Answered step by step

Verified Expert Solution

Question

1 Approved Answer

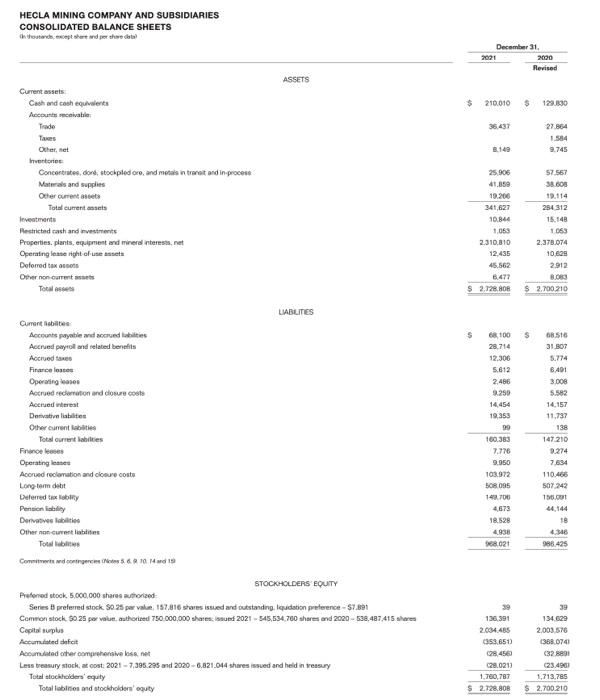

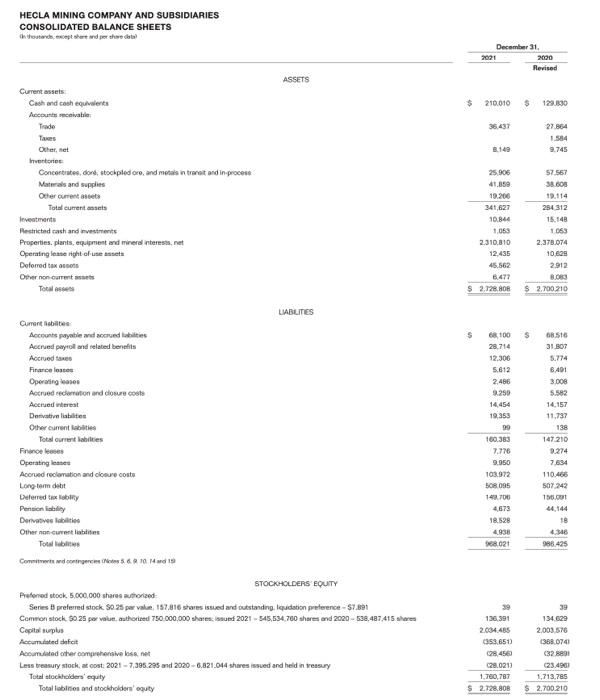

perform a vertical analysis of the company's balance sheet. 2020 as the base year. HECLA MINING COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS thousands, except share

perform a vertical analysis of the company's balance sheet. 2020 as the base year.

HECLA MINING COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS thousands, except share and per share data) Current assets Cash and cash equivalents Accounts receivable Trade Taxes Other, net Inventories Concentrates, done, stockpiled ore, and metals in transit and in-process Materials and supplies Other current assets Total current assets levestments Restricted cash and investments Properties, plants, equipment and mineral interests, net Operating lease right of use assets Deferred tax asses Other non-current assets Cument abilites Accounts payable and accrued abilities Accrued payroll and related benefits Accrued taxes Finance leases Operating leases Accrued reclamation and closure costs Accrued interest Derivative liabilities Other current labilities Total current labilties Finance leases Operating leases Accrued reclamation and closure costs Long-term debt Deferred tax liability Pension ability Derivatives abilities Other non-current liablities Total lobites Commitments and contingencies (Notes 56.9 10 14 and 15 Preferred stock, 5,000,000 shares authorized ASSETS December 31, 2021 2020 Revised $ 210.010 $ 129.830 36.437 27.864 1.584 8.149 9.745 25.906 57.567 41.859 38.608 19.206 19.114 341,627 284.312 10.844 15.148 1,053 1.063 2.310,810 2.378.074 12,435 10.628 45.562 2.912 6477 8.083 $ 2.728.808 $ 2,700.210 LIABILITIES $ 68,100 S 68.516 28.714 31.807 12.306 5.774 5.612 6.491 2.486 3.008 9.259 5.582 14,454 14,157 19,353 11,737 99 138 160.383 147.210 7.776 9.274 9,950 7,634 103.972 110.466 508.095 507.242 149.700 156.001 4,673 44,144 18.528 18 4.938 4.348 908021 986.425 STOCKHOLDERS EQUITY Series B preferred stock $0.25 par value, 157.816 shares issued and outstanding liquidation preference - $7.891 Common stock $0.25 per value, authorized 750,000,000 shares issued 2021-545,534,760 shares and 2020-538,487,415 shares Capital surplus Accumulated deficit Accumulated other comprehensive loss, net Less treasury stock, at cost: 2021-7,395.295 and 2020-6.821.044 shares issued and held in treasury Total stockholders' equity Total liabilities and stockholders' equity 136,391 2.034.485 134.629 2,003,576 (353,651) (368,074) (28,456) (32.8801 (28.021) (23.496) 1,760,787 1,713,785 $ 2.728.808 2.700.210

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started