Answered step by step

Verified Expert Solution

Question

1 Approved Answer

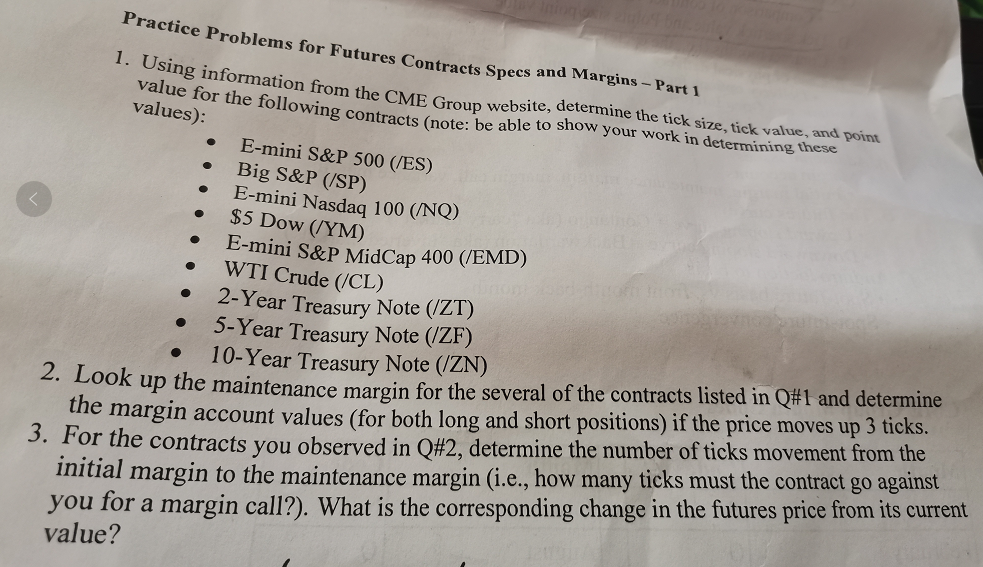

Please answer Q2andQ3 e Problems for Futures Contracts Specs and Margins - Part 1 1. Using information from the CME Group websi website, determine the

Please answer Q2andQ3

e Problems for Futures Contracts Specs and Margins - Part 1 1. Using information from the CME Group websi website, determine the tick size, tick value, and point value for the following contracts (note: for the following contracts (note: be able to show your work in determining these values): E-mini S&P 500 (ES) Big S&P (SP) E-mini Nasdaq 100 (/NQ) $5 Dow (/YM) hini S&P MidCap 400 (EMD) WTI Crude (CL) 5 2-Year Treasury Note (IZT) 5-Year Treasury Note (IZF) 10-Year Treasury Note (IZN) Ook up the maintenance margin for the several of the contracts listed in Q#1 and determine the margin account values (for both long and short positions) if the price moves up 3 ticks. . For the contracts you observed in Q#2, determine the number of ticks movement from the initial margin to the maintenance margin (i.e., how many ticks must the contract go against you for a margin call?). What is the corresponding change in the futures price from its current value? e Problems for Futures Contracts Specs and Margins - Part 1 1. Using information from the CME Group websi website, determine the tick size, tick value, and point value for the following contracts (note: for the following contracts (note: be able to show your work in determining these values): E-mini S&P 500 (ES) Big S&P (SP) E-mini Nasdaq 100 (/NQ) $5 Dow (/YM) hini S&P MidCap 400 (EMD) WTI Crude (CL) 5 2-Year Treasury Note (IZT) 5-Year Treasury Note (IZF) 10-Year Treasury Note (IZN) Ook up the maintenance margin for the several of the contracts listed in Q#1 and determine the margin account values (for both long and short positions) if the price moves up 3 ticks. . For the contracts you observed in Q#2, determine the number of ticks movement from the initial margin to the maintenance margin (i.e., how many ticks must the contract go against you for a margin call?). What is the corresponding change in the futures price from its current valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started