Answered step by step

Verified Expert Solution

Question

1 Approved Answer

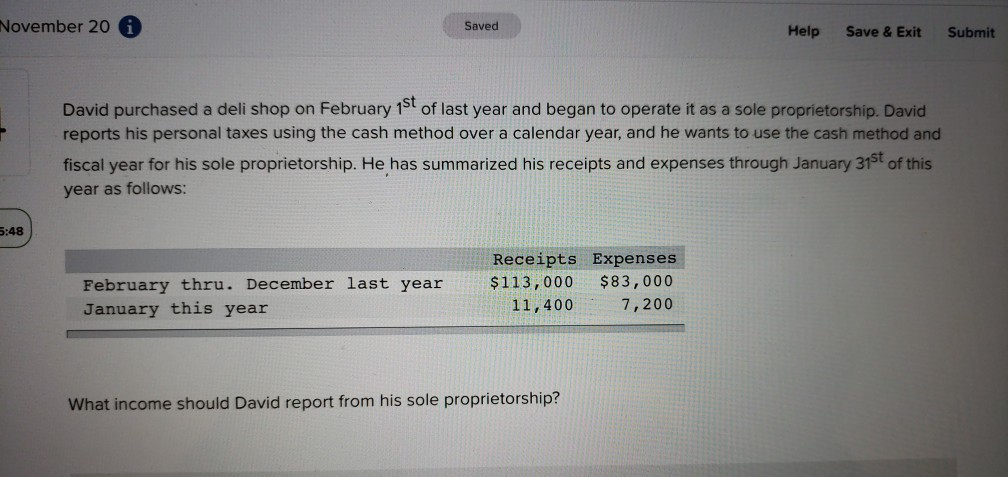

November 20 6 Saved Help Save & Exit Submit David purchased a deli shop on February 1St of last year and began to operate it

November 20 6 Saved Help Save & Exit Submit David purchased a deli shop on February 1St of last year and began to operate it as a sole proprietorship. David reports his personal taxes using the cash method over a calendar year, and he wants to use the cash method and fiscal year for his sole proprietorship. He has summarized his receipts and expenses through January 31St of this year as follows: :48 February thru. December last year January this year Receipts Expenses $113,000 $83,000 11,400 7,200 What income should David report from his sole proprietorship

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started