please help fill in boxes for question A and help with question B please

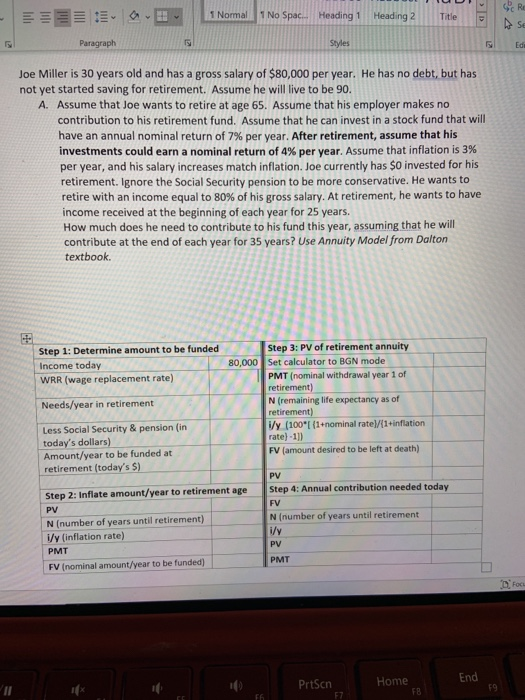

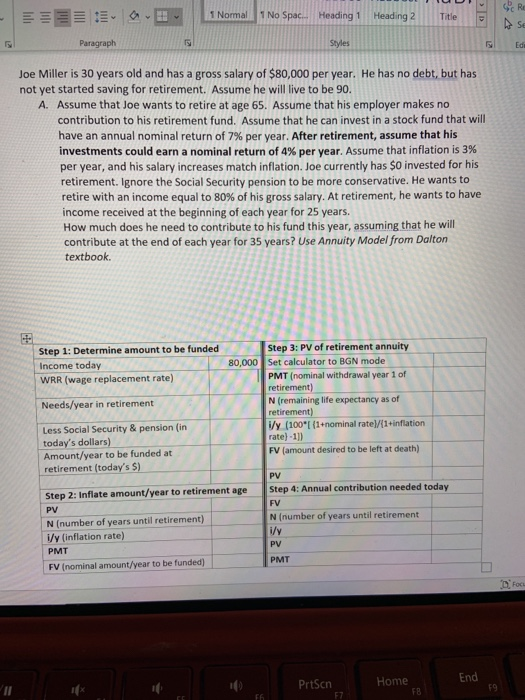

SCRE 1 Normal 1 No Spac. Heading 1 Heading 2 Title Paragraph Styles Edi Joe Miller is 30 years old and has a gross salary of $80,000 per year. He has no debt, but has not yet started saving for retirement. Assume he will live to be 90. A. Assume that Joe wants to retire at age 65. Assume that his employer makes no contribution to his retirement fund. Assume that he can invest in a stock fund that will have an annual nominal return of 7% per year. After retirement, assume that his investments could earn a nominal return of 4% per year. Assume that inflation is 3% per year, and his salary increases match inflation. Joe currently has $0 invested for his retirement. Ignore the Social Security pension to be more conservative. He wants to retire with an income equal to 80% of his gross salary. At retirement, he wants to have income received at the beginning of each year for 25 years. How much does he need to contribute to his fund this year, assuming that he will contribute at the end of each year for 35 years? Use Annuity Model from Dalton textbook. 1: Step 1: Determine amount to be funded Income today WRR (wage replacement rate) Step 3: PV of retirement annuity 80,000 Set calculator to BGN mode PMT (nominal withdrawal year 1 of retirement) N (remaining life expectancy as of retirement) i/y (100'[(1+nominal rate)/(1+inflation rate)-1]) FV (amount desired to be left at death) Needs/year in retirement Less Social Security & pension (in today's dollars) Amount/year to be funded at retirement (today's $) Step 2: Inflate amount/year to retirement age PV N (number of years until retirement) i/v (inflation rate) PMT FV (nominal amount/year to be funded) PV Step 4: Annual contribution needed today FV N (number of years until retirement i/y PV PMT Foc End PrtScn F7 Home FB 19 out References Mailings Review View Help Table Design Layout E 21 AaBbccbd AaBbceDd AaBbcc Aabbcct AaB! 1 No Spac... Heading 1 Heading 2 CO CRE 1 Normal Title Paragraph Styles Ed CSCFFS 427 Week 5 Monday September 21 , 2020 B. Use the information in part A, but use the capitalization of Earnings model instead. How much does he need to contribute to his fund this year, assuming that he will contribute at the end of each year for 35 years

please help fill in boxes for question A and help with question B please

please help fill in boxes for question A and help with question B please