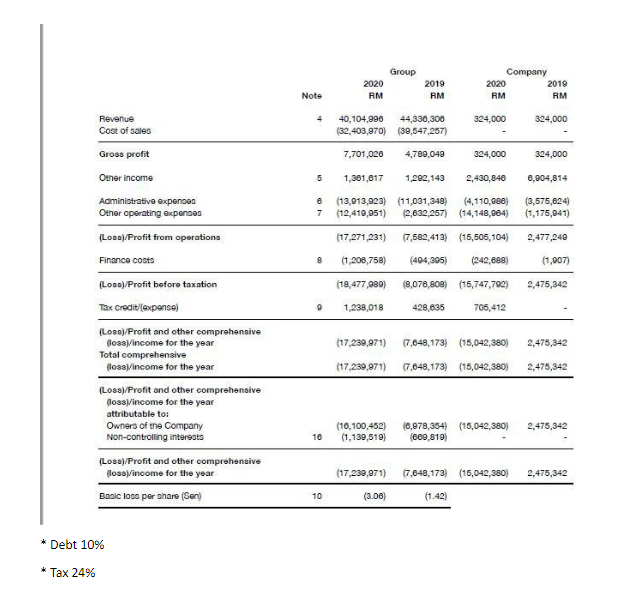

Non-Current Assets \begin{tabular}{lrrrrrr} Property, plent and equipment & 11 & 39,831,515 & 31,960,313 & 2,735,398 & 3,508,115 \\ Right-of-use assets & 12 & 7,100,591 & - & 2,581,104 & - & - \\ Deferred tax assets & 13 & 823,531 & 309,599 & - & 5,000,000 \\ Investment properties & 14 & 18,200,000 & 18,351,762 & 9,000,000 & - \\ Goodwill on consolidation & 15 & 3,370,300 & 5,805,412 & - & 7,964,598 & 8,764,598 \\ Investments in subsidiary companies & 16 & - & - & - & - \\ Investment in associate company & 17 & 18 & 7,075,436 & 5,406,905 & 6,891,240 & 5,228,864 \\ Other investments & 18 & & 76,401,373 & 61,833,991 & 29,172,340 & 26,501,577 \\ \hline Total Non-Current Assets & & & & \end{tabular} Current Assets \begin{tabular}{lrrrr} & \multicolumn{2}{c}{ Group } & \multicolumn{2}{c}{ Compony } \\ & 2020 & 2019 & 2020 & 2019 \\ Note & RM & AM & AM & RM \end{tabular} Equity Non-Current Liabilities \begin{tabular}{lrrrrr} Term ioan & 27 & 8,771,024 & - & - & - \\ Hire purchase palyablec & 28 & 442,721 & 185,473 & - \\ Lesse liabilities & 29 & 5,125,055 & 503,089 & 1,858,498 & - \\ Deferred tax llabilites & 13 & 512,230 & 1,231,175 & 496,793 & 1,194,700 \\ \hline Total Non-Current Liabilities & & 14,851,030 & 1,919,737 & 2,355,291 & 1,194,700 \\ \hline \end{tabular} Current Liabilities TradepayablesOtherpayables,depositsandaccrualsContractliabilitiesAmountduetosubsidiarycompanies3031322223,529,67720,857,9696,817,28519,214,2515,935,8421,559,0346,296,5392,116,087207,257207,1,422,498 Bank overdrafts Term loan Hire purchase payables Lesse liabilitigs 242728291,991,116828,976410,5522,869,0101,909,904267,304623,403823,221 Total Current Liabilities \begin{tabular}{llll} 57,404,585 & 29,509,738 & 9,235,847 & 1,629,755 \\ \hline \end{tabular} Total Liabilities 72,256,215 31,428,475 11,591,1382,824,455 Total Equity and Liabilities \begin{tabular}{llll} 132,930,150 & 107,359,536 & 78,570,873 & 82,677,570 \\ \hline \end{tabular} * Debt 10% * Tax24% 3.Determine ROCE (without leverage) Non-Current Assets \begin{tabular}{lrrrrrr} Property, plent and equipment & 11 & 39,831,515 & 31,960,313 & 2,735,398 & 3,508,115 \\ Right-of-use assets & 12 & 7,100,591 & - & 2,581,104 & - & - \\ Deferred tax assets & 13 & 823,531 & 309,599 & - & 5,000,000 \\ Investment properties & 14 & 18,200,000 & 18,351,762 & 9,000,000 & - \\ Goodwill on consolidation & 15 & 3,370,300 & 5,805,412 & - & 7,964,598 & 8,764,598 \\ Investments in subsidiary companies & 16 & - & - & - & - \\ Investment in associate company & 17 & 18 & 7,075,436 & 5,406,905 & 6,891,240 & 5,228,864 \\ Other investments & 18 & & 76,401,373 & 61,833,991 & 29,172,340 & 26,501,577 \\ \hline