Question

note: pleses anwers all question from A to D, and show the workout. Thank you note : Medicare levy is 2% of the taxable income

Answer the questions in the following scenario. Be sure to show all your working.

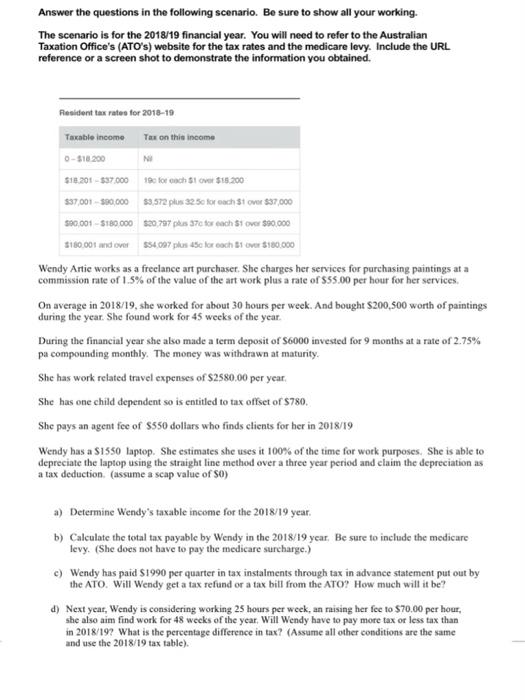

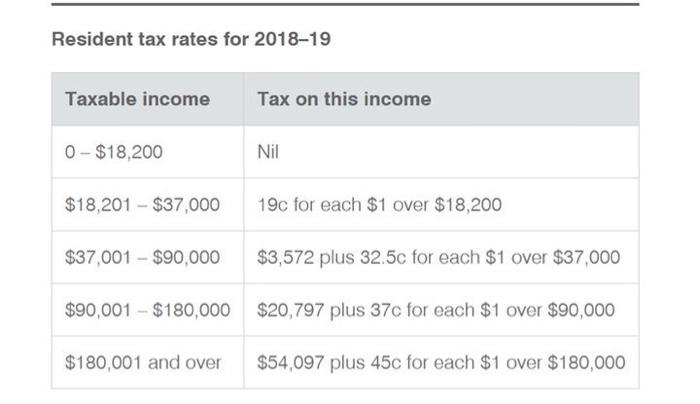

The scenario is for the 2018/19 financial year. You will need to refer to the Australian Taxation Office's (ATO's) website for the tax rates and the medicare levy. Include the URL reference or a screen shot to demonstrate the information you obtained.

Wendy Artie works as a freelance art purchaser. She charges her services for purchasing paintings at a commission rate of 1.5% of the value of the art work plus a rate of $55.00 per hour for her services.

On average in 2018/19, she worked for about 30 hours per week. And bought $200,500 worth of paintings during the year.

She found work for 45 weeks of the year.

During the financial year she also made a term deposit of $6000 invested for 9 months at a rate of 2.75% pa compounding monthly. The money was withdrawn at maturity.

She has work related travel expenses of $2580.00 per year.

She has one child dependent so is entitled to tax offset of $780.

She pays an agent fee of $550 dollars who finds clients for her in 2018/19

Wendy has a $1550 laptop. She estimates she uses it 100% of the time for work purposes. She is able to depreciate the laptop using the straight line method over a three year period and claim the depreciation as a tax deduction. (assume a scap value of $0)

A) Determine Wendy's taxable income for the 2018/19 year.

B) Calculate the total tax payable by Wendy in the 2018/19 year. Be sure to include the medicare levy. (She does not have to pay the medicare surcharge.)

C) Wendy has paid $1990 per quarter in tax instalments through tax in advance statement put out by the ATO. Will Wendy get a tax refund or a tax bill from the ATO? How much will it be?

D) Next year, Wendy is considering working 25 hours per week, an raising her fee to $70.00 per hour, she also aim find work for 48 weeks of the year. Will Wendy have to pay more tax or less tax than in 2018/19? What is the percentage difference in tax? (Assume all other conditions are the same and use the 2018/19 tax table).

Answer the questions in the following scenario. Be sure to show all your working.

The scenario is for the 2018/19 financial year. You will need to refer to the Australian Taxation Office's (ATO's) website for the tax rates and the medicare levy. Include the URL reference or a screen shot to demonstrate the information you obtained.

Wendy Artie works as a freelance art purchaser. She charges her services for purchasing paintings at a commission rate of 1.5% of the value of the art work plus a rate of $55.00 per hour for her services.

On average in 2018/19, she worked for about 30 hours per week.

And bought $200,500 worth of paintings during the year.

She found work for 45 weeks of the year.

During the financial year she also made a term deposit of $6000

invested for 9 months at a rate of 2.75% pa compounding monthly.

The money was withdrawn at maturity.

She has work related travel expenses of $2580.00 per year.

She has one child dependent so is entitled to tax offset of $780.

She pays an agent fee of $550 dollars who finds clients for her in 2018/19

Wendy has a $1550 laptop. She estimates she uses it 100% of the time for work purposes. She is able to depreciate the laptop using the straight line method over a three year period and claim the depreciation as a tax deduction. (assume a scap value of $0)

- Determine Wendy's taxable income for the 2018/19 year.

- Calculate the total tax payable by Wendy in the 2018/19 year. Be sure to include the medicare levy. (She does not have to pay the medicare surcharge.)

- Wendy has paid $1990 per quarter in tax instalments through tax in advance statement put out by the ATO. Will Wendy get a tax refund or a tax bill from the ATO? How much will it be?

- Next year, Wendy is considering working 25 hours per week, an raising her fee to $70.00 per hour, she also aim find work for 48 weeks of the year. Will Wendy have to pay more tax or less tax than in 2018/19? What is the percentage difference in tax? (Assume all other conditions are the same and use the 2018/19 tax table).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started