Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please at least answer #6! Thank you. 44. If a bond is selling at par value, which of the following would be the same as

Please at least answer #6! Thank you.

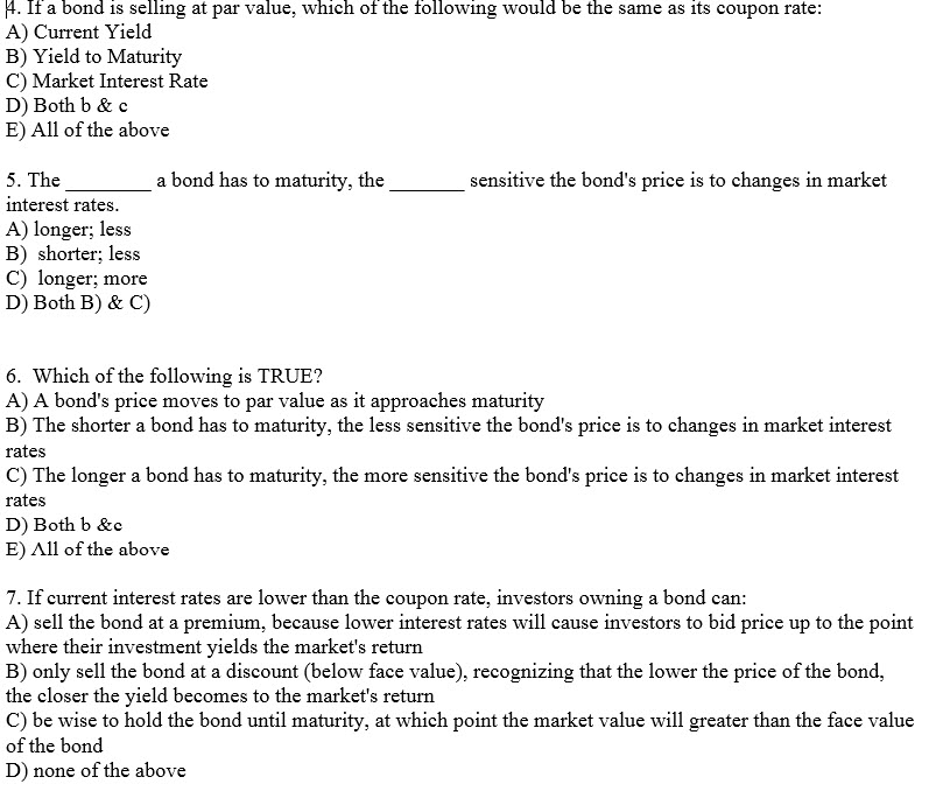

44. If a bond is selling at par value, which of the following would be the same as its coupon rate: A) Current Yield B) Yield to Maturity C) Market Interest Rate D) Both b&c E) All of the above sensitive the bond's price is to changes in market 5. The a bond has to maturity, the interest rates. A) longer; less B) shorter; less C) longer; more D) Both B) & C) 6. Which of the following is TRUE? A) A bond's price moves to par value as it approaches maturity B) The shorter a bond has to maturity, the less sensitive the bond's price is to changes in market interest rates C) The longer a bond has to maturity, the more sensitive the bond's price is to changes in market interest rates D) Both b &c E) All of the above 7. If current interest rates are lower than the coupon rate, investors owning a bond can: A) sell the bond at a premium, because lower interest rates will cause investors to bid price up to the point where their investment yields the market's return B) only sell the bond at a discount (below face value), recognizing that the lower the price of the bond, the closer the yield becomes to the market's return C) be wise to hold the bond until maturity, at which point the market value will greater than the face value of the bond D) none of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started