Total Non-Current Assets & & & & \end{tabular} Current Assets \begin{tabular}{lrrrr} & \multicolumn{2}{c}{ Group } & \multicolumn{2}{c}{ Compony } \\ & 2020 & 2019 & 2020 & 2019 \\ Note & RM & AM & AM & RM \end{tabular} Equity Non-Current Liabilities \begin{tabular}{lrrrrr} Term ioan & 27 & 8,771,024 & - & - & - \\ Hire purchase palyablec & 28 & 442,721 & 185,473 & - \\ Lesse liabilities & 29 & 5,125,055 & 503,089 & 1,858,498 & - \\ Deferred tax llabilites & 13 & 512,230 & 1,231,175 & 496,793 & 1,194,700 \\ \hline Total Non-Current Liabilities & & 14,851,030 & 1,919,737 & 2,355,291 & 1,194,700 \\ \hline \end{tabular} Current Liabilities TradepayablesOtherpayables,depositsandaccrualsContractliabilitiesAmountduetosubsidiarycompanies3031322223,529,67720,857,9696,817,28519,214,2515,935,8421,559,0346,296,5392,116,087207,257207,1,422,498 Bank overdrafts Term loan Hire purchase payables Lesse liabilitigs 242728291,991,116828,976410,5522,869,0101,909,904267,304623,403823,221 Total Current Liabilities \begin{tabular}{llll} 57,404,585 & 29,509,738 & 9,235,847 & 1,629,755 \\ \hline \end{tabular} Total Liabilities 72,256,215 31,428,475 11,591,1382,824,455 Total Equity and Liabilities \begin{tabular}{llll} 132,930,150 & 107,359,536 & 78,570,873 & 82,677,570 \\ \hline \end{tabular} * Debt 10% * Tax24% 3.Determine ROCE (without leverage)

Non-Current Assets \begin{tabular}{lrrrrrr} Property, plent and equipment & 11 & 39,831,515 & 31,960,313 & 2,735,398 & 3,508,115 \\ Right-of-use assets & 12 & 7,100,591 & - & 2,581,104 & - & - \\ Deferred tax assets & 13 & 823,531 & 309,599 & - & 5,000,000 \\ Investment properties & 14 & 18,200,000 & 18,351,762 & 9,000,000 & - \\ Goodwill on consolidation & 15 & 3,370,300 & 5,805,412 & - & 7,964,598 & 8,764,598 \\ Investments in subsidiary companies & 16 & - & - & - & - \\ Investment in associate company & 17 & 18 & 7,075,436 & 5,406,905 & 6,891,240 & 5,228,864 \\ Other investments & 18 & & 76,401,373 & 61,833,991 & 29,172,340 & 26,501,577 \\ \hline Total Non-Current Assets & & & & \end{tabular} Current Assets \begin{tabular}{lrrrr} & \multicolumn{2}{c}{ Group } & \multicolumn{2}{c}{ Compony } \\ & 2020 & 2019 & 2020 & 2019 \\ Note & RM & AM & AM & RM \end{tabular} Equity Non-Current Liabilities \begin{tabular}{lrrrrr} Term ioan & 27 & 8,771,024 & - & - & - \\ Hire purchase palyablec & 28 & 442,721 & 185,473 & - \\ Lesse liabilities & 29 & 5,125,055 & 503,089 & 1,858,498 & - \\ Deferred tax llabilites & 13 & 512,230 & 1,231,175 & 496,793 & 1,194,700 \\ \hline Total Non-Current Liabilities & & 14,851,030 & 1,919,737 & 2,355,291 & 1,194,700 \\ \hline \end{tabular} Current Liabilities