Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all! Thumbs up! What is the effective annual rate if the annual percentage rate is 13% compounded daily? Enter your answer as a

Please answer all! Thumbs up!

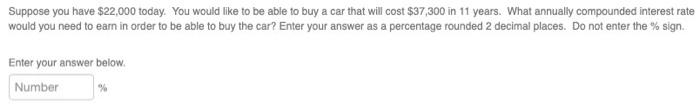

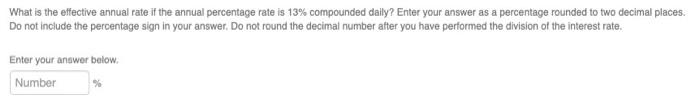

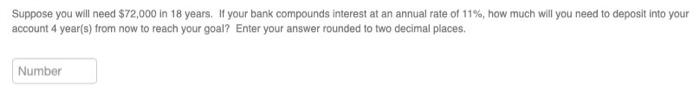

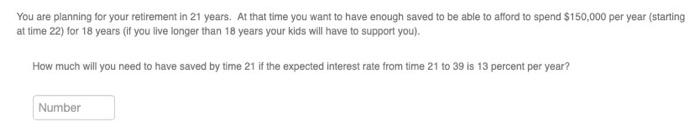

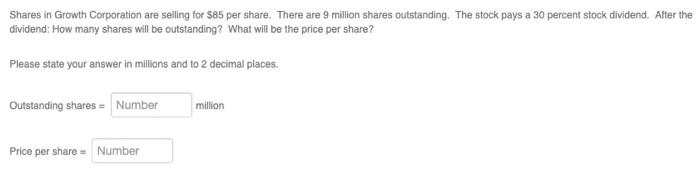

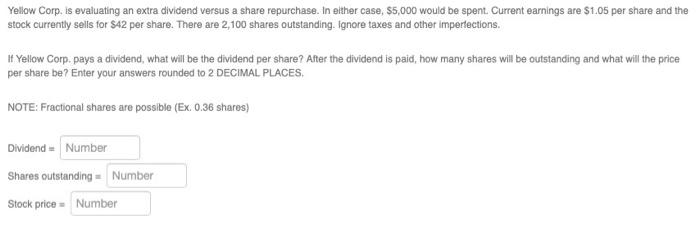

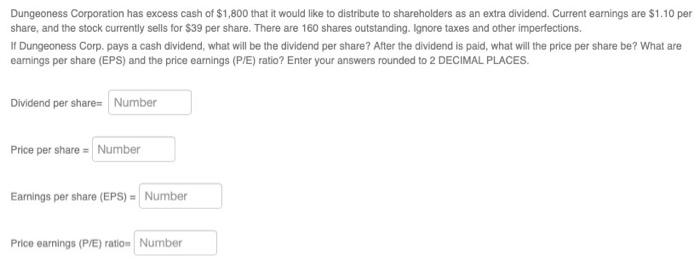

What is the effective annual rate if the annual percentage rate is 13% compounded daily? Enter your answer as a percentage rounded to two decimal places. Do not include the percentage sign in your answer. Do not round the decimal number after you have performed the division of the interest rate. Enter your answer below. Number % Suppose you will need $72,000 in 18 years. If your bank compounds interest at an annual rate of 11%, how much will you need to deposit into your account 4 year(s) from now to reach your goal? Enter your answer rounded to two decimal places Number You are planning for your retirement in 21 years. At that time you want to have enough saved to be able to afford to spend $150.000 per year (starting at time 22) for 18 years (if you live longer than 18 years your kids will have to support you). How much will you need to have saved by time 21 if the expected interest rate from time 21 to 39 is 13 percent per year? Number Shares in Growth Corporation are selling for $85 per share. There are 9 million shares outstanding. The stock pays a 30 percent stock dividend. After the dividend: How many shares will be outstanding? What will be the price per share? Please state your answer in millions and to 2 decimal places. Outstanding shares - Number million Price per share. Number Yellow Corp, is evaluating an extra dividend versus a share repurchase. In either case, $5,000 would be spent. Current earnings are $1.05 per share and the stock currently sells for $42 per share. There are 2,100 shares outstanding. ignore taxes and other imperfections. If Yellow Corp. pays a dividend, what will be the dividend per share? After the dividend is paid, how many shares will be outstanding and what will the price per share be? Enter your answers rounded to 2 DECIMAL PLACES NOTE: Fractional shares are possible (Ex. 0.36 shares) Dividend = Number Shares outstanding = Number Stock price - Number Dungeoness Corporation has excess cash of $1,800 that it would like to distribute to shareholders as an extra dividend. Current earnings are $1.10 per share, and the stock currently sells for $39 per share. There are 160 shares outstanding. Ignore taxes and other imperfections. 1 Dungeoness Corp. pays a cash dividend, what will be the dividend per share? After the dividend is paid, what will the price per share be? What are earnings per share (EPS) and the price earnings (P/E) ratio? Enter your answers rounded to 2 DECIMAL PLACES. Dividend per share= Number Price per share= Number Earnings per share (EPS) = Number Price earnings (P/E) ration Number Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started