Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One of the primary functions of the Federal Reserve is to limit the growth of the money supply. In order to do this, the

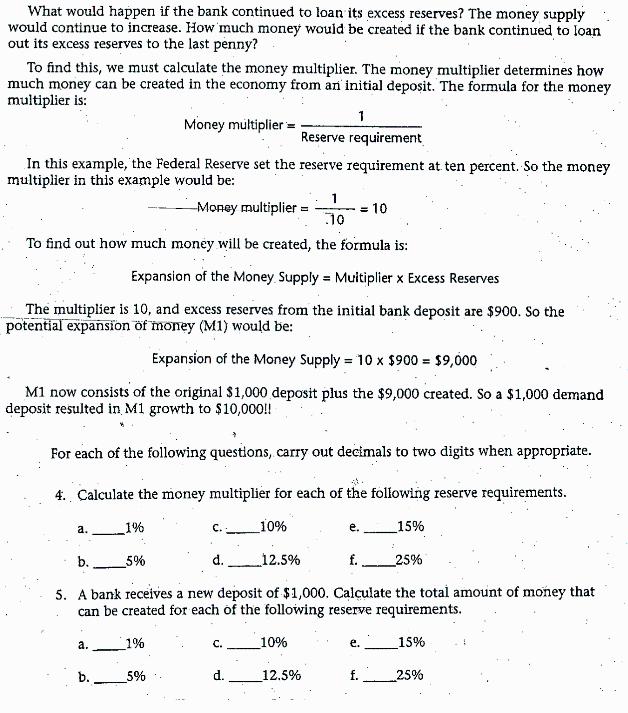

One of the primary functions of the Federal Reserve is to limit the growth of the money supply. In order to do this, the Board of Governors sets reserve requirements, percentages of the bank's deposits that must be held by the bank. Banks may not loan out these required reserves. The use of this fractional reserve system actually allows banks to create money. The total amount of reserves held by a bank is known as the actual reserves. These actual reserves. are composed of required reserves, which the bank must keep, and excess reserves, which the bank can loan to other customers. The reserves held by the bank beyond those required by the Fed are excess reserves. Complete the following calculations illustrating reserve requirements. 1. If $1,000 is deposited in the bank, calculate how much the bank must hold in -reserve for each of the following reserve requirements. How much is the required reserve? a. 1% C. 10% e. 15% b. 5% d. 12.5% f. 25% 2. If $1,000 is deposited in the bank, calculate how much the bank can loan out for each of the following reserve requirements. How much is the excess reserve? 4 a. 1% C. 10% e. _15% 5% d: 12.5% f. 25% Money is created when the bank makes loans to customers. To illustrate how money can be "created," a bank balance sheet is shown in the next question. We will begin with two assumptions: The reserve requirement is ten percent, and the bank will loan out all of its excess reserves. All money loaned out will be returned to the same bank in the form of demand deposits (for example, if Jamal borrowed $1,000 to buy a bike from Emilio, Emilio would deposit his $1,000 back into the same bank that issued Jamal the loan). 3. Fill in the blanks on the balance sheet. Carry decimals out to two digits when appropriate. Bank Balance Sheet Account Holder New Deposits Required Reserves Excess Reserves Eric. $1,000.00 $900.00 Juan. $900.00 $90.00 LaTandra $810.00 Angie $72.90 Huang Suk $590,49 Each new deposit is a demand deposit; thus, it is counted in M1. In this example, before the bank issued any loans, M1 equaled $1,000. But as it loaned the first $900 of excess reserves, the money supply rose to $1,900 because of the new demand deposit. In only five rounds of spend- ing, M1 rose from $1,000 to $4,095.101 What would happen if the bank continued to loan its excess reserves? The money supply would continue to increase. How much money would be created if the bank continued to loan out its excess reserves to the last penny? To find this, we must calculate the money multiplier. The money multiplier determines how much money can be created in the economy from an initial deposit. The formula for the money multiplier is: 1 Money multiplier = Reserve requirement In this example, the Federal Reserve set the reserve requirement at ten percent. So the money multiplier in this example would be: -Money multiplier= 1 10 = 10 To find out how much money will be created, the formula is: Expansion of the Money Supply Multiplier x Excess Reserves The multiplier is 10, and excess reserves from the initial bank deposit are $900. So the potential expansion of money (M1) would be: Expansion of the Money Supply = 10 x $900 = $9,000 M1 now consists of the original $1,000 deposit plus the $9,000 created. So a $1,000 demand deposit resulted in M1 growth to $10,000!! For each of the following questions, carry out decimals to two digits when appropriate. 4. Calculate the money multiplier for each of the following reserve requirements. a. 1% 10% 15% b. 5% 12.5% f. 25% 5. A bank receives a new deposit of $1,000. Calculate the total amount of money that can be created for each of the following reserve requirements. a. 1% 10% e. 15% b. 5% 12.5% 25%

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 a Amount deposited 1000 Reserve requirements 1 1 x 1000 10 Reserve to be maintained 10 b Amount de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started