TradepayablesOtherpayables,depositsandaccrualsContractliabilitiesAmountduetosubsidiarycompanies3031322223,529,67720,857,9696,817,28519,214,2515,935,8421,559,0346,296,5392,116,087207,257207,1,422,498 Bank overdrafts Term loan Hire purchase payables Lesse liabilitigs 242728291,991,116828,976410,5522,869,0101,909,904267,304623,403823,221 Total Current Liabilities \begin{tabular}{llll} 57,404,585 & 29,509,738 & 9,235,847 & 1,629,755 \\ \hline \end{tabular} Total Liabilities 72,256,215 31,428,475 11,591,1382,824,455 Total Equity and Liabilities \begin{tabular}{llll} 132,930,150 & 107,359,536 & 78,570,873 & 82,677,570 \\ \hline \end{tabular} * Debt 10% * Tax24% 3.Determine ROCE (without leverage) Non-Current Assets \begin{tabular}{lrrrrrr} Property, plent and equipment & 11 & 39,831,515 & 31,960,313 & 2,735,398 & 3,508,115 \\ Right-of-use assets & 12 & 7,100,591 & - & 2,581,104 & - & - \\ Deferred tax assets & 13 & 823,531 & 309,599 & - & 5,000,000 \\ Investment properties & 14 & 18,200,000 & 18,351,762 & 9,000,000 & - \\ Goodwill on consolidation & 15 & 3,370,300 & 5,805,412 & - & 7,964,598 & 8,764,598 \\ Investments in subsidiary companies & 16 & - & - & - & - \\ Investment in associate company & 17 & 18 & 7,075,436 & 5,406,905 & 6,891,240 & 5,228,864 \\ Other investments & 18 & & 76,401,373 & 61,833,991 & 29,172,340 & 26,501,577 \\ \hline Total Non-Current Assets & & & & \end{tabular} Current Assets \begin{tabular}{lrrrr} & \multicolumn{2}{c}{ Group } & \multicolumn{2}{c}{ Compony } \\ & 2020 & 2019 & 2020 & 2019 \\ Note & RM & AM & AM & RM \end{tabular} Equity Non-Current Liabilities \begin{tabular}{lrrrrr} Term ioan & 27 & 8,771,024 & - & - & - \\ Hire purchase palyablec & 28 & 442,721 & 185,473 & - \\ Lesse liabilities & 29 & 5,125,055 & 503,089 & 1,858,498 & - \\ Deferred tax llabilites & 13 & 512,230 & 1,231,175 & 496,793 & 1,194,700 \\ \hline Total Non-Current Liabilities & & 14,851,030 & 1,919,737 & 2,355,291 & 1,194,700 \\ \hline \end{tabular} Current Liabilities TradepayablesOtherpayables,depositsandaccrualsContractliabilitiesAmountduetosubsidiarycompanies3031322223,529,67720,857,9696,817,28519,214,2515,935,8421,559,0346,296,5392,116,087207,257207,1,422,498 Bank overdrafts Term loan Hire purchase payables Lesse liabilitigs 242728291,991,116828,976410,5522,869,0101,909,904267,304623,403823,221 Total Current Liabilities \begin{tabular}{llll} 57,404,585 & 29,509,738 & 9,235,847 & 1,629,755 \\ \hline \end{tabular} Total Liabilities 72,256,215 31,428,475 11,591,1382,824,455 Total Equity and Liabilities \begin{tabular}{llll} 132,930,150 & 107,359,536 & 78,570,873 & 82,677,570 \\ \hline \end{tabular} * Debt 10% * Tax24% 3.Determine ROCE (without leverage) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started