Answered step by step

Verified Expert Solution

Question

1 Approved Answer

o Calculate, Interprets and Evaluation T Times interest earned o Debt ratio o Debt/equity ratio o Fixed Charge Coverage ratio o Horizontal Analysis (for evaluating

o Calculate, Interprets and Evaluation

T Times interest earned

o Debt ratio

o Debt/equity ratio

o Fixed Charge Coverage ratio

o Horizontal Analysis (for evaluating ratios, trends, etc.)

o Vertical Analysis (for evaluating ratios, trends, etc.)

Thank you for your help

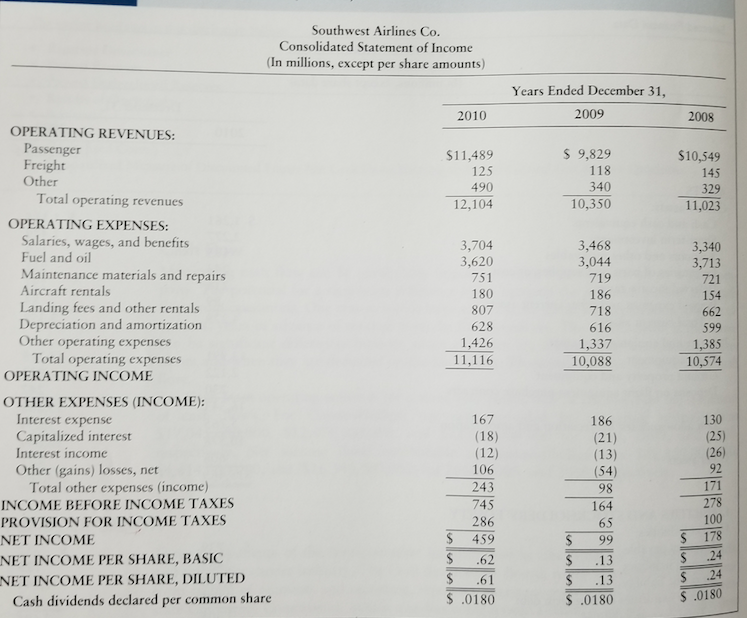

Southwest Airlines Co. Consolidated Statement of Income (In millions, except per share amounts) Years Ended December 31, 2010 2009 2008 OPERATING REVENUES Passenger $11,489 125 490 12,104 S 9,829 118 340 10,350 $10,549 145 329 11,023 Other Total operating revenues OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Aircraft rentals Landing fees and other rentals Depreciation and amortization Other operating expenses 3,704 3,620 751 180 807 628 1,426 11,116 3,468 3,044 719 186 718 3,340 3,713 721 154 662 599 1,337 Total operating expenses 11.11610,08810574 OPERATING INCOME OTHER EXPENSES (INCOME): 167 186 Interest expense Capitalized interest Interest income Other (gains) losses, net 130 (25) (26) 92 (12) 106 243 745 286 S 459 $ .62 (13) (54) 98 164 Total other expenses (income) 278 100 INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES NET INCOME NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED S 99 S .24 $ .0180 Cash dividends declared per common share $ .0180 $ .0180Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started