Answered step by step

Verified Expert Solution

Question

1 Approved Answer

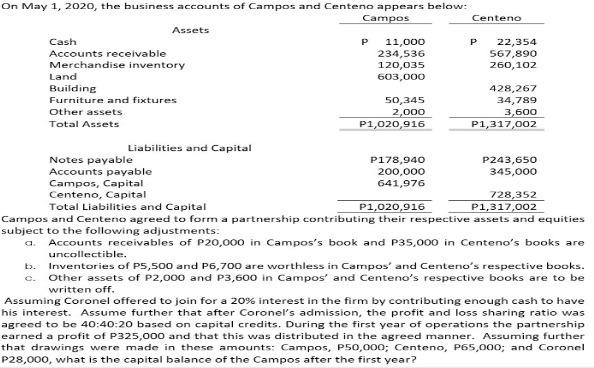

On May 1, 2020, the business accounts of Campos and Centeno appears below: Campos Cash Accounts receivable Merchandise inventory Assets Land Building Furniture and

On May 1, 2020, the business accounts of Campos and Centeno appears below: Campos Cash Accounts receivable Merchandise inventory Assets Land Building Furniture and fixtures Other assets Total Assets Liabilities and Capital Notes payable Accounts payable Campos, Capital Centeno, Capital P 11,000 234,536 120,035 603,000 50,345 2,000 P1,020,916 P178,940 200,000 641,976 Centeno P 22,354 567,890 260,102 428,267 34,789 3,600 P1,317,002 P243,650 345,000 728,352 P1,317,002 Total Liabilities and Capital P1,020,916 Campos and Centeno agreed to form a partnership contributing their respective assets and equities subject to the following adjustments: a. Accounts receivables of P20,000 in Campos's book and P35,000 in Centeno's books are uncollectible. b. Inventories of P5,500 and P6,700 are worthless in Campos' and Centeno's respective books. C. Other assets of P2,000 and P3,600 in Campos' and Centeno's respective books are to be written off. Assuming Coronel offered to join for a 20% interest in the firm by contributing enough cash to have his interest. Assume further that after Coronel's admission, the profit and loss sharing ratio was agreed to be 40:40:20 based on capital credits. During the first year of operations the partnership earned a profit of P325,000 and that this was distributed in the agreed manner. Assuming further that drawings were made in these amounts: Campos, P50,000; Centeno, P65,000; and Coronel P28,000, what is the capital balance of the Campos after the first year?

Step by Step Solution

★★★★★

3.38 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started