Question

One of the building contracts currently engaged in by a construction company commenced 15 months ago and remains unfinished. The following information relating to work

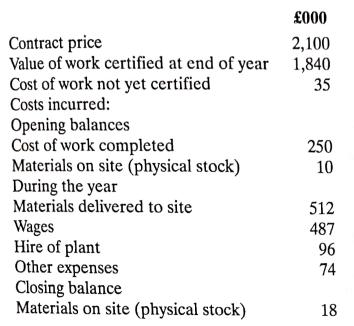

One of the building contracts currently engaged in by a construction company commenced 15 months ago and remains unfinished. The following information relating to work on the contract has been prepared for the year just ended.

As soon as materials are delivered to the site, they are charged to the contract account. A record is also kept of materials as they are actually used on the contract. Periodically a stock check is made and any discrepancy between book stock and physical stock is transferred to a general contract materials discrepancy account. This is absorbed back into each contract, currently at a rate of 0.4% of materials booked. The stock check at the end of the year revealed a stock shortage of £4,000.

In addition to the direct charges listed above, general overheads of the company are charged to contracts at 5% of the value of work certified. General overheads of £13,000 had been absorbed into the cost of work completed at the beginning of the year.

It has been estimated that further costs to complete the contract will be £215,000. This estimate includes the cost of materials on site at the end of the year just finished, and also a provision for rectification.

Required:

a. Explain briefly the distinguishing features of contract costing.

b. Determine the profitability of the above contract, and recommend how much profit (to the nearest £000) should be taken for the year just ended. (Provide a detailed schedule of costs.)

c. State how your recommendation in b. would be affected if the contract price was £3,500,000 (rather than £2,100,000) and if no estimate has been made of costs to completion.

000 Contract price 2,100 Value of work certified at end of year 1,840 Cost of work not yet certified 35 Costs incurred: Opening balances Cost of work completed Materials on site (physical stock) During the year Materials delivered to site Wages Hire of plant Other expenses Closing balance Materials on site (physical stock) 250 10 512 487 96 74 18

Step by Step Solution

3.48 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

a Contract costing is a method of costing used to allocate the costs of a contract to the periods in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started