Answered step by step

Verified Expert Solution

Question

1 Approved Answer

one question with sub part like will be given 2. Gale. McLean, and Lux are partners of Burgers and Brew Company with capital balances as

one question with sub part

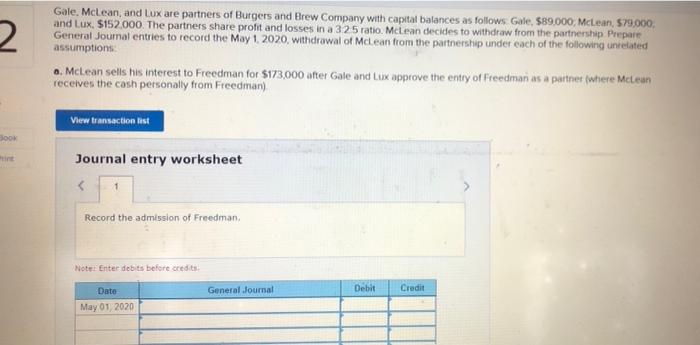

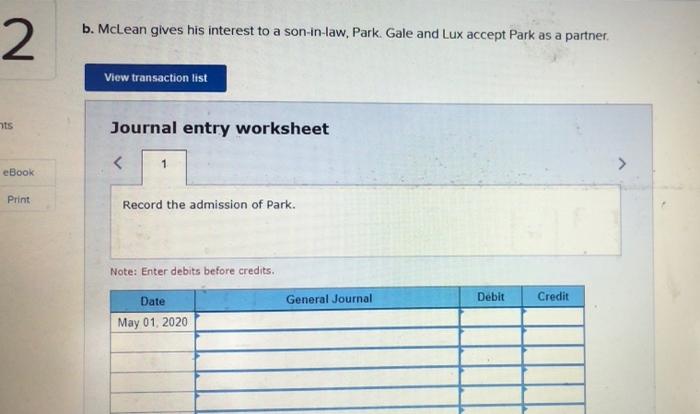

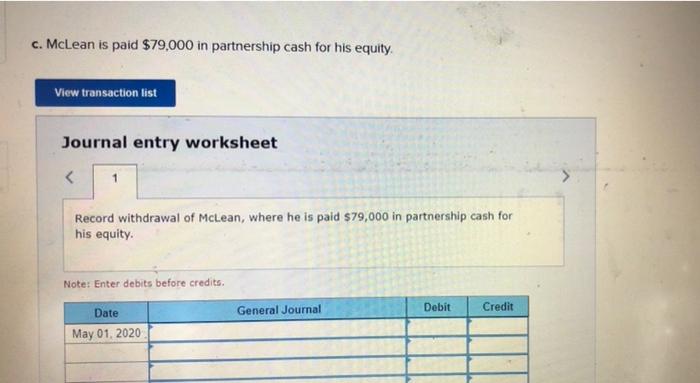

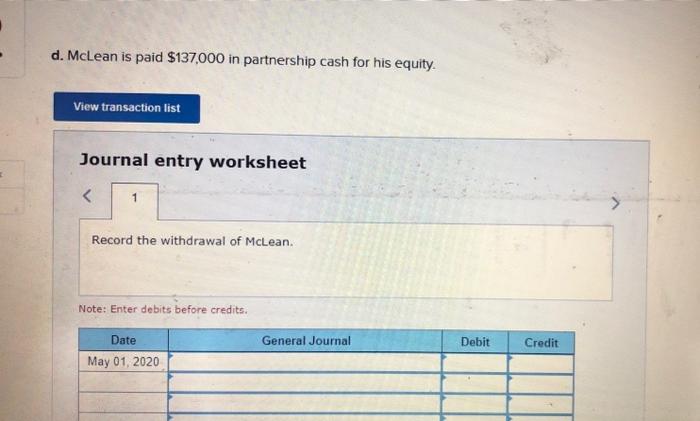

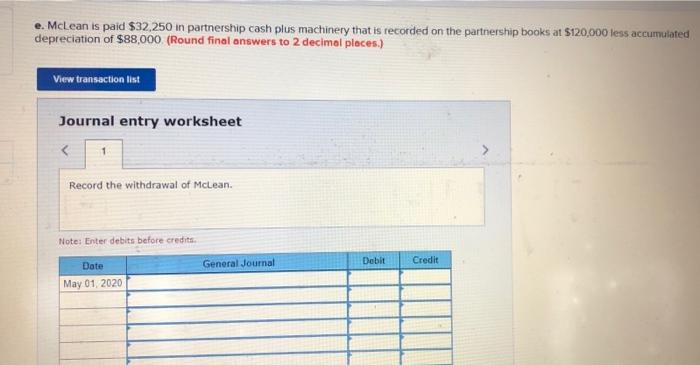

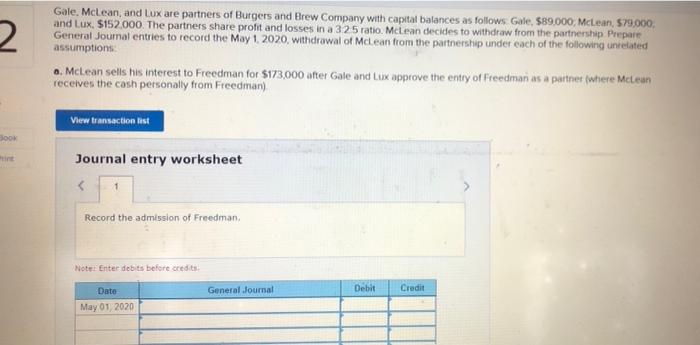

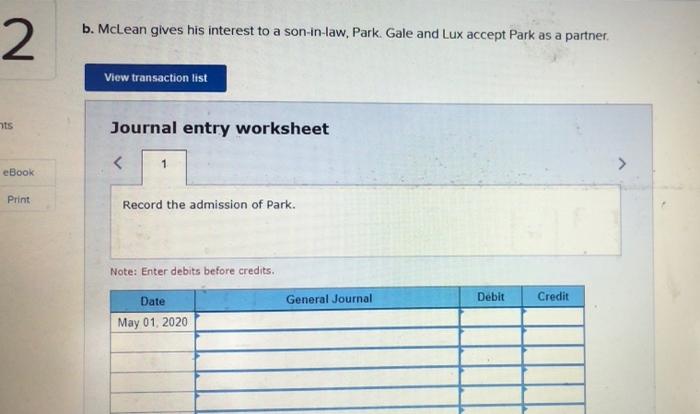

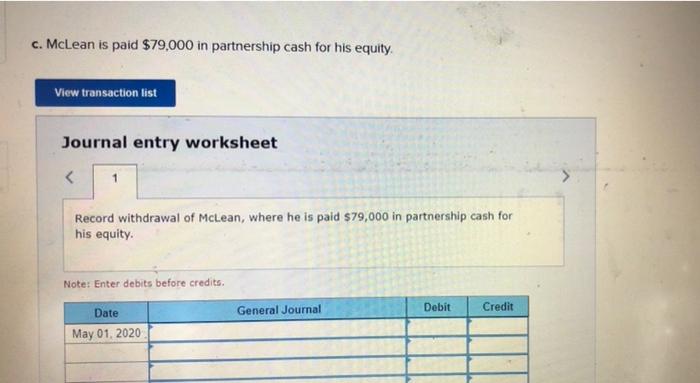

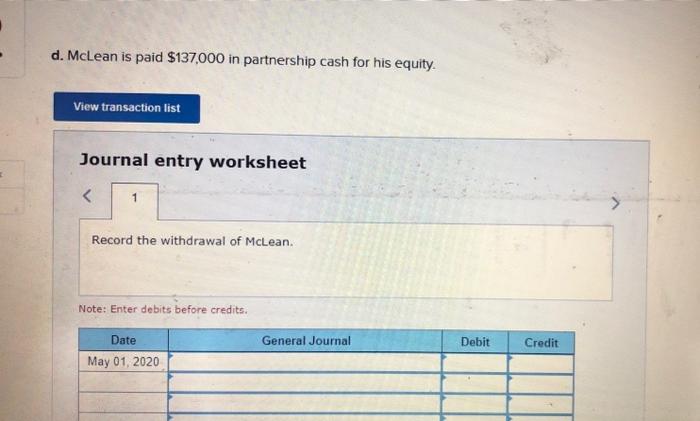

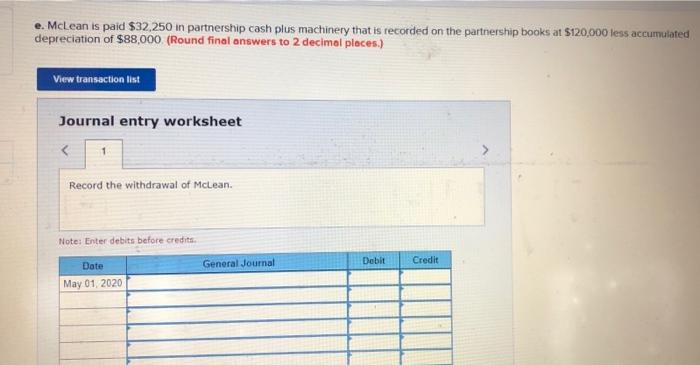

2. Gale. McLean, and Lux are partners of Burgers and Brew Company with capital balances as follows Gale, $89.000, McLean, 579,000, and Lux. $152.000. The partners share profit and losses in a 325 ratio. McLean decides to withdraw from the partnership Prepare General Journal entries to record the May 1, 2020, withdrawal of Mclean from the partnership under each of the following unrelated assumptions a. McLean sells his interest to Freedman for $173,000 after Gale and Lux approve the entry of Freedmari as a partnet (where McLean receives the cash personally from Freedman) View transaction ist Jook Journal entry worksheet eBook Print Record the admission of Park. Note: Enter debits before credits. General Journal Debit Credit Date May 01, 2020 c. McLean is paid $79,000 in partnership cash for his equity View transaction list Journal entry worksheet like will be given

